Up, Up, and Away

Inflation is up, and your dollars’ purchasing power is going away!

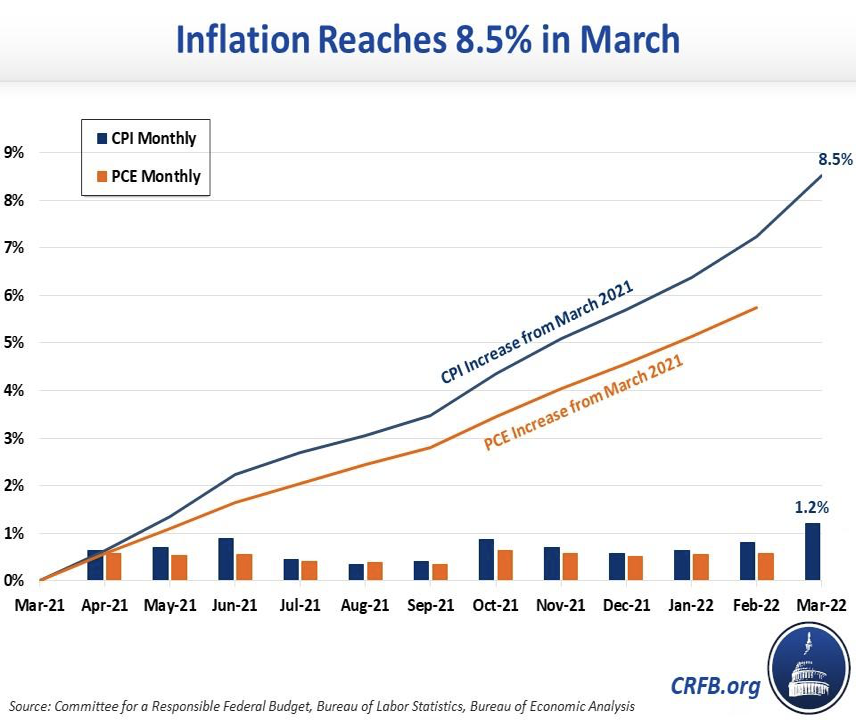

Consumer prices have climbed 8.5 percent over the last 12 months.

Stated differently, if you had tucked away $1,000 a year ago – congratulations! Your purchasing power has shrunk to $850.

In some parts of the country, the inflation rate is now at 10 percent or more. And in fact, the inflation rate in March annualizes to well over 14 percent.

Inflation has been spiraling higher month after month, plundering the savings of the American people and decapitalizing them.

But it’s not just that the monetary authorities are taking wealth from you surreptitiously, without even the benefit of a legislated tax hike. It’s also about the way the process of destroying the currency is hidden from the people.

After all, in just the last two years the Federal Reserve has made up $2.6 trillion out of thin air. But it tends to escape the notice of the financial press.

If the authorities jack the amount of printed money up by 40 percent, do you think it might dilute the purchasing power of all the other dollars that are already out there?

But the national financial press can’t seem to come to terms with that. The Wall Street Journal writes that “this bout of high inflation” can be attributed to a strong economy, to Russia, and to supply chain issues.

See for yourself:

There are several reasons behind this bout of high inflation. First, the economy is strong and employers have been adding more than 400,000 jobs for 11 straight months. Energy prices also soared in early March as Russia’s invasion of Ukraine pushed up crude-oil prices. And food prices are rising rapidly due to higher demand and supply chain issues. The conflict in Ukraine will likely push up food prices further since Ukraine and Russia are major wheat and fertilizer exporters.

Not a word about the Fed.

Canada’s leading business journal, the Financial Post, citing an expert, says the exact same thing. Once again, see for yourself:

Over the past 30 years globalization, demographics, technological change have driven prices. The Fed cannot do anything about the three of them,” said RSM chief economist Joe Brusuelas. “We are just going through a period of prolonged disruption” that could mean structurally higher inflation as populations age and then save less and spend down assets, and globalization suffers through a series of shocks including the trade war launched by former President Donald Trump, the pandemic, and now the war in Ukraine.

Once again, it is not the fault of the crazed money printers.

As for the Washington Post, one of its star columnists explains that all we need to do about inflation is have more immigration. Right. But at least they are deflecting blame from the Bernankes, Yellens, and Powells in an original way.

Don’t be deluded by any of this rhetorical sleight of hand. If you would like to find out more about how our money is being corrupted and learn how to protect yourself with gold and silver, speak with a Republic Monetary Exchange precious metals professional today.