Gold vs. U.S. Dollar

Gold moves into first place on the world stage!

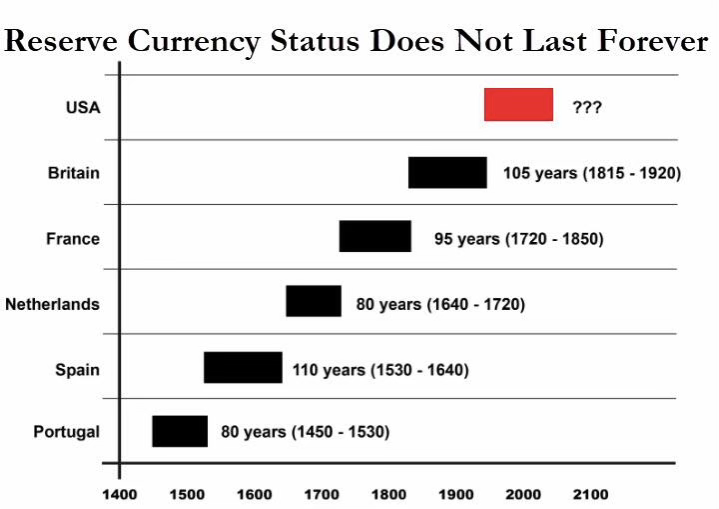

The US dollar became the world’s reserve currency after World War II.

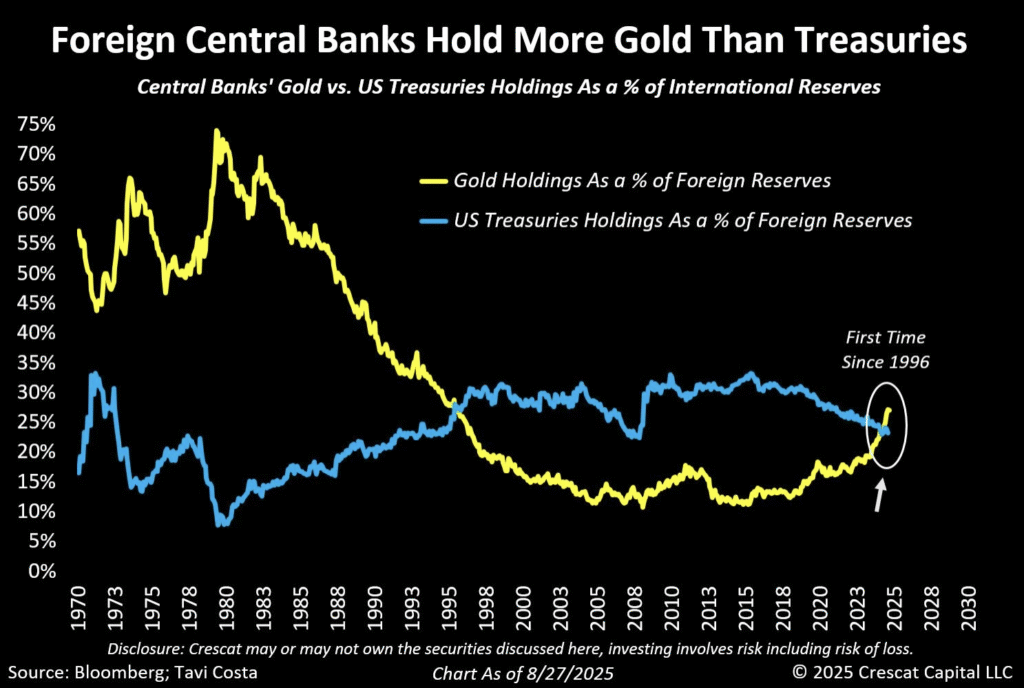

But that was then, and this is now. Now the world’s central banks hold more gold reserves than they do US dollars. Gold is in first place now. Gold is again the world’s reserve asset.

For some time we have described de-dollarization, the replacement of the dollar by gold around the world as the most important monetary megatrend of our age. It is clear that our warning was important, because as we predicted, that trend would mean reduced dollar purchasing power and higher gold prices.

And lo, it has come to pass.

What does this move mean?

It means that the world is fearful of the weaponized dollar, the inflating dollar, the indebted dollar. It means we are at the beginning of a global monetary reset.

Just as an aside, it’s okay if this makes you angry. The preeminence of the dollar was good for Americans, our prosperity, and our standard of living. And all Washington had to do was conduct its affairs honestly. Balance its budgets. Honor its promises. Refrain from legal counterfeiting. Just honest, responsible things.

But that was too much to ask of them. So things have changed. Now central banks hold more gold than dollars.

The megatrend will continue. The old monetary system is coming apart at the seams and you can’t stop it. But you can still protect yourself and profit from these changes. Discover gold!