It’s When…Not If

Why a Crisis in Inevitible

Everyone knows – perhaps I should say “every thinking person” since there are some in Washington who don’t actually know and therefore should not be accused of thinking – that the US debt can’t keep growing forever.

When the day arrives that it is evident to all that the US can’t pay its debts except by printing money, the game is over.

When foreign governments

Because no one will want to loan money at any kind of reasonable rate knowing that they will be paid back in cheaper dollars.

Governments always count on some slippage in there, allowing them to inflate away the currency for a while before most people sit up and take notice. And just because they begin to notice doesn’t mean that they won’t be fleeced a little more.

So, for example, if government inflation results in a ten percent loss of purchasing power over a given period, most investors will demand an “inflation premium” on government bonds to compensate for the diminished purchasing power of the currency.

If a normal interest return of, say, five percent a year is expected, a bond would have to offer a fifteen percent return.

That sort of device works for a while, but generally not for long.

After all, why should the ten percent inflation rate in our hypothetical example, not give way to a 15 or 20 percent rate? Or higher.

Of course it will. Most gold investors understand this.

They aren’t suckers.

The rationale for government debt, going back to John Maynard Keynes, is that deficit spending will allow the authorities to “goose” the economy and get higher productivity.

But take a good, sober look at where we are right now. We are ten years into an economic expansion. Unemployment is said to be low, with armies of working people paying taxes.

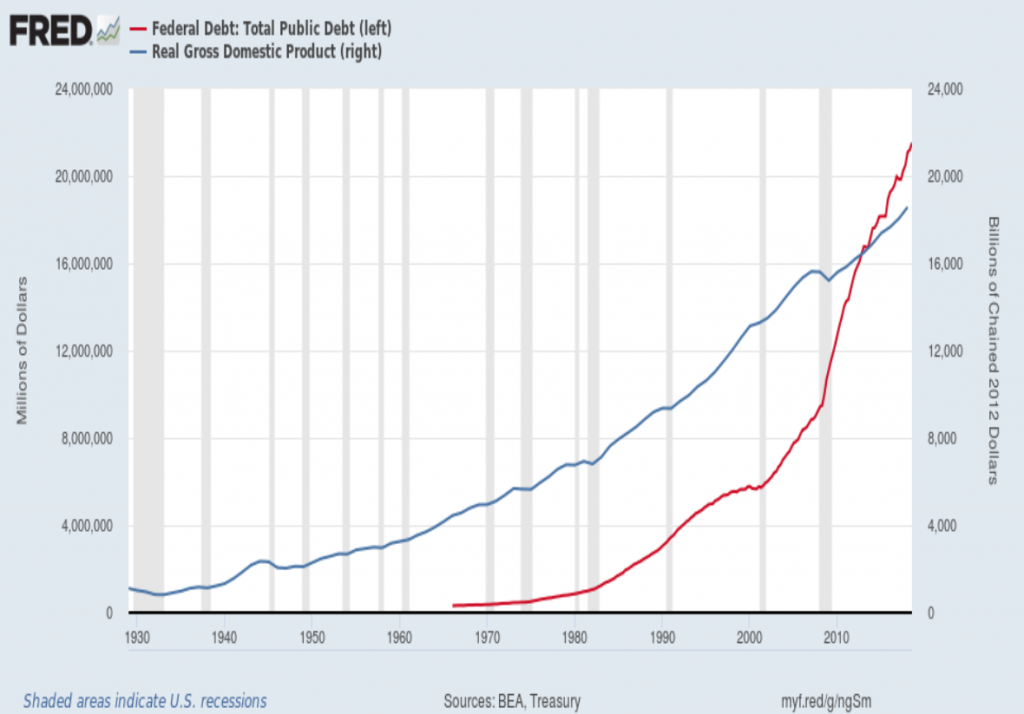

And yet, what is happening to US debt? Despite a growing economy and low unemployment, the debt is climbing even faster! As you can see from the following chart, the gross federal debt (the red line) has overtaken GDP, the total productivity of the economy (the blue line).

Stated differently, a new dollar of national debt is unable to produce even a dollar of productivity. This crossover took place in 2013.

If the government cannot reduce its indebtedness in an expanding economy with supposed full-employment, when can it?

Here’s David Stockman’s answer: “We are probably only monthsfrom the onset of a budgetary red ink eruption that will envelope Washington and Wall Street alike as far as they eye can see.”

Our advice is to take whatever profits you may have in stocks and move to the safety of precious metals at once.