The soaring debt has no end in sight. See why that makes gold glitter and silver shine.

The soaring debt has no end in sight. See why that makes gold glitter and silver shine.

(and war threats are spreading by the day!) “The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.” — Ernest Hemingway Bombs have been falling all over the place this […]

We say prepare now with gold and silver! The US government collects $5 trillion. It spends $7 trillion. And that is not a recipe for economic health! That’s the view of hedge fund superstar Ray Dalio, the founder of Bridgewater Associates. Five years ago we included Dalio in our pantheon of billionaires that were urging […]

Gold and the Dollar are Facing Off As far as bull markets go, this gold market is impressive! But it is much more that just another bull market. This is a global monetary reset! This is more like a showdown. The endgame for a monetary system that is no longer sustainable. As we have […]

The amount of mined gold and silver in the world – all of it known to exist – is a very finite amount. We ask xAi model GROK to put the numbers into perspective.

Latest figures from the Silver Institute! When the gold price broke out to new highs this year, we repeatedly advised that silver would follow and even outpace gold. It sure has. Silver is up more than 30 percent. And even though gold made new all-time highs this year, silver has outperformed gold. Silver in […]

What happens to gold if Trump decides to fire Fed Chairman Powell? The president has been demanding lower rates from who he dubs “Too Late”. Take a look at the impact on gold in that event.

The most important indicator of future gold prices is the relentless move by the world’s central bank of inch away from US dollar reserves and their movement to gold. The world’s central banks have purchased 1,000 metric tons of gold a year for each of the last three years. This year they are on track to do it again.

Another Look at Gold’s Purchasing Power A month ago we posted a comment about preserving your wealth with the purchasing power of gold. Now we’ll refresh your memory and add to the story. At the signing into law of a Florida bill recognizing gold and silver as legal tender, the bill’s sponsor, Representative Doug Bankson, offered this illustration of gold’s purchasing […]

Accept No Substitutes for Real Gold and Silver Today, with socialism on the march everywhere from New York to California, it’s more important than ever that you protect yourself with real, physical gold and silver. Not paper gold, shares, or title to gold. That’s to protect yourselves from government risk. Right now […]

Forecasts should “Buy Gold!” Long-time friends may have noted that we don’t devote much space to long-term budget projections out of Washington. Not that we pay a lot of attention to a lot of stuff that comes out of Washington, but long-term budget projections should not be relied upon by anyone. The only thing they […]

What to expect Washington to do, and what you should do about Social Security’s bankruptcy! In Part One of The Truth About Social Security we shared the latest news from the program’s Trustees: the retirement fund will be out of money by 2033. Government accounting is funny. The retirement fund is already out of money, […]

Better start putting away more gold and silver coins! What do you need to do about Social Security? Simple. Start putting away more gold and silver coins for the future. That’s because the Social Security Trust Fund is in deep kimchi. Simple put, there are no funds. There is no security. And don’t even think […]

Experts note changing global monetary role It’s one of those headlines that sums everything up in a few lines. This is from the Financial Times on 6/17/25: We are certainly glad to see some of the international news media catching on. Our only interest is seeing to it that our friends and clients get in […]

Ask knowledgeable people how high gold will go, and they’ll ask, “how low will the dollar go?” That’s because the price of gold is the world’s referendum on the quantity and quality of the U.S. dollar. The future of the dollar is the same as it has been for all debt-backed paper currencies throughout history. […]

A Look at Gold’s Purchasing Power We reported last month about the states that are passing laws to protect the people from the effects of Washington’s inflation. In short, inflation destroys the purchasing power of a currency like the dollar. As the government or central bank creates more and more dollars, they buy less and […]

. . . of silver no one ever yet possessed so much that he was forced to cry “enough.”—Xenophon, “On Athens”Silver is moving! Silver is moving!With Thursday’s breakout silver hit a 13-year high. A week ago we posted a piece calling silver the double-play precious metal. And right on cue it decided to prove us right. […]

(Because it can just print more money) It wouldn’t surprise us to learn that even Federal Reserve officials are secretly buying gold! That’s because in the face of unpayable US debt, establishment figures, left and right, are acknowledging that it’s all a game! One hedge fund manager even called it “KAFAYBE!” That’s a term from […]

Demand for Silver Keeps Growing! You would probably be handsomely rewarded in this era of massive and unpayable government debt if you were substantially invested in something that is a time-tested currency alternative with a propensity to explode in price in a monetary crisis. And if you are a trend follower, you would expect to […]

