Year-End Observations About Inflation, Deficit, and Gold

As we head to the end of the year, there are a couple of things we have intended to mention to you that we could not get to until today.

So here they are:

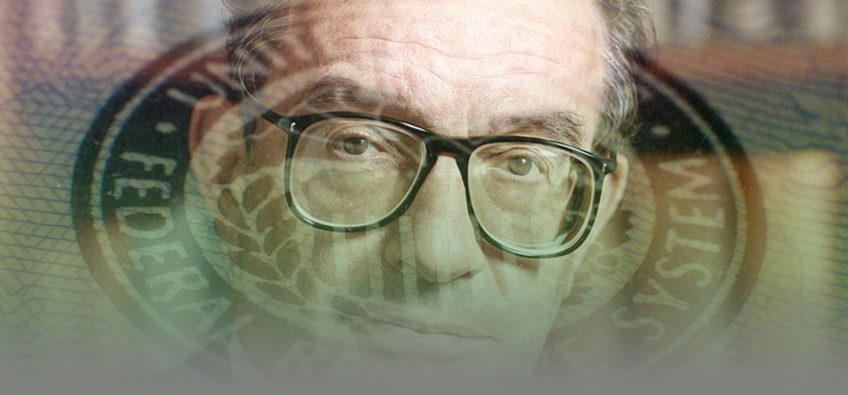

“The Maestro,” former Federal Reserve Chairman Alan Greenspan was back in the financial media this week, remarking that if the deficit continues to rise, “inflation is inevitably going to rise.”

That’s the sort of thing that should go without saying since the Fed is monetizing the deficit, printing money to cover the gap between exploding federal spending and revenue.

According to Greenspan, “Putting the federal budget on a sustainable path would aid the long-term vigor of the U.S. economy and help ensure that policymakers have the space to use fiscal policy to assist in stabilizing the economy if it weakens.”

As we have pointed out repeatedly, there is not any prospect for the budget being put on a sustainable path. The most of the very few fiscal conservatives there once roosted in Washington have gone the way of the dodo bird.

None of these financial realities are lost on investment banking giant Goldman Sachs, which is bullish on gold in 2020. A Goldman Sachs analyst has taken note of Modern Monetary Theory, the newest inflationary rage on the left. He writes, “In the next recession, our US economists do not expect governments to adopt direct monetary financing and expect inflation to remain firmly anchored, But this doesn’t necessarily prevent an increase in debasement concerns if conversations around MMT become more widespread — a potential boost to demand for gold as a debasement hedge.”

Maybe the word “direct” in carefully chosen here, since the latest surge in repo funding and the latest round of Quantitative Easing is effective Fed monetary financing of the US deficit already.

And in fact, just over a week ago, a Credit Suisse analyst said the Fed would begin a new round of money printing before the end of the year. According to CNBC:

The fourth version of quantitative easing — often referred to as “money-printing” for the way the Fed uses digitally created money to buy bonds from big financial institutions — would be needed by year’s end to bridge a funding gap as banks scramble for scarce reserves, Zoltan Pozsar, Credit Suisse’s managing director for investment strategy and research, said in a note to clients.

“If we’re right about funding stresses, the Fed will be doing ‘QE4’ by year-end,” Pozsar wrote.

The new round of money printing has already begun. Please see our essays from November, Inflate or Die, Part I and Inflate or Die, Part II.

We recommend you begin planning today for gold profits and wealth preservation in 2020. Contact an RME professional today!