The Jaws of Stagflation

Stagflation is just another factor making gold and silver go up

As we write this note, gold prices have gained nearly 39 percent this year. That follows a 27 percent jump in 2024. It’s a good time to look at one of the most powerful dynamics that makes gold price go up: Stagflation!

In the modern American memory there aren’t many things as closely associated with explosive gold and silver price increases as stagflation – the brutal combination of inflation and a stagnant economy.

In fact, the entire decade of the 1970s is often simply called the Stagflation Decade. The decade was characterized by subpar growth (rising interest rates killed a lot of businesses; the Fed funds rate peaked at 20 percent at the end of the decade), recessions (two of them), and sky-high inflation (it peaked at almost 15 percent in March 1980).

Of course GDP contracted, and consumer confidence collapsed.

But precious metal? Whoooo, boy! The stagflation decade was a spectacular bull market in both gold and silver.

So is there any evidence that we are again entering a period of stagflation, one that can be very profitable for investors well-positioned in gold and silver?

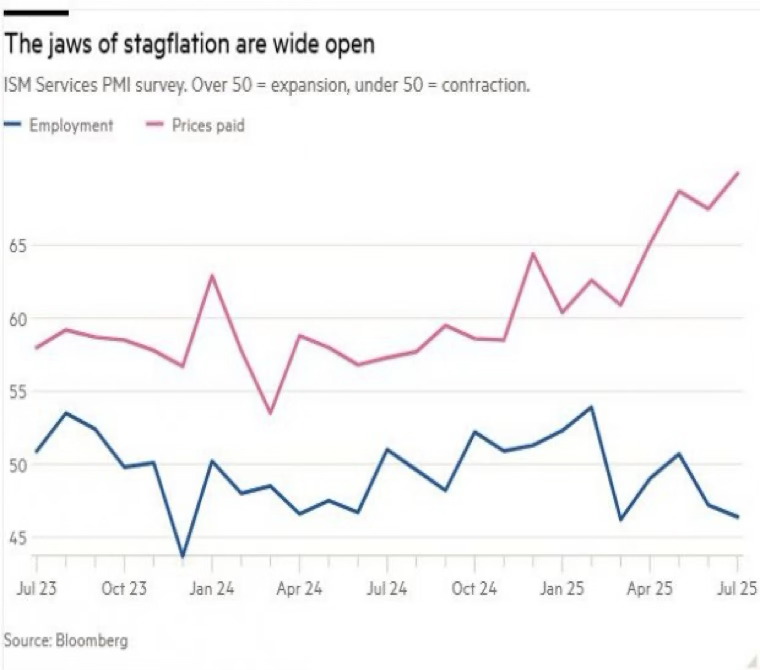

The answer is yes. To go along with that short answer, take a look at this chart from the respected Purchasing Managers Index. It shows contraction in employment along with rising prices.

There is plenty of confirmation of this picture, especially the July Producer Price Index that took a big, unexpected jump. The money supply, M2, is growing at almost 5 percent.

GDP (productivity) growth in the first half of 2025 was only 1.2 percent annualized, less than half 2024’s 2.8 percent growth. The unemployment rate is inching up. The Conference Board reports that consumer confidence is down as well. The price of oil is down as well from high in 2022. Slowdown in economic activity means lower energy demand.

As for the Federal Reserve, it is in about the same place it was during the Stagflation Decade. Trump wants a rate cut to goose the economy, but that isn’t usually done when the stock markets are at all-time highs (remember the stock market collapsed under these same conditions in the 70s!) and the indices show inflation already climbing. On the other hand, raising rates to head off inflation threatens more stagnation.

It’s the same conundrum the Fed was in 50 years ago. So it did a little of both, it raised rates and then lowered them. Then it lowered them some more and then raised them. Then it raised them and then lowered them again. The number of interest rate changes was mind-boggling, because they simply didn’t know what to do. Just like today. So people protected themselves with gold and silver.

We are in the jaws of Stagflation!! Speak with a Republic Monetary Exchange professional today to protect yourself and your family from the volatile financial conditions ahead!