The return to honest money can’t be stopped! It only stands to reason that we would spend more time than others tracking movements in the return to an honest precious metals-based currency system. It’s our job! We want our friends and clients to profit from this epochal change in monetary dynamics. Today there is more […]

Taking Risk Seriously! The lights went out in Europe – Spain, Portugal, France, and Belgium. It’s just one more wake up call. On Monday, April 28, Spain and Portugal experienced the brunt of a massive power outage. Spain lost about 60 percent of its electricity within about five seconds. 60 million people were without […]

Here’s a better idea- Gold! 81 percent of Americans think the government is corrupt. Do you agree? If you agree the government is corrupt, why would you trust the government’s money? The U.S. dollar has lost 97 of its value since the creation of the Fed. Why would you trust the government’s money? The government […]

Even establishment institutions are raising their gold price forecasts. Like UBS, Citi Bank, and Goldmann Sachs. With other targets at $3,700 and $3,900, Goldman Sachs has a scenario that sees gold hitting $4,500 an ounce! This year! A Bloomberg Intelligence analyst sees recent price action is as the beginning of a larger move to $4,000. […]

The Dollar’s Safe Haven Status at Risk! We read it in The Telegraph headline: Trump’s tariff blitz has put America’s safe haven status at risk. We knew it would come to this. We knew it was headed our way. Only when didn’t know exactly when it would arrive, and we don’t know exactly how it […]

In Part I of this post, we have tried to make the case that governments simply cannot be trusted to manage monetary affairs reliably. We believe that a dawning awareness of the dangers involved is the reason so much gold is suddenly in motion around the world. Or one more example. In the lates 1970s, […]

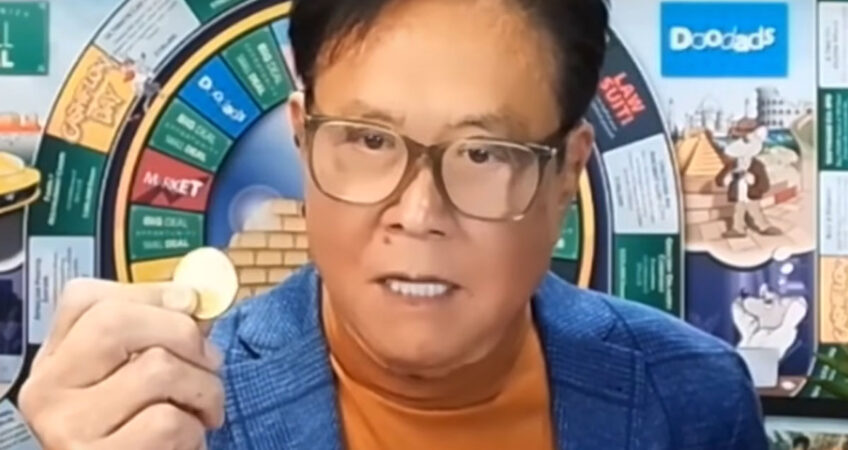

Robert Kiyosaki: “Silver will 2x this year to at least $70 an ounce” The millions of people who follow Rich Dad Poor Dad’s Robert Kiyosaki may have seen this message on his X account: SILVER set to boom. Hottest investment today is silver. Much more demand than supply…. I predict silver will 2X this year […]

A Dispatch from the War on Cash! The war on cash is an extension of the war on gold. Enemies of your autonomy and financial privacy have made the elimination of cash a priority. Now one of the battleground countries in that war may be waving a white flag! Sweden is having second thoughts. A […]

Gold just keeps on going. As we write this post it has reached 18 new record highs so far this year! One reason gold is racing to new heights is that there just isn’t much to go around. The world has plenty of experience with collapsing monetary systems. When people suddenly realized that the […]

There is nothing like gold for privacy! We have warned from time to time that Central Bank Digital Currencies pose an almost unprecedented threat to your freedom. Now the head of the European Central Bank, Christine Lagarde, says the digital euro will arrive in October. A European CBDC is a stalking horse for a Federal […]

By now, just about everyone we know has learned to view the mainstream press through skeptical side eyes. So, today’s message is very short. Here’s the front page of the financial section of the Wall Street Journal two and a half years ago. Gold was $1,678 at the time that “the world’s leading business publication” […]

