Failing Money

There probably are not a lot of places in the real world where one can massively, spectacularly mal-perform – we’re talking world-class failure – and keep a coveted position as the head of an enterprise.

Football coaches with losing records get fired. Movie directors with a string of failures do not often get invited back to sit in the director’s chair. Salespeople who do not meet quotas… pilots who land at the wrong airport… auto mechanics who cannot make cars run… All these would soon find themselves in professional jeopardy.

Public policy positions and government are conspicuous exceptions to normal accountability.

Confirmation hearings this month for Federal Reserve chairman Jerome Powell have us wondering about this. After a badly bungled first term, President Biden has nominated Powell to serve another four years.

Readers of this blog do not need a lengthy recitation of Powell’s failures and monetary mishaps. But even those who pay no attention to monetary policy, investments, or America’s economic challenges are liable to be aware of Powell’s spectacular failure to foresee and manage inflation’s debilitating reemergence in 2021.

Powell may have been advised that it was a good opening to announce to the Senate on the first day of his hearings that “the Fed works for all Americans.” But it is only further evidence of his disconnectedness.

That is because the wealth gap is visible to just about everyone now. Fed policy has so aggressively favored the wealthy that Bill Gates and Warren Buffett and their “class” mates have done exceptionally well.

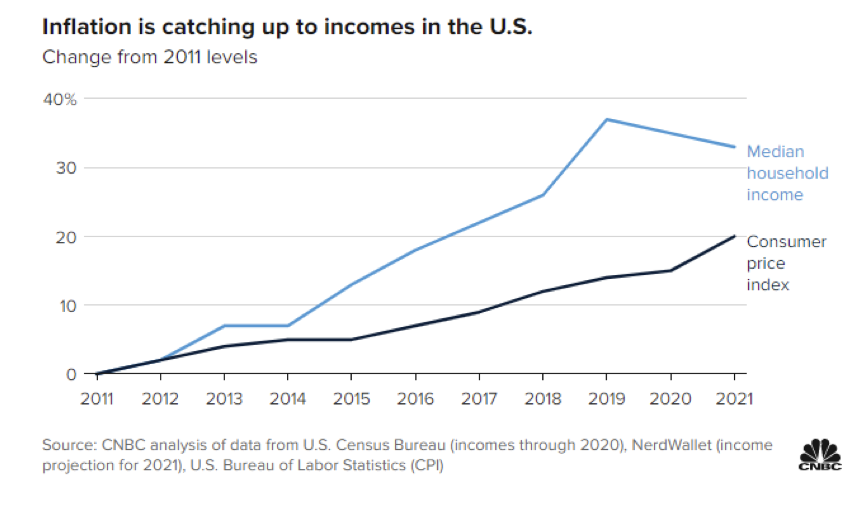

Not so much your typical, average American. Their incomes are not keeping up with the cost of living. They and their “class” mates are falling further and further behind.

CNBC:

Over the past two years, median income fell 3% while the cost of living rose nearly 7 percent, due, in part, to rising housing and medical costs….

The average U.S. household with debt now owes $155,622, or more than $15 trillion altogether, including debt from credit cards, mortgages, home equity lines of credit, auto loans, student loans and other household obligations — up 6.2% from a year ago.

So, things are not working out too well under Mr. Powell’s watch. But, like so many in government, he will be allowed to “fail up” and will be confirmed.

By now Americans should begin to suspect that it is the monetary system itself that is failing, the handiwork of the issuers of made-up money. For that is what inflation is: the failure at one rate or another of the money itself.

We do not think Powell should be reconfirmed. We do not think incompetence should be rewarded. But in the long run, it won’t matter much if he is.

The only real protection from central banking failures is a good portfolio of gold and silver.