Inflate or Die, Part 2

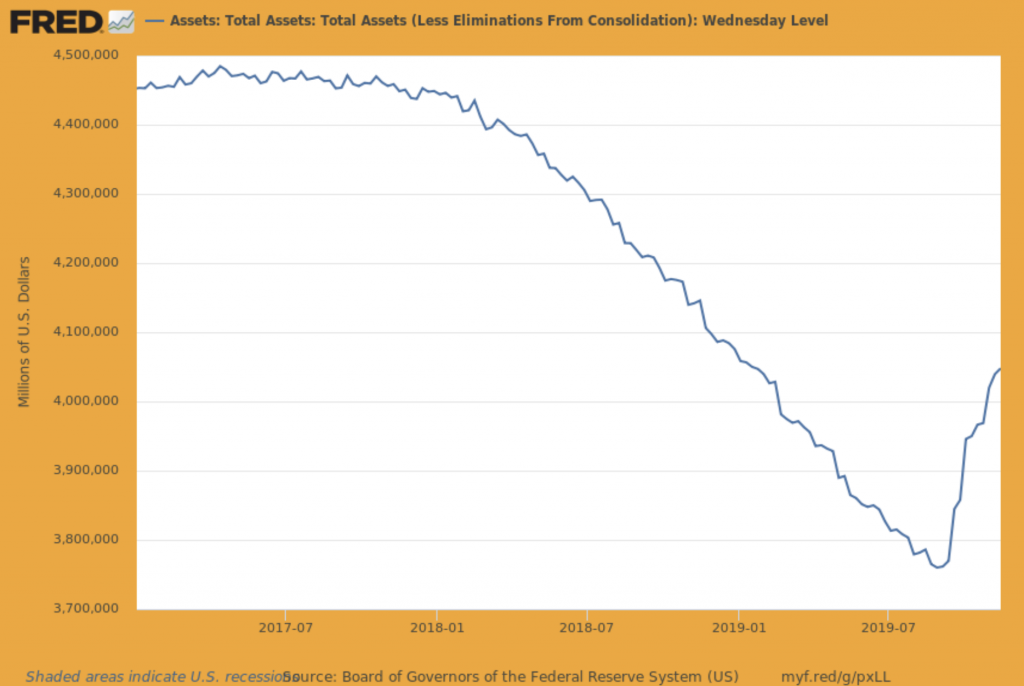

Before the trillions of dollars of made-up digital “money” it created in 2008-2014 does its real damage, driving consumer prices to the moon, the Fed started to reduce its assets with a program called Quantitative Tightening. They didn’t discuss it much, and the mainstream press didn’t say much about the risk overhanding the economy from QE either, but even the Fed knew that had created a huge problem with trillions of dollars of money it made up out of thin air in its Quantitative Easing program. You can see on the chart below that Fed assets began to move lower in 2018 as the Fed targeted reducing its holdings by $50 billion a month

But by last fall, the stock market threw a fit. Since it had been climbing for years on the backs of free money for Wall Street, as the Fed tightened and reduced its assets, the market began to collapse. The S&P500 had traded as high as 2941 points in late September; by Christmas Eve it was 2350, a staggering 20 percent loss in only three months!

Wall Street was on strike! More free money, it told the Fed, or we’ll bring the whole stock market house of cards down.

The Fed got the message. By Labor Day, as you can see on the chart, the Fed’s balance sheet began to grow once again. Fast!

Not only did the Fed reverse gears, but it also stomped on the money printing accelerator!

Notice that the blue line, Fed assets, is now climbing faster than it came down. The upward trajectory is steeper than the rate at which it declined in the first nine months of the year. This illustrates the fact that with the new QE the Fed is printing at least $60 billion a month, which is more than the original QE that began in 2008.

Fed chief Jerome Powell says the new QE (which he refuses to call QE) is an interim measure. But is it?

The Fed knows it has to print money or the stock market will go into free-fall. The Fed has become the guarantor of stock market profits. The Fed has become Wall Street’s “Hey, boy!” It is inflate, or die!

Eventually, a critical mass of investors will figure that out. Discovering that the market is only held aloft by the Fed, they will head for the door all at once. And there is nothing the Fed can do at that point.

Well, there is one thing. The Fed can begin printing money and buying stock itself. That is a real endgame scenario. Seriously, if that happens, it’s the end of American free enterprise. Get out of the way!

One more thing. And this is the reason for telling the whole story. When the Fed prints new money, it reduces the value of every other existing dollar. That’s inflation. It’s a stealth tax, voted for by no one. It appears to make everything cost more, but in reality, the dollar buys less and less.

That’s one of the reasons people buy gold.

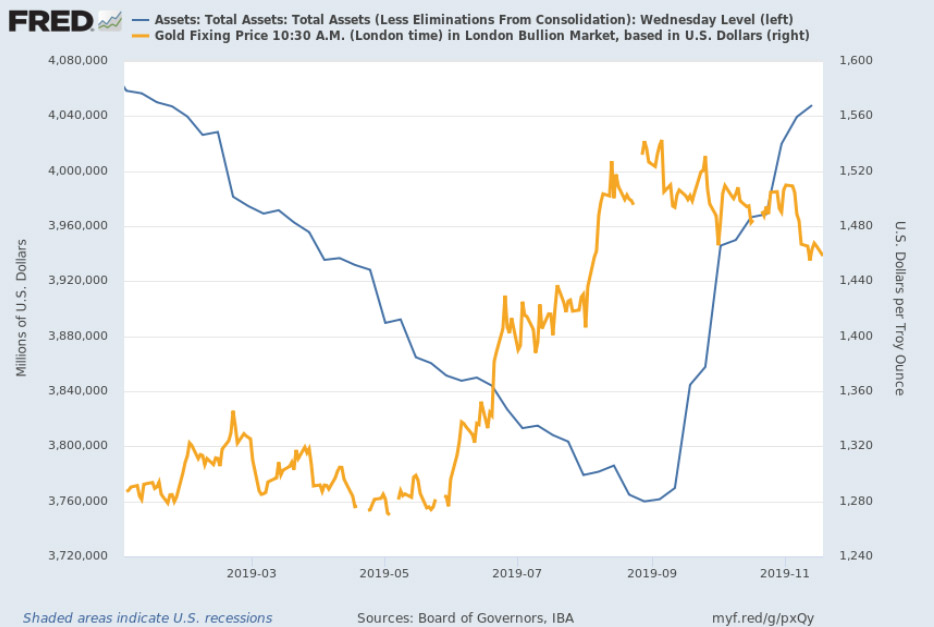

And in fact, you may remember when the market figured out last summer that the Fed was going to start a new round of inflation, the new gold and silver bull market was born. Gold and silver prices took off!

Here’s a chart that shows what happened.

The Inflate or Die Fed is in a fix. The only beneficiaries of its dilemma are people with gold. By its own logic, the Fed must continue to print more dollars. That will drive gold higher. Much higher. If it stops printing money, the stock market will plummet. And stock investors will rush into gold.

Either way, your best choice is to own gold.