President Trump’s 25 percent tariffs on goods from Mexico and Canada might or might not be in effect soon. As we write this, tariffs are on hold for goods that are covered by the North American trade agreement. If and when a general tariff kicks in, Canada has promised to retaliate with 25 percent tariffs […]

The Worldwide Turn to Gold Continues! If you are adding gold to your profit and protection portfolio, you are in good company! The price of gold hit new highs in February in all the world’s major currencies, according to the World Gold Council, a London-based industry trade association. The cross-currency performance is important to note, […]

The Worst of Both Worlds! Is the Stagflation Train pulling into the station? Bringing both inflation and a depressingly stagnant slow growth or shrinking economy with it? If you listen carefully, you can hear its whistle blowing. It’s coming around the bend! The Stagflation Train brings carloads of economic misery, but at the same time […]

The Inflation outlook… Grim! Our adjoining post this week STAGFLATION HERE AND NOW? focuses mostly on evidence of the slowing US economy. That is the stagnation part of stagflation. Now we look a little more closely at the inflation component of stagflation. Let’s start here. The Consumer Price Index has been higher than the Federal […]

The January CPI is the fourth straight monthly increase and the seventh straight month over month increase from the prior year.

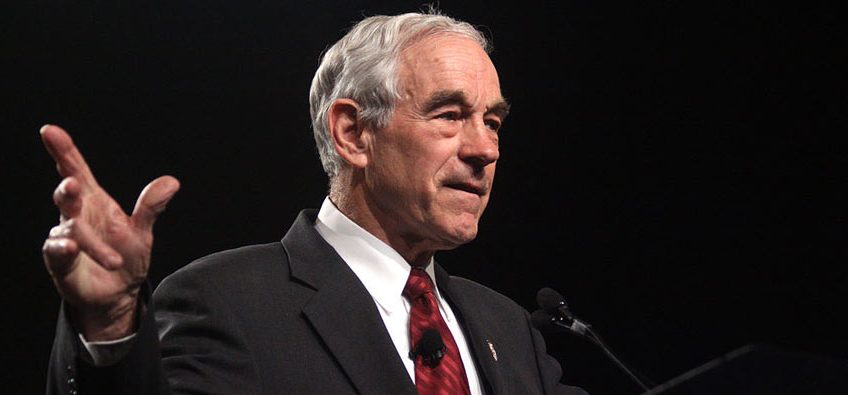

“You’ll see gold double, triple, and quadruple if we don’t do the right thing.” – Ron Paul

Who is going to dominate global affairs in the future? As we have said on ample precent many times, nations that are net acquirers of gold rise in the affairs of the world. Nations that are net dishoarders sink. Some people think that rising nations become acquirers of gold because they are prosperous. But they […]

Gold keeps hitting new record highs! It’s evidence of serious turmoil. Gold is a sensitive indicator of trouble. Sometimes the price of gold starts moving before the actual evidence of trouble becomes clear. But then the dust settles! Foreign central banks loading up, gold shortages, currency wars, and overseas exchanges scrambling to get their […]

take a look at what the World Gold Council considers the key attributes of gold.

How high will gold go in the next four years? The price of gold has risen under every US presidency since 2000. This graphic from Visual Capitalist reflects the gold price action from 1989 until August 2024 using World Gold Council benchmark prices. That month gold broke above $2,500 for the first time ever. To […]

Gold a shade under $4,000? Silver at $51, a new all-time high? We don’t publish a lot of predictions for future gold and silver prices. We do know what happens to unbacked paper or fiat money: it eventually goes to nothing. The US has gone a long way down that road already. That means […]

“I want to just obey the Constitution. The Constitution says only gold and silver can be legal tender.” – Ron Paul He’s an icon of the sound money movement, the former Congressman who knows more about gold and money than others in Washington, and the elected official who tried valiantly year after year to have […]

What they are saying about the gold, stocks, and the year ahead… Another hike in the debt ceiling. That’s highly correlated with higher gold. And there are a host of things that threaten the stock market which is already in dangerous territory because of fundamentals like high price/earning ratios in a rising interest rate environment. […]

(Although they never really left!) SHANGHAI (Reuters) – China’s central bank resumed buying gold for its reserves in November after a six-month pause, official data by the People’s Bank of China (PBOC) showed on Saturday. That’s Part One of the story. Here’s Part Two: (Business Standard.com) – China added gold for a second straight month […]

As the calendar turns over to 2025, take a look at these important quotes about gold and silver investing.

