World Debt Goes Stratospheric

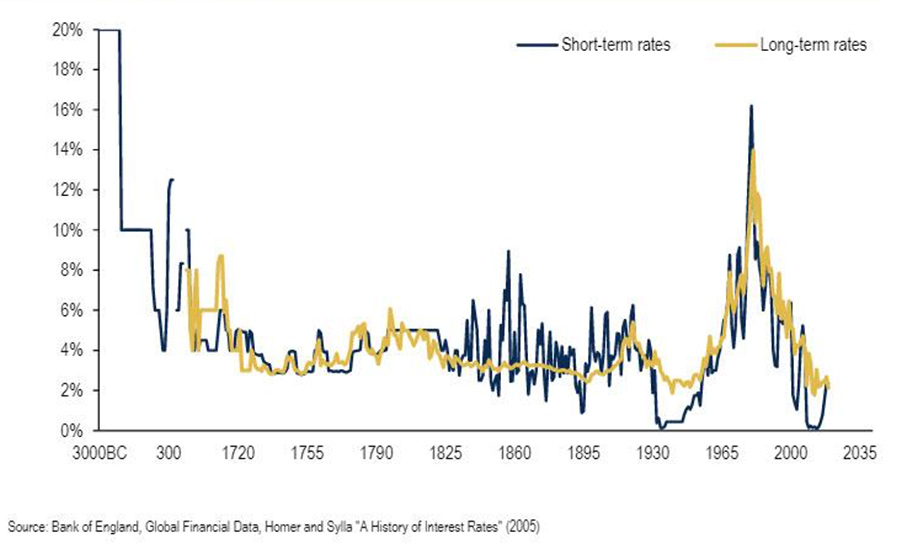

Meanwhile, Interest Rates are the Lowest in History

The debt splurge continues.

Reuters reports that global debt is expected to reach $277 trillion by the end of this year. That’s up from $257 trillion last year, with government debt accounting for more than half of the increase so far in 2020.

Citing a new report from the Institute of International Finance (IIF), Reuters writes that “Total U.S. debt is on track to hit $80 trillion in 2020.” That is a gain from $71 trillion last year.

Reuters:

“Developed markets’ overall debt jumped to 432 percent of GDP in the third quarter, from a ratio of about 380 percent at the end of 2019. Emerging market debt-to-GDP hit nearly 250 percent in the third quarter, with China reaching 335 percent, and for the year the ratio is expected to reach about 365 percent of global GDP.”

We can illustrate in alarming detail just how wobbly the debt structure is with an account from Bloomberg News about zombie companies.

Zombie companies – among them Boeing, Carnival, Delta Air Lines, Exxon Mobil and Macy’s – “get their nickname because of their tendency to limp along,” writes Bloomberg, “unable to earn enough to dig out from under their obligations, but still with sufficient access to credit to roll over their debts. They’re a drag on the economy because they keep assets tied up in companies that can’t afford to invest and build their businesses.”

Bloomberg’s analysis reveal that more than 500 of the companies in the Russell 3000 index are not making enough to meet their interest payments.

How does the world get out from under this this debt burden? The IIF answers in with carefully hedged institutional/bureaucratic language: “There is significant uncertainty about how the global economy can deleverage in the future without significant adverse implications for economic activity.”

That’s one way to put it.

The other is that the central baks will try to print their way out, destroying currency values so that debts can be paid in cheap, cheaper, cheapest money.

That is why you must own gold to preserve your wealth.

Incidentally, we note with interest that China has been able to sell bonds denominated in euros at negative interest rates. Five-year bonds, as part of a larger bond offering totaling $4.74 billion, were sold with a negative yield, minus 0.152 percent.

Altogether, there is almost $17 trillion of negative yielding bonds in the global market.

Which leads to the question we have asked repeatedly: How long can the lowest interest rates in history co-exist with the lowest interest rates in history?

If you devote an hour to thinking about that, you will probably decide to buy gold sometime in the first five minutes. At Republic Monetary Exchange, we’ll be waiting to hear from you.

We can help.