A Wild Week for Gold and the Markets Due to D.C. Drama

Tax Reform and D.C. Drama Made for a Wild Week for Gold and the Markets

It was a wild week for gold and the markets. The Dow went from breaking above 24,000 to falling over 350 points Friday. Gold also fluctuated rising to just under $1,300 at the start of the week to dropping below $1,280 to close out Friday above $1,280 again.

It was a wild week for gold and the markets. The Dow went from breaking above 24,000 to falling over 350 points Friday. Gold also fluctuated rising to just under $1,300 at the start of the week to dropping below $1,280 to close out Friday above $1,280 again.

Drama in domestic politics was a significant reasons for the fluctuations this week. The possibility of the Senate tax reform bill passing is looking more certain, which helped cue the stock market to its midweek rally. But on Friday the market took a sharp downturn due to political volatility when former National Security Adviser Michael Flynn admitted to lying to the FBI over their investigation of foreign interference with President Trump’s election. The dollar index took a sharp plunge on Friday as well, and this helped boost gold prices. The Dow recuperated some of its losses by the close after enough Senators came out in vocal support of the tax reform bill to ensure its passage.

What this means for investors: Unforeseen events that trigger the markets like the Michael Flynn situation cause immediate, short term moves. But the repercussions can ripple into longer term uncertainty. Gold is still remaining on the quiet side for now, and lower prices mean better buying opportunity.

U.S. Margin Debt Equal to Economy of Taiwan

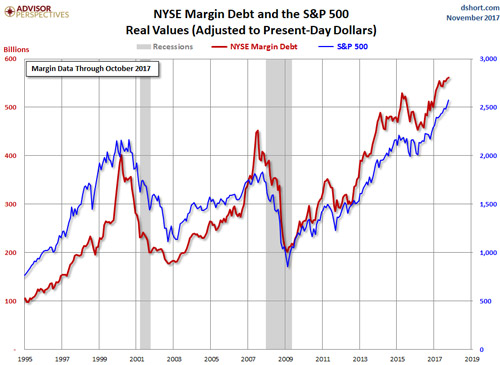

The U.S. margin debt recently reached the same size as the entire economy of Taiwan. Margin debt is money borrowed by stock investors to buy more stock, and in October it hit the astounding level of $561 billion. In the event of a sell off, when margin debt is at such high levels, the sell off will accelerate and lead to a sharp tightening of financial conditions. The liquidity from margin debt vanishes in the event of a sell off just when liquidity is needed the most.

What this means for investors: Few people are talking about these numbers, and yet they are significant. The 2007-2008 financial crisis was amplified by margin debt sell off, and in 2017, margin debt has risen 16%. When the correction comes, this is certainly going to adversely affect the recovery.

The Return of Volatility?

Volatility has been relatively low this year, although it surged on Friday due to political turbulence. In fact, volatility is at a historically low level right now according to Dallas Fed President Robert Kaplan. We haven’t had a 3% correction in the stock market in 12 months, which is highly unusual, and being monitored carefully. Stocks are surging, but so are corporate stock buybacks, which begs the question of how much substance is behind this rally. Corporate earnings and expectations of a December rate hike helped boost stocks this week, but volatility was also on the rise during the week as monetary policy between the Fed and ECB (which is still at negative interest rates) seems to start to diverge.

Volatility has been relatively low this year, although it surged on Friday due to political turbulence. In fact, volatility is at a historically low level right now according to Dallas Fed President Robert Kaplan. We haven’t had a 3% correction in the stock market in 12 months, which is highly unusual, and being monitored carefully. Stocks are surging, but so are corporate stock buybacks, which begs the question of how much substance is behind this rally. Corporate earnings and expectations of a December rate hike helped boost stocks this week, but volatility was also on the rise during the week as monetary policy between the Fed and ECB (which is still at negative interest rates) seems to start to diverge.

What this means for investors: Gold protects against market volatility. Volatility is certainly creeping back into the markets. It will rise rapidly as geopolitical tensions continue to increase and Washington keeps running into political deadlock. Additionally, the stock market rally is continuing to run for now, but eventually will become unsustainable. Corporate buybacks can’t fuel the rally forever, and margin debt levels should be sending up red flags.

Gold’s “Unusually Quiet Year”, According to One Metals Expert

Metals prices have been showing some stagnancy lately as stocks continue to rally. However, gold is on pace for its biggest yearly gain since 2010. Metals expert Michael Dudas of Vertical Research sees gold going higher next year.

Dudas’ bull case for gold and silver from CNBC.

Stay Connected to the Markets. Subscribe Now to Get the Gold Market Discussion Delivered Every Sunday Directly to Your Inbox!

As always, I encourage you to speak with your broker at RME for more market updates. Expert brokers are available Monday-Friday from 9 AM- 5 PM or by special appointment after hours. Call today at 602-955-6500 or toll-free at 877-354-4040.