Each year, we like to wrap up the end of December with some important quotes about gold and silver. This year is no different… here is our list of things worth remembering about gold and silver… ●●● Now when Jesus was born in Bethlehem of Judaea in the days of Herod the king, behold, there […]

SHANGHAI (Reuters) – China’s central bank resumed buying gold for its reserves in November after a six-month pause, official data by the People’s Bank of China (PBOC) showed on Saturday. That’s the story. China is serious about gold and that is not going to change even if the People’s Bank appears to be out of […]

Massive Increase in Debt Signals Another Reason to Buy More Gold This is serious. “Trillions are flying by so fast they’re hard to see!” That the description of the skyrocketing national debt from Wolf Richter at WolfRichter.com. He is right. The US national debt just topped $36 trillion. It broke through $35 trillion just four […]

In a recent post, Silver Shines, we asked if you are ready for the silver shortage. We have repeatedly cited leading financial institutions that foresee big moves in silver. Among them are calls for silver to trade at $38-$40 and $40 per ounce by mid-2025. We think these market calls from major banks have […]

We Hope You’re Watching! You may have heard about the popular poster back in the 1970s that read “War is not good for children and other living things!” But war sure seems to be good for silver. It was good for silver in the 1970s. And you may have noted how silver prices took off […]

Beware the next round of big bank loses! America’s biggest banks are sitting on mountains of distressed and non-performing commercial real estate loans. They have squeezed their eyes tightly shut, hoping the problem will somehow just go away, a strategy called “extend and pretend.” A report inside the Federal Reserve describes this practice of delaying […]

…But they will keep digging! A few years ago we warned that the Republicans and Democrats were acting like they had signed a mutual suicide pact! That’s because they were digging us into a debt hole so deep that eventually they wouldn’t be able to climb out. Our advice at the time: “STOP DIGGING!” […]

“Time Bomb Ticking” (which is why you need gold now) Just so you know, even though we have been warning that this is where we are headed, it’s now no longer just us saying that the dollar scam will end badly. We hope all the government grifters, Fed flimflammers, cronies and crooks, Washington wastrels and […]

You’ll need Gold and Silver to Do it! It’s the question the mainstream financial media should be asking but doesn’t. While they remain behind events unfolding, year after year the Mises Institute takes dead aim at the economic realities others prefer to ignore. This month a Mises article asks “Can America Survive Global De-Dollarization?” We […]

The disastrous economists are a signal to buy gold! Like other disasters, hurricanes are bad for the economy. So are most Washington economists. The destructive effects of both are frightful and when these “disastrous economists” are making monetary policy, it is a very good time to own gold! Year in and year out, statist economists […]

Washington keeps piling on unsustainable costs for Americans. Owning gold now “increasingly important!” A new fiscal year for the Federal government began on October 1. The acknowledged US national debt has now hit $35.6 trillion. Let us tell you what happened during the fiscal year 2024. It began at the beginning of October 2023 with […]

What’s your plan for the cataclysmic reckoning? “Only a dwindling number of denialists doubt that a cataclysmic reckoning, including double-digit damage to Americans’ income growth, lies ahead. It’s past time to prepare.” It sounds like what we have been increasingly warning about. Only this time it didn’t come from us. Somehow it made it onto […]

Saudi Arabia joins China in quiet gold acquisitions! Have you thought about doing the same? There appears to be a sharp rise in secret, off-the-books gold buying by foreign central banks. Based on World Gold Council reports and other sources, Saudi Arabia has cranked up its gold buying machine. Since 2022 the Saudi Arabian […]

A picture is worth a thousand words! The gold bull market has outperformed both stocks and fixed income indices for the past two years. And the silver story in one word: Wow! As we write these observations, spot gold is $2,673. Here is a chart showing the history of gold prices on the Chicago […]

No Wonder Gold is Flying High! Things are out of control and won’t get better! That’s why gold is up more than 34 percent in the last 12 months! Washington’s fiscal year ends in just a couple of weeks and it’s going to be a doozie! No wonder gold is flying! Bloomberg News: The US […]

Why we get deficits, debts, inflation, and why gold goes up! “Free stuff! Step right up! Get your free stuff now!” Washington politics has become nothing less than a bunch of carney barkers! “Quick grab your Obama phone and hurry!” The House Budget Committee has gone through the Harris-Walz economic proposals, and it is […]

