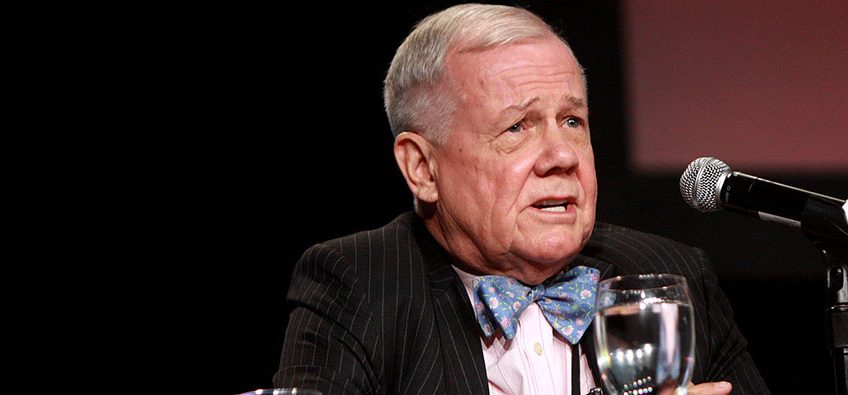

“Be Extremely Worried” Warns Jim Rogers

Coming Wall Street crash biggest in a lifetime!

“[In] 2008, we had a bear market because of too much debt,” says legendary investor Jim Rogers. “Look out the window since 2008, debt everywhere has skyrocketed.”

“It’s a simple statement that the next bear market will be the worst in my lifetime because the debt has gone up by such staggering amounts in the past 14 years.”

It’s been a while since we checked in with Jim Rogers, but he is an informed and often prescient voice. During the brutal bear market of the 1970s, the Quantum Fund, which Rogers co-founded, beat the S&P by an incredible 4,150 percent, making it one of the best-performing hedge funds ever.

Since there is no substitute for up-close and personal real-life experience, Jim Rogers has twice driven around the world, once by motorcycle, crossing primitive frontiers and backwater boundaries in search of investment opportunities.

It has been a long time – too long – since we last wrote about Jim’s outlook. In fact, last time we did, the national debt was only $22 trillion. Now it’s about $10 trillion higher, with the statutory debt limit being raised again. (If nothing else, we need to be aware that things are moving fast… very fast).

Back then, Jim was saying that things in America peaked out in about the year 2000. “Since then,” he says, “with Dubya’s $5 trillion war against Iraq… Obamacare… quantitative easing and a negative real fed funds rate for 10 years… transgenderism, the Kardashians, Lee Greenwood, trillion-dollar deficits, $22 trillion in federal debt, fake money, fake interest rates, and fake wars – it has been all downhill.”

Speaking to a group of fund managers in May, Rogers addressed the debt crisis, foreseeing trouble for both the country and the dollar: “Every country in history that’s gotten into this situation has had serious problems eventually,” the investment veteran said. “And we will, too.”

“You should be extremely worried because if you’re not, you don’t know what’s going on,” he warned. “Many countries are starting to look for alternatives to the U.S. dollar, partly because of its horrendous debt problem.”

Jim Rogers is a gold and silver investor himself. “The best place to be when you have inflation is real assets, and real assets are commodities,” he said.