Middle East Gold Demand

Yep, it’s not just China!

We report often on China’s substantial gold buying. Along with central banks elsewhere, it is one of the powerful dynamics driving gold prices to new heights.

And we know something about India’s devotion to gold. People in India’s gold purchases are so dependable that many analysts regularly expect firming or higher prices to coincide with the annual wedding season there.

But what about the Middle East where wealth pools around oil riches?

The Middle East is third after China and India in gold acquisition.

The World Gold Council confirms that this ranking continued in the second quarter of 2025:

- China led the way with a 44 percent increase over the same quarter the prior year, purchasing a total of 115 tons.

- Indian demand totaled 46 tons in the second quarter. That’s the eighth consecutive quarter of buying.

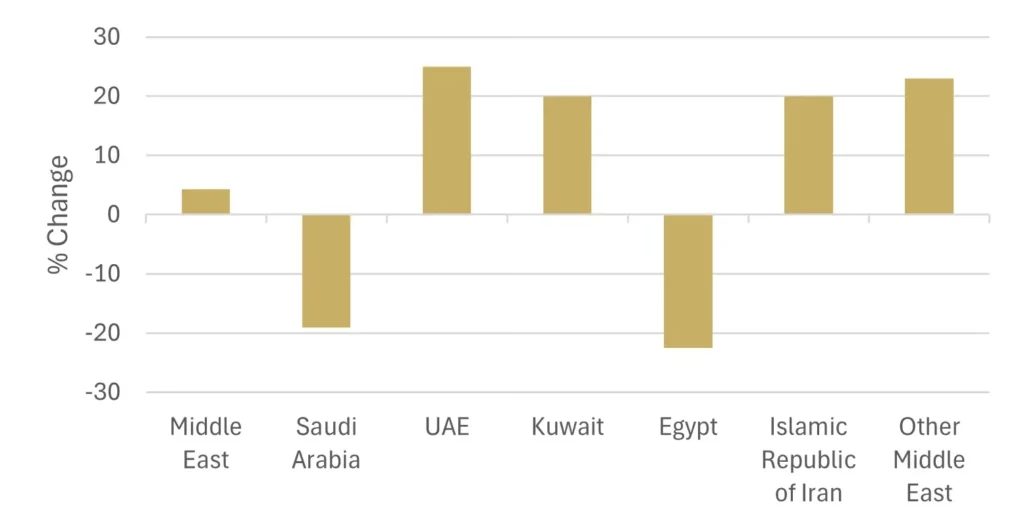

- Middle Eastern demand was healthy at 31 tons, purchases coming from different countries across the region.

Altogether, the WGC reports, last year (2024) the Middle East (excluding Turkey) consumed 281 tons of gold. That’s more than twice the amount of Europe which acquired 134 tons of gold.

The United Arab Emirates has become an important global center of the gold market, according to the WGC. “It is now the second largest cross-border physical trading hub after Switzerland. With no gold deposits of its own, it acts as a trading center for the processing of gold for onward export, and as a major jewelry wholesale and retail destination…”

“The Middle East is a major gold market, and the growth of the region is powering the gold industry across the [Gulf Cooperation Council] and beyond. This is evidenced by the growing gold trading links between the Middle East and Southeast Asia.”

There is an enormous amount of liquidity in the oil producing nations of the Middle East.

For now we will share the observation of Goldman Sachs that if Goldman Sachs stated that if 1 percent of the privately held U.S. Treasury market, valued at over $24 trillion, were to shift to gold, it would drive gold to around $5,000 per ounce.