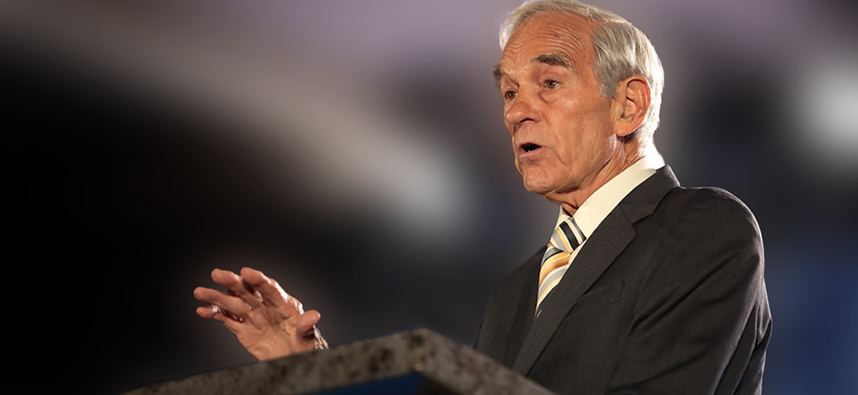

Big Government and Big Inflation

Ron Paul has something to say about both

April’s big jumps in prices are not going to mean changes in the Federal Reserve’s near-zero interest rate policies, according to gold expert and former Congressman Ron Paul.

The Consumer Price Index rose 0.8 percent in April. Over the last 12 months, the CPI is up 4.2 percent. Wholesale prices rose 0.6 percent in April.

According to Dr. Paul, Fed chairman Powell “does not want to admit that the real reason the Fed will continue to keep rates low is that increasing rates will cause the federal government’s interest payments to rise to unsustainable levels.”

“One way the Fed increases the money supply — and thus lowers interest rates — is by purchasing US Treasury securities,” writes Dr. Paul in his latest weekly column. “These purchases increase demand for US government debt, keeping government’s borrowing costs low. An expansionary monetary policy thus enables increased federal spending and deficits. Since the lockdowns, the Fed has worked overtime to monetize federal debt, doubling its holdings of Treasury securities.”

It is an important point. The normalization of interest rates would make the US government’s $28 trillion debt virtually unpayable. A mere two percent increase in rates across its debt portfolio will add well over a half-trillion dollars to federal interest rate expense alone.

Dr. Paul’s warnings are the same messages we have been sharing with our friends and clients in this space. He writes, “The refusal of Congress to cut spending means the Fed will keep increasing its balance sheet in an effort to monetize skyrocketing debt. Eventually, the increasing debt and inflation will lead to a major economic meltdown. The meltdown will likely include a rejection of the dollar’s world reserve currency status.”

It will be a long time before anybody in congress knows as much about money and markets as Dr. Paul. You should know that when he talks about protecting yourself and your family from a financial crisis, he means with gold and silver.

Last year we cited these remarks from Paul:

“The dollar’s value goes down. It never keeps up. There are more dollars around. The purchasing power goes down. Real wages go down.”

“Big government always undermines personal liberties and encourages wars.

“The issue is liberty, and liberty cannot be preserved without sound money.”

Dr. Paul is the author of Gold, Peace, and Prosperity, End the Fed, and The Case for Gold.