If you own silver, wish you owned silver, or are thinking about owning silver some day, the headlines in a recent Jerusalem Post story should grab your attention and not let go: CHINA’S STRATEGIC SILVER TAKEOVER: A CALCULATED MOVE TO DRAIN THE WEST China hoarding silver, price 10% higher than West. Secret weapon or economic […]

The failures of government currencies are the rule. They are not the exception. There are more paper and other government money failures than we could possibly cover, but we’ve taken a close-up look at many of them over the years including the big ones like the German inflation a hundred years ago. Or the Zimbabwe […]

What’s the deal with gold? What’s going on? Yahoo! Finance pointed out the other day that “The yellow metal has forged meteoric gains this year.” Jared Blikre, Yahoo’s finance editor sought to explain it in an article whose headline we borrowed for this piece, “WHY GOLD IS OUTPERFORMING NEARLY EVERYTHING!” Here is some of what […]

We’ve already had Third World inflation, endless wars, defund the police, socialist leaders, and a currency that the whole world is backing away from! So why not be prepared? Consumer prices are up 39% since 2012. If you retired in 2012 after carefully planning your household budget, too bad for you! You could say, as […]

At Republic Monetary Exchange, we built our business with a policy of putting our clients first. Our Best Practices Policy is designed to protect you. We have warned for years about gold dealers that pop like mushrooms when gold prices are rising. As we have warned, some pop-up dealers ask customers to pay for […]

The pilots flying don’t know how to fly! We don’t know how to say it nicely. Besides, your wealth and prosperity matter too much to pussyfoot around about stuff. So here you go: Far from the fabled “best and brightest,” of yesteryear, today’s Washington clowns have no idea what they are doing to our economy. […]

WAR! Better be ready! Things are getting pretty dicey on the world stage and the Biden administration doesn’t even know how to spell diplomacy! Amid rising geopolitical tensions on multiple fronts, we’d like to make a single point. Iran’s leadership has been virtually assuring the world that it will retaliate for the assassination of […]

…core consumer prices are up 50 months in a row! When stock markets are in chaos… When Warren Buffet sells half his Apple stock… When the commercial real estate market is a mess… When phony paper currencies like the Japanese yen get crushed… When central bank gold buying hits one record high after another… When […]

The Federal Reserve Banking System is a political institution. It is not a philanthropic institution, nor is it an academic one. Nor is an honest bank, one that takes in money from willing depositors and makes loans to willing borrowers to make a spread. The Fed is a political institution. Its politics are hard left. […]

What happened to the gold in Olympic gold metals? For hundreds of events, the 2024 Olympics handed out thousands of medals. The Paris Mint made more than 5,000 medals, 2,600 for the Olympics and 2,400 for the Paralympics. When the modern Olympics began in 1896, the official US gold price was $20.67 an ounce. […]

Oh, What a Tangled Web! Let’s see. The mainstream media has been wrong about almost everything! So, why should we be surprised they are clueless about the economy? We’ll begin with the obvious. Despite the Biden/Harris administration crowing non-stop about the great unemployment picture (and the lapdog press echoing their every word), In the last […]

As students of monetary history, we have an advantage in the gold price forecasting game. Based on abundant precedent we can simply say that at some point people will no longer refer to the dollar value of the gold they own; they will instead just refer to the number of ounces they own. And what […]

Is the United States insolvent? By that I mean is it unable to pay its debts? The honest answer is yes. The formal answer is no. Let us explain. Better yet, let Ben Bernanke, the former Chairman of the Federal Reserve System explain: “The US government has a technology, called a printing press, that allows […]

The Crowstrike Outage Shows How Fragile Our Digital Infrastructure Can Be The headlines captured the story this way: It’s like Y2K, except it happened this time! “Largest IT Outage In History” Sparks Disruptions Worldwide! Unprecedented IT Outage Cripples Businesses Around the Globe! The IT shutdown impacted major banks, stock exchanges, 911 services, media, and airlines. […]

Is the Inflation Rate only the 3% that the Government says it is? Here’s a wake-up call! Yes, another one! The government tells us the inflation rate is currently 3.0 percent. That’s the Consumer Price Index increase for the 12 months ending in June. Between January 2020 and last May, consumer prices rose […]

