What Happens to Inflation if Oil Hits $150?

And what happens to gold?

Here’s one of those issues that should not need extensive polling and surveys. It should be self-evident.

But let’s back into it.

JPMorgan analysts say the price of oil will test $125 a barrel next year, on its way to $150 in 2023.

Their analysis HERE finds that producers OPEC and Russia “have returned to a position of positive leverage.”

Speaking of things that are self-evident, that should have been foreseeable on inauguration day in January, when President Biden canceled the federal permit for construction of the Keystone XL oil pipeline. Keystone was expected to deliver 800,000 barrels per day from Canada to the US.

So, if the price of gasoline doubles or more, who is hit hardest? People already struggling with high gas prices and fearing winter’s energy bills? Or the rich, people whose wealth will suffer negligible impact?

Sorry for asking the obvious. But it came to mind when we saw this report on a new Gallup survey about inflation: “45 percent of American households report that recent price increases are causing their family some degree of financial hardship. Ten percent describe it as severe hardship affecting their standard of living, while another 35 percent say the hardship is moderate.”

The report finds that poorer people are hit harder by inflation than the rich. For example, “Seventy-one percent of those living in households making less than $40,000 a year say that recent price hikes have caused their family financial hardship. That compares with 47 percent of those in middle-income households and 29 percent in upper-income households.”

We would not have known what those percentages were in advance, and they will change, but it is only obvious that those with less money will have a harder time absorbing the impact of inflation.

It is only obvious as well, that if JPMorgan analysts are right about oil running up to $150, it is the poor and middle class that will feel it the most.

A better question is this: What will $150 oil do the inflation rate? Everything made, everything consumed, everything transported to a store or to your home has an energy component. Noting escapes energy costs. Nothing.

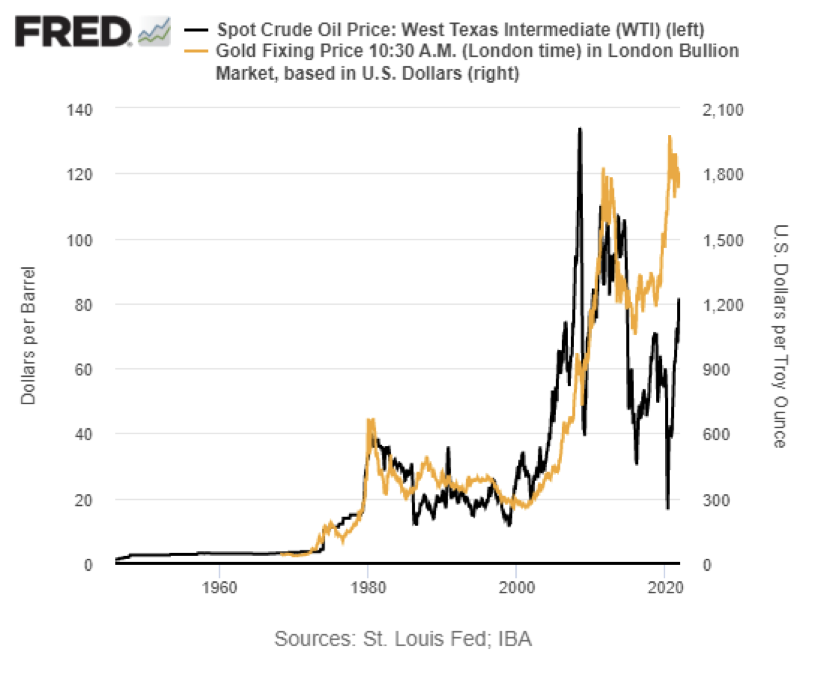

Here’s a long-term chart of both oil and gold prices. We can not say they move in lockstep, but they tend to move in a tandem direction.

That is to be expected since they are both natural resources that must be recovered from the earth at substantial expense.

We think it is also self-evident that if the analysts are correct and oil prices double from here (likely, given Biden’s energy policies) it will increase price inflation throughout the economy.

And it will pull the gold price much, much higher.