Common Sense About Fed Interest Rate Policy

It’s too little, too late to stop inflation!

“The Great Central Bank Pivot is now underway around the globe, but it’s not the one Wall Street has been praying for. Instead of another round of easing juice to brake the obvious fall in economic activity, central banks en masse are racing to goose interest rates by 75 or even 100 basis points.”

David Stockman

It’s not often we find ourselves pointing to anything that emanates from the Federal Reserve’s huge stable of economists. But like a stopped clock, somebody there is bound to be right sometime.

Now we have a candidate. A pair of economists, Francesco Bianchi of Johns Hopkins University and Leonardo Melosi of the Chicago Fed presented a report at the recent central bank confab at Jackson Hole, Wyoming. Their paper, “Inflation as a Fiscal Limit,” deserves a little more exposure.

Especially amidst all the hubbub and confusion surrounding the Fed’s interest rate hikes. We will paraphrase the authors’ point: Even if the Fed (representing monetary policy) is serious about wringing inflation out of the economy, if the big spenders in Washington (representing fiscal policy) don’t take offsetting steps to rein in spending, “a vicious circle of rising nominal interest rates, rising inflation, economic stagnation, and increasing debt would arise.”

That is really pretty elementary, although it is a viewpoint that may not be often expressed in the Marriner Eccles building. But it is exactly where we are today. The Fed can raise rates but expecting the White House and Capitol Hill to do something about spending… forget about it!

Without endorsing everything the authors say, here is a bit more common sense:

In this pathological situation, monetary tightening would actually spur higher inflation and would spark pernicious fiscal stagflation, with the inflation rate drifting away from the monetary authority’s target and with GDP growth slowing down considerably. While in the short run, monetary tightening might succeed in partially reducing the business cycle component of inflation, the trend component of inflation would move in the opposite direction as a result of the higher fiscal burden.

The authors argue in a nice, political, and academic way that something must be done about spending. Well, the Biden administration is doing something about spending: they are driving it to the moon! The exact opposite of what needs to be done!

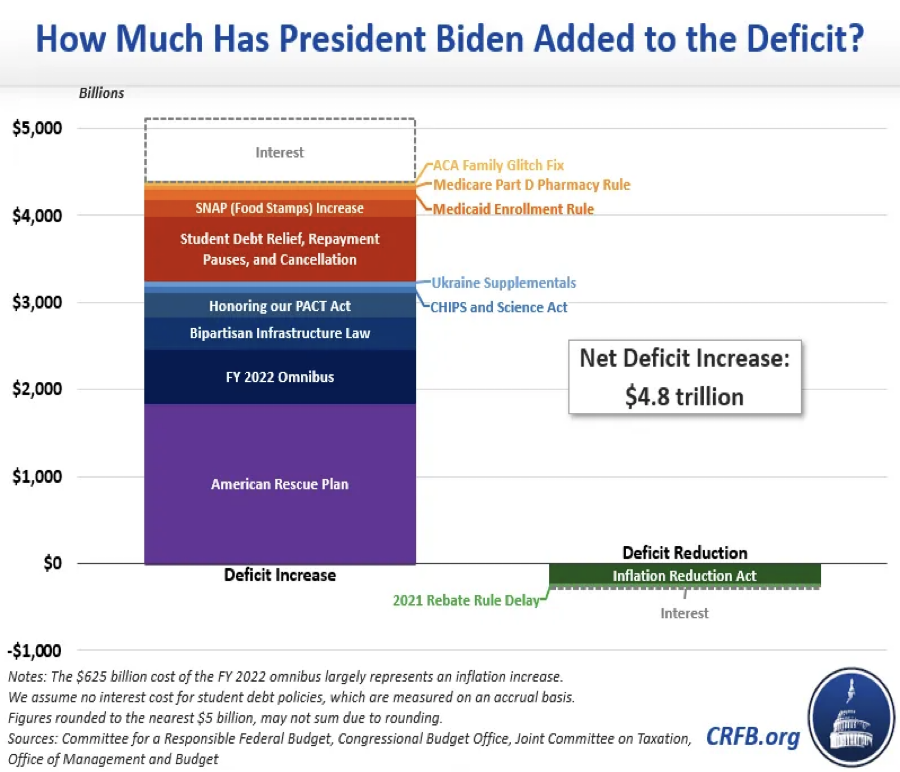

The folks at the Committee for a Responsible Federal Budget estimate that “the Biden Administration has enacted policies through legislation and executive actions that will add more than $4.8 trillion to deficits between 2021 and 2031…. This is on top of the trillions of dollars we were projected to borrow before President Biden took office.”

We are not politicians or Fed economists, so we don’t mind addressing the situation directly and honestly: It’s every man for himself! In other words, don’t expect the authorities to rescue or protect your wealth. You must do so yourself. You must do so with gold and silver.