Your Essential Financial Survival Briefing! The American Gold Story! Reviewers praise Real Money for Free People! Rich Dad Poor Dad’s Robert Kiyosaki says Jim Clark’s book is “essential reading for anyone who values their financial freedom.” New York Times bestselling author Charles Goyette says Jim Clark’s book “explains in easy-to-understand terms what the Founders knew, […]

They’re even wrong about being wrong about inflation! What a bunch we have running fiscal policy in our country. Treasury Secretary Janet Yellen has distinguished herself for being wrong about inflation and virtually everything else. And President Biden, well there’s no need to describe his abject confusion anymore. Since everyone except a few shameless toadies […]

What are the major forces driving gold prices up? We spotlight four of them: WAR It is our view that the mainstream media ignores or underplays the significance of all of the forces destroying our currency and prosperity. But it seems most clueless about the way war destroys both. However, our hands-on experience goes back […]

If it is so strong, why does it buy less and less? Headline, the Wall Street Journal, June 4, 2024: The Dollar Is at Its Strongest Since the 1980s. Can It Last? Sorry, but it’s flapdoodle. Gobbledygook. Gibberish. Bafflegab. Or to put it in more serious terms, it’s Newspeak. George Orwell coined that term […]

Here is just a short list of the major – some might say existential – threats we Americans are facing. They all have the same cause. It’s not hard to figure out. It‘s not because of the alignment of Jupiter and Mars. It’s not because of subversion by space aliens. They are all […]

It’s a purchasing power calamity! Brace yourself! Another huge wave of inflation is approaching! The purchasing power of your savings is about to get swamped once again. So far the purchasing power of the US dollar has lost about 20 percent of its value during the Biden presidency. But the Biden presidency is not […]

Suppose a hundred years ago some far-sighted benefactor, someone a few generations back, wanted to leave some wealth for their descendants – including you. Would you be better off if they left you $10,000 cash in bills or $10,000 in gold? A hundred years ago American money was gold. Americans commonly carried and conducted commerce […]

The headline on Yahoo! Finance reads, “Living on Edge: Nearly 90% of Retirees Worried Inflation Will Eat Away Savings.” The story reports that a third of retired Americans are worried that they haven’t saved enough. No surprise there. 89 percent describe themselves as deeply concerned about the erosion of their purchasing power by inflation. As […]

It’s not something that people generally want to talk about – widespread civil chaos, lawlessness, and social collapse. But it goes hand in hand with the failure of the monetary system. And it doesn’t take a Nostradamus to see the sign of something like that on the horizon. Just the other day we noticed […]

Sorry, too late. You just can’t turn a $24 trillion economy over to someone a clueless as Joe Biden and expect things to go well. How many examples do you need? It was just last week the President claimed that inflation was 9 percent when he took office, but he got it on the run. […]

Ron Paul says, “Massive public unrest… violence… authoritarianism!” Make sure you have plenty of gold and silver, because it’s not going to be pretty! No one has a better track record than former Congressman and presidential candidate Ron Paul when it comes to foreseeing the results of government interventions. Whether it is foreign policy like […]

Something is beginning to bubble in the silver market! The year isn’t even half over and silver is already up more than 15 percent. And yet it is still unbelievably inexpensive! But first, there is more going on in the silver market than just the insanity of Bidenomics. More than Washington’s unpayable $34.6 trillion […]

So now the Federal Reserve has had to backpedal on its presumed interest rate cut this year. That’s due to “a lack of further progress” on inflation says the new policy announcement. The Deep State Money Manipulators are in one hell of a fix! Again. If they cut rates and loosen money, prices will keep […]

A Former Treasury Official Says You Already Don’t! In YOU WILL OWN NOTHING, Part I, we shared a video of a Canadian man trying to withdraw a few thousand dollars from his bank account. The bank wanted a document of some sort to show what he was going to do with his money. There is […]

The only money you own is gold and silver in your personal possession! You better watch this video. Especially if you think you own what is in your bank account. Ownership is the ability to call upon and dispose of assets as you desire or as agreed upon. When you deposit your money into your […]

Gold is going through the roof because the already unpayable US debt is, too! After all, if there is no hope for US debt at $34 trillion today, how about when it reaches $141 trillion in 2054? And that is where the Congressional Budget Office says we are headed! $141 trillion is a lot of […]

Here’s a story we have told before, but with gold hitting so many all-time highs lately, it is one that deserves to be told again. It begins with a serious economic crisis that is fast approaching. Here’s a snippet from Fred Hickey (The High Tech Strategist) on April 2 that highlights just how fast things […]

