Germany Invested in Gold More in 2020 Than Ever Before; Russia Dumping US Dollars

Germany Set their own record for annual gold purchases in 2020

Recently we wrote that due to the brutally destructive German inflation of a hundred years ago, Germans to this day retain a suspicion of money printing. Now we learn from a World Gold Council blog post that Google searches for “inflation” in Germany have been trending higher since October. No wonder. German inflation expectations reached a five year high in March. The post notes that “Germans bought more gold bars and coins in 2020 than in any previous year, by some margin. And so far in 2021, they have maintained a pace of investing that far outstrips the historical average…”

Last year we reported that Germans lined up outside bullion dealers’ offices to buy physical gold before the imposition of new bureaucratic regulations on gold purchases.

64 percent of inflation-wary Germans believe that gold is a good safeguard against inflation and currency fluctuations. The WGC says the German gold investing is likely to remain elevated the rest of this year.

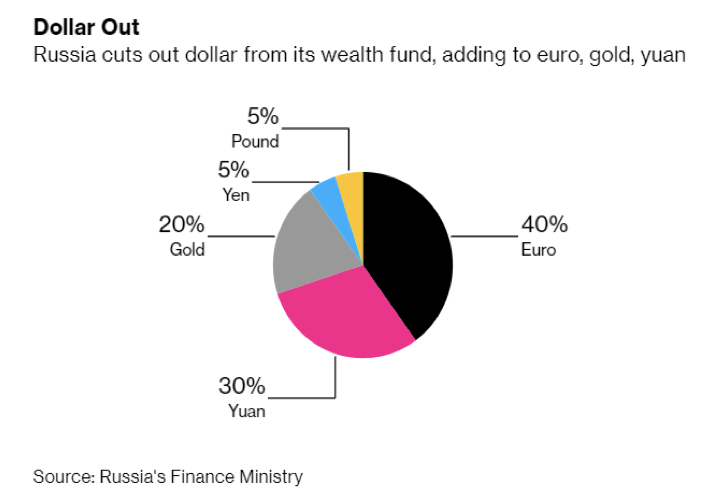

Russia Dumping US Dollars

But there is even more evidence that overseas gold buying will be strong in the months ahead, thanks to more de-dollarization. Russia has announced that its sovereign wealth fund – the entity that collects profits from Russian-state oil production – will cease to hold US dollars.

The Russian National Wealth Fund is estimated to hold $119 billion in liquid assets of which $41.5 billion is in US dollars. But the fund will abandon the dollar at once and henceforth be diversified among euros (40 percent), yuan (30 percent), and gold (20 percent).

Global de-dollarization moves are a growing phenomenon among sovereign nations that seek to protect themselves from both US sanctions and from promiscuous US monetary policies.

A Kremlin spokesman said that “”the de-dollarization process is constant. It is, in fact, now visible to the naked eye.”

De-dollarization will continue and will certainly pick up steam as US inflation numbers rise.

We recommend our friends and client get ahead of the curve by taking steps to de-dollarizing with a portfolio of gold and silver that meets their wealth protection objectives. Your Republic Monetary Exchange precious metals professional is ready to help.