US Debt: Already Impossible and Headed Higher

Have you noticed that nobody much is talking about the US debt these days? We scour the news and especially the financial media pretty carefully and it seems that most are hauntingly silent about the debt these days.

It is a little bit like the Sherlock Holmes story about the dog that didn’t bark. Maybe no one much cares about the debt these days because they know that the Federal Reserve will just print the money to cover it.

Last month we pointed out that Congress voted two years ago to suspend the national debt ceiling until July 31 this year. We wrote, “Over the next 12 weeks you will hear a fair amount about the nation’s already unpayable debt and about the debt ceiling.”

We were wrong. We have been listening for the debate to begin, and so far, it is just crickets.

Oh, sure, if you hunt you can find a couple of little things. A handful of congressmen began pushing a measure last month to eliminate the national debt ceiling entirely. The big-spenders do that all the time. Another headline crawled by that said something about the US being one of only two countries with a national debt ceiling. We didn’t read it because it seemed to fall under the category of “so what?” Are we to be ashamed to have measure in place to limit our debt—even if politicians try to make it ineffective—just because others don’t?

Maybe it is so quiet because everyone knows that the national debt is unpayable and we are holding our breath to see how long until the endgame.

Economist Keith Weiner has been thinking about the endgame, too. He writes, “That the debt is unpayable may be obvious, but the endgame is not obvious at all. At first glance, it looks like the government will default. However, as the issuer of its own currency—and the world’s reserve currency at that—there is no reason to default.

“The government can always get as many dollars as it needs. It can always sell more bonds.”

Well, it can sell more bonds to the Fed anyway, which will finally only make the endgame more destructive.

The only real solution is for individuals to buy gold and silver so the aren’t taken down with the collapsing debt.

May was the eighth month of the current fiscal year. So, in just two-thirds of FY2021 on the books, Washington has managed to blow up this year’s debt by an astonishing $2.1 trillion. That’s $184 billion more than the first eight months of the year before.

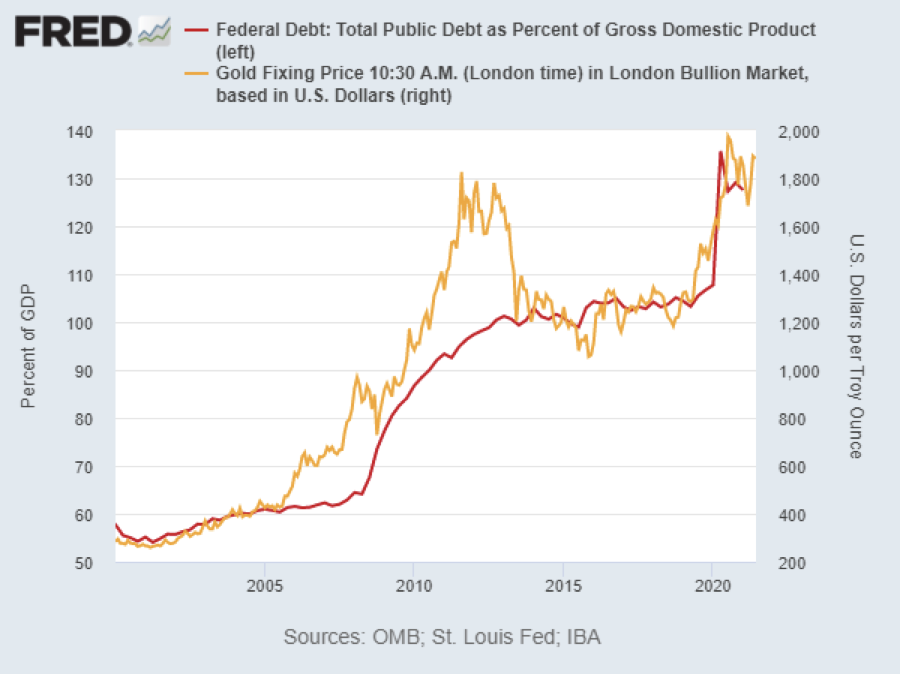

Still the debt ceiling looms ahead. But since we know that the debt will continue to climb, pulling our gold along with it, we will just relax and listen to the Washington crickets.