BRICS Nations: A New Gold Currency Ahead?

Circle August 22 -24 on your calendar.

That is when the BRICS nations gather for a key summit meeting in Johannesburg, South Africa.

The US dollar will be in their crosshairs. And a BRICS currency tied to gold is expected to be a part of the discussion. It is not a coincidence that a move to re-monetize gold is on the table. More and more of the world’s central banks have independently been moving reserves away from the dollar and into gold.

It may be early in the development of a BRICS gold currency. There are steps along the way. But to be clear, an unbacked, irredeemable, made-up fiat currency like the US dollar cannot possibly compete with an honest gold currency.

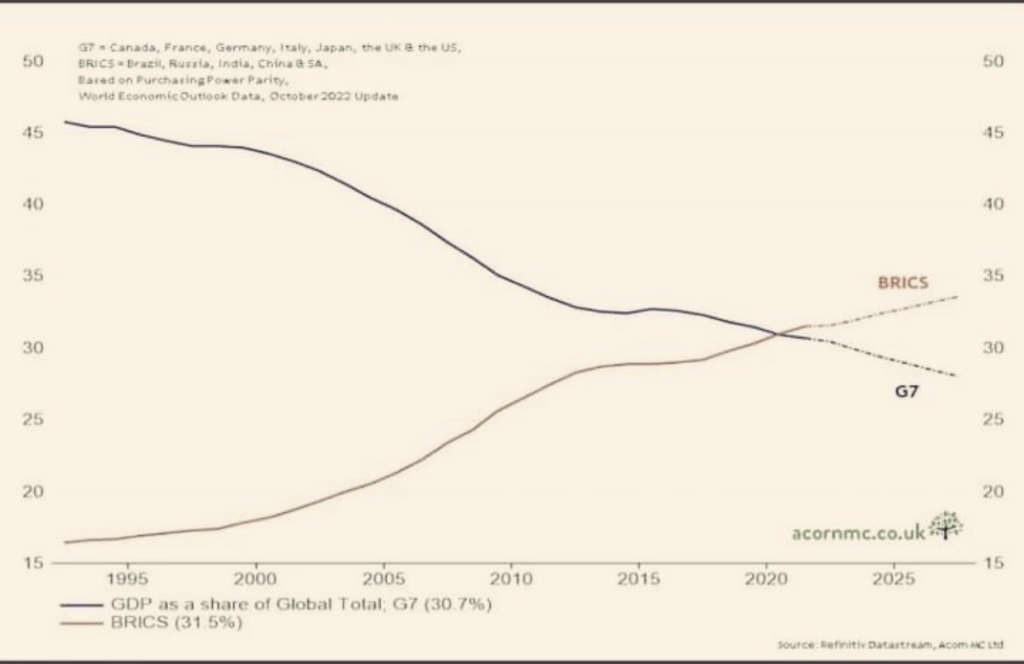

The BRICS is a consortium of five nations – Brazil, Russia, India, China, and South Africa – that together are responsible for 31.5 percent of global productivity.

That means the BRICS have now surpassed the total productivity of the G7 nations consortium, which includes the US, Canada, France, Germany, Italy, Japan, and the United Kingdom. Together the G7 is accountable for only 30 percent of total global production.

To put it poetically, you could say the BRICS are waxing, while the G7 is waning. Here is a chart that illustrates the changing dynamics.

The BRICS have not been shy about the need for a challenge to the US dollar as a weaponized tool of US imperialism. They represent a revolt against the economic interventionism in their internal affairs, the unilateral global military hegemony, and the regime change wars of the US.

Other nations have similar views about the US, so the ranks of the BRICS are bound to grow. Among the nations that have expressed an interest in affiliation with the BRICS are Egypt, Nigeria, Mexico, Iran, Indonesia, Turkey, and others.

From a recent Fortune magazine article:

The BRICS summit comes as countries across the world are confronting a changing geopolitical landscape that is challenging the traditional dominance of the West. And while the BRICS countries have been seeking to reduce their reliance on the dollar for over a decade, Western sanctions on Russia after its invasion of Ukraine have accelerated the process.

Meanwhile, rising interest rates and the recent debt-ceiling crisis in the U.S. have raised concerns among other countries about their dollar-denominated debt and the demise of the dollar should the world’s leading economy ever default.

e BRICS have called for a new global currency that can challenge the dominant role of the US dollar in the international monetary system.

As the world seeks to reduce its dependency on the dollar, gold appears as the best, most confidence-inspiring and reliable store of value. We will be watching the BRICS summit closely and reading between the lines of their official announcements.

When gold is remonetized, we believe its price in dollar terms will skyrocket higher.

Be ready.