Wobbling Debt Structure

“The most insane accumulation of debt… ever imagined!”

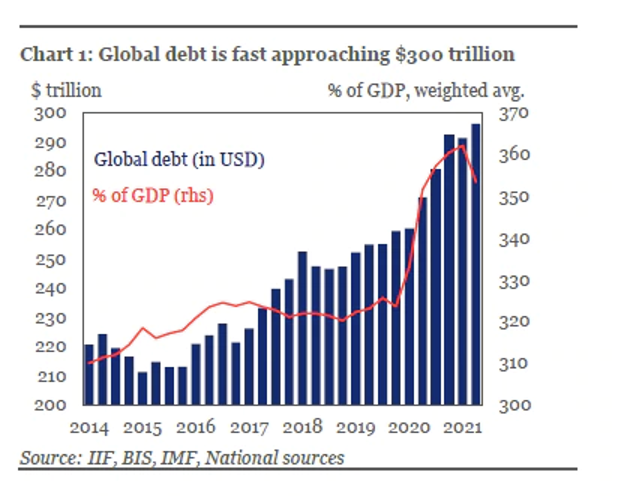

Total world debt is now approaching $300 trillion. And it continues to grow at a breathtaking pace.

The Institute of International Finance’s latest Global Debt Monitor reports that the world’s wobbly debt structure grew by $4.8 trillion in the second quarter of this year to total $296 trillion.

The report totals government, household, and corporate and bank debt.

There have been almost 50 sovereign nation bond defaults since 2000. At least a half-dozen countries are in default today.

As for the US, former Reagan budget director David Stockman says, “They [Federal Reserve policymakers] have fostered the most insane accumulation of debt in all sectors of the US economy ever imagined, even as they have staked their credibility on a lowflation/transitory inflation thesis that is getting blown to smithereens by the day.’

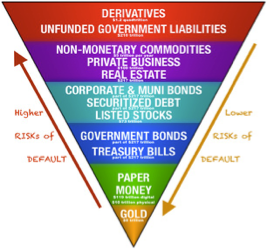

With the world is awash in debt, much of it unpayable, it must be noted that it rests dangerously on a base of very little real liquidity. Stated differently, the debt structure is like an inverted pyramid, an enormous mass of debt all balancing precariously on a teeny-tiny tip of gold, which is real liquidity, real money. Be sure you have a base of gold (and silver) to support your financial structure in the tumultuous days ahead. Speak with a Republic Monetary Exchange precious metal professional to review your portfolio today.