Washington is squirting red ink out from every pore. The budget year is half over, finishing with a deficit of more than a trillion dollars. This will end badly. We have been sounding an alarm in these posts about US debt and the fear that it would get away from us. A few recent […]

Lew Rockwell Explains it All! “The power to create money is the most ominous power ever bestowed on any human being. This power is rightly criminalized when it is exercised by private individuals, and even today, everyone knows why counterfeiting is wrong and knavish. Far fewer are aware of the role of the federal government, […]

As Zimbabwe’s latest attempt at a currency collapses – this would be the sixth one since 2008 – the country’s leaders are watching it fall and hinting that the next Zimbabwe dollar will be gold-backed. Riiiight! Of course it will!!!! Bloomberg News: The country’s local dollar has weakened against the US dollar every day in […]

It’s time again to update our friends and clients on the financial situation of the US government. We are neither surprised nor pleased with what we have to report. While no one likes to be the bearer of bad news, despite what the lapdog press tells you the situation is growing grim. We have […]

Some are leaving the dollar. You might want to think about it, too! Charles de Gaulle, the former Premier of France, called the global dollar system America’s “exorbitant privilege.” Or maybe he didn’t. Maybe with was a French finance minister. But if de Gaulle hadn’t said it himself, he could have because he understood that […]

“You know the Founders wrote the Constitution “to bind down the government from mischief,” said Jefferson. Then they added the Bill of Rights, and you know what those ten amendments say: The government shall not… shall not… shall not… shall not… all the way up to the marvelous Tenth Amendment that said if we forgot […]

Global debt is soaring! Up $15 trillion last year! Uh oh! Unpayable debt leads to money printing. That’s just the government playbook. The Institute of International Finance, a global association of financial institutions, tracks and analyzes global capital flows and debt trends. It reports that “over $15 trillion of additional debt was added to the […]

The following graphic is from Visual Capitalist. It displays the top 11 countries by gold reserves as of September 2023, based on data from Central Banks, the Federal Reserve Bank of St. Louis, the International Monetary Fund, the World Bank, and the World Gold Council. It says, “In 2023, amid uncertainty about US interest rates and continued […]

And then stake out a long-term gold and silver position! “Any way you look at it, interest costs on the national debt will soon be at an all-time high!” So says the Peter G. Peterson Foundation, a nonpartisan organization dedicated to addressing America’s long-term fiscal challenges. They provide the following illustrations of the problem Washington […]

PICK ONE: Central bank purchases, stagflation, or a deep global recession! You could see gold surge by 50 percent according to Aakash Doshi, Citi’s North America head of commodities research. He and other Citi analysts wrote in a recent note to clients that among the pathways to $3,000, gold would be a ramp-up in de-dollarization […]

It was not quite a year ago that banks started tumbling down. You remember the names: Silicon Valley Bank, Signature Bank, and First Republic, all American banks. But it wasn’t just an American problem as the presence of Swiss banking giant Credit Suisse and Deutsche Bank on the troubled list attested. Rising interest rates were […]

Their financial situation is worse than alarming! “Twitching like a fingerOn the trigger of a gun.” -Paul Simon Uh oh! China is making things feel twitchy! We are always on the alert for the most likely trigger of the coming economic calamity. The thing that ends the made-up, manipulated money system and remonetizes honest money. […]

First the NY Times! Now Chase Bank? If you aren’t panicking about the US debt picture, you may not be paying attention! Now even the most establishment of establishment figures are starting to show signs of panic. Including the most establishment banker of America’s most establishment bank. Jamie Dimon is the chairman and chief executive […]

Forget what the Fed chairman says. Forget the Consumer Price Index and the Producer Price Index. Pay no attention to core inflation and the Personal Consumption Expenditures (PCE) price index. Pay no attention to any of Washington’s price indices. Instead, trust your own living experience. Is your cost of living going up or down? […]

See for yourself, it’s US against them! Having ignored the Constitution and subverted our once good-as-gold dollar, the American elites hope to complete their betrayal with Soviet-style policies (for you, not for themselves, of course). That includes eliminating freedoms (yours that is), gas stoves (yours that is), air travel (yours that is), parental rights […]

Once again Republic Monetary Exchange’s Jim Clark joins Robert Kiyosaki’s panel of experts to complete the four-part series that Robert calls “the most important show ever!” The Rich Dad Poor Dad radio show panelists – all veteran gold professionals – have been called together to explore the significance of gold as a timeless form of […]

