Wages Fail To Keep Up as Gold and Silver Race Ahead

The $20 advance gold put on with the release of the latest inflation numbers on Thursday, 1/12, was exceeded by a hike of about $23 dollar hike in gold prices the next day, on Friday, 1/13.

Silver marched higher as well, up $0.52 an ounce on Thursday, followed by another sharp gain of $0.46 gain on Friday.

We have identified central bank gold buying as one of the driving forces of this surge in precious metals prices. The current move-up began in early November and continued through December and now well into January. So, you will not be surprised to learn that China’s central bank is reported to have purchased 32 metric tons of gold in November and another 30 tons in December.

That is a total of 62 tons since November which is substantial indeed. As one new commentator put it, “China is weaning itself from the US dollar.”

Now we hear from sources that we presume are reliable that China’s buying has actually continued, escalating to a recent total of 100 tons.

Here is an assortment of forecasts for the gold price in 2023 gathered by newsletter writer Jeff Clark:

