Are We in Trouble?

Sure. That’s why you’re going to need gold and silver!

The Federal Reserve’s decision to begin raising interest rates and unwinding a lot of the assets it bought with made-up digital money over the last 14 years is beginning to take a toll.

Stocks down. Bonds down. Real estate down. Cryptos down.

The Fed’s new higher interest rates – although still deeply negative – look good to Wall Street and foreign exchange speculators here and abroad who have been starving for interest returns. The current yield on the US 10-year Treasury is 3.75 percent.

That must look pretty good compared to things two years ago. The 10-year yield was less than one percent then. So, they have been buying dollars and making the dollar rise against other currencies.

But today’s rates are still not enough to wring inflation out of the dollar economy, at least according the Fed’s own favorite theory. That theory demands that market rates be raised over the inflation rate. That is why, with inflation touching 14 percent, former Fed chairman Paul Volcker pushed the Fed’s policy rate, the Fed funds rate to over 20 percent.

It was the undoing of double-digit inflation, to be sure. But it created the steepest US economic downturn since the Great Depression.

So now the Fed is again raising rates to undo the damage from their years of creating trillions of digital dollars. It has already begun causing pain, but it is still completely inadequate for the Fed’s purposes.

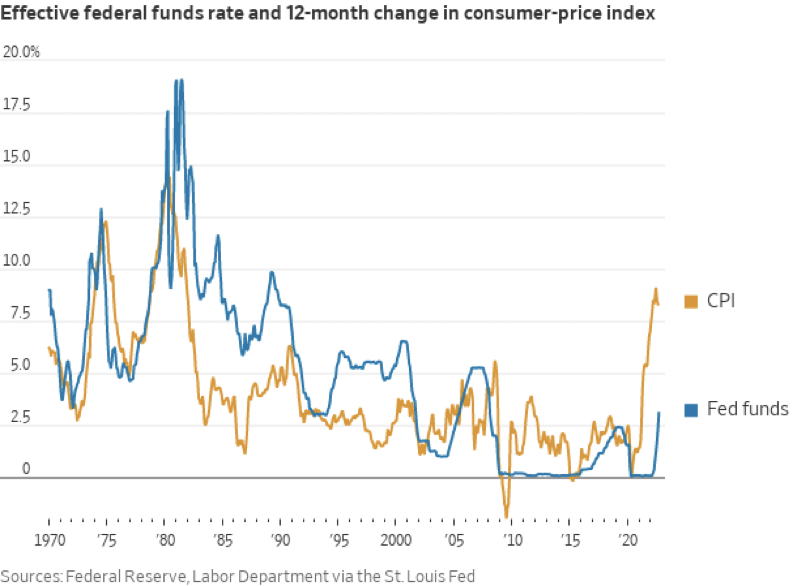

Here is a chart showing more than 50 years of both the Fed funds rate and the CPI inflation rate. You can see the Fed funds rate, the spiking blue line in the early 1980s, and the steep drop in the inflation rate in yellow.

On the right-hand side of the chart, you can see that the Fed has begun raising interest rates, but those rates are still far below the inflation rate.

Will the Fed stay the course? Are Chairman Powell and Fed board members really willing to crush the economy to undo what they shouldn’t have done in the first place? So far Powell’s record at the Fed has resembled Hamlet’s dithering: Powell flips and he flops. He has been indecisive and has been afraid to act when he should have. So, we will see.

But remember Ronald Reagan’s famous line when he was about to flip-flop on something: “When I feel the heat, I see the light!” When unemployment soars and the recession deepens, the people will scream and the politicians will bluster and threaten.

And the Fed will see the light. It will crank up the digital printing presses. If you would like a precedent, look no further than the Bank of England’s action this week. It panicked. As the pain from monetary tightening grew too intense, it turned on a dime, suddenly reversing course and starting money-printing and bond-buying all over again.

How do you protect yourself from these people? With gold, of course.