In our effort to make sure our friends and clients are always well-informed, we work our way through mountains of information. We were surprised and happy a few days ago to see that The Market Oracle was quoting our friend and colleague Charles Goyette from his New York Times bestseller The Dollar Meltdown: The Market […]

Rich Dad Poor Dad author Robert Kiyosaki presents a four-part program that he calls “the most important” show ever. Today we present Part 1, The Good News and Bad News about Money. It features Jim Clark on a panel with other veteran precious metals experts including RME associate Charles Goyette. The discussion addresses the historical […]

Harry Dent Warns about the Stock Market: Since 2009, this has been 100 percent artificial, unprecedented money printing and deficits: $27 trillion over 15 years, to be exact. This is off the charts, 100 percent artificial, which means we’re in a dangerous state. I think 2024 is going to be the biggest single crash year […]

One really easy lesson… here’s what’s going to happen to your money! The current inflation rate (CPI) is 3.1 percent. What does that mean for your money? Jim Rickards at the Daily Reckoning sums it all up in just a few words: How damaging is 3.1% inflation? That rate will cut the value of the […]

We grow very wary when it appears almost everyone is thinking the same thing. It often means there is not a lot of real thinking going on. The view that Chairman Powell and the Fed are going to be able to drive interest rates lower in the New Year is nearing unanimity. But […]

Now is the time to buy gold according to Marc Faber, a leading French bank, and others! When is the right time to buy gold? If you don’t have enough for what’s coming, right now is the best time to buy gold… whenever right now happens to be. Who has enough gold? We’ve never met […]

Who are you going to believe? The Swamp media or your lying eyes? With less than a year before the presidential election, a Swamp public relations agent named Taylor Lorenz, who poses as a reporter at the Washington Post, is hard at work on the newspaper’s relentless mission to explain that prices, inflation, and the […]

All Eyes are on Argentina! It’s an upset! Javier Milei’s landslide win in Argentina has toppled – at least for now – the country’s inflationary Peronista left-wing rule. “Freedom goes forward! Hail freedom, dammit!” shouted Milei. Milei will be sworn in as president in December. He has promised to end central banking and the […]

RME’s Jim and Charles join friend Robert Kiyosaki to Talk Precious Metals, the Economy, and the Hunt Brothers This past week, RME’s Jim Clark and Charles Goyette were guests on friend Robert Kiyosaki’s Rich Dad Radio Show. Below you can watch the entire interview. In addition to the topics of the U.S. going bankrupt, precious […]

Central Banks all over the world are buying gold. Are you? Because central banks around the world sold so much gold in the post-WWII era – to hold US dollars in their currency reserves instead – we believe the reversal of that practice represents the biggest monetary megatrend of our time. In other words, these […]

End users of industrial silver will experience surging output totaling 46 percent between now and 2033. The surge is expected to be especially rapid in the electrical and electronics industries which are forecasted to grow by 55 percent over the decade. That is the finding of a new study by Oxford Economics, a leading global […]

Newsweek reports that China is gobbling up gold on the international market. China is already the world’s largest gold producer, but it’s buying more gold hand-over-fist. And it has been doing so every single month for almost a year. For thirteen years central banks have been socking away gold. The Financial Times headlines its account […]

Here are a Few Answers! Someone asked us, “Why does the Federal Reserve destroy our money with inflation? Don’t they realize what they are doing to this country?” No answer we give will be complete. There are too many things going on and too many different interests at work for an all-encompassing response. But […]

We say be prepared for an inflation resurgence! Some sectors of the markets along with some analysts believe that the Federal Reserve has declared victory over inflation. That would be like General Custer encountering one lone Sioux on his way to Little Big Horn and patting himself on the back. Still, stocks roared higher the […]

Read ‘Em and Weep! Or Buy Gold and Laugh! At least we’re not the only ones writing about the US Treasury’s debt crisis now. The story is starting to play far and wide now. That’s because it is becoming impossible to ignore! Here are three consecutive headlines from the Drudge Report on Wednesday, 11/1. The […]

Gold’s next stop is $3,700! Silver to $68! It’s time now to wake up! And to tell your friends! Rich Dad Poor Dad author Robert Kiyosaki doesn’t issue a wake-up call like that very often. When he does, he means it! We follow our friend Robert closely. And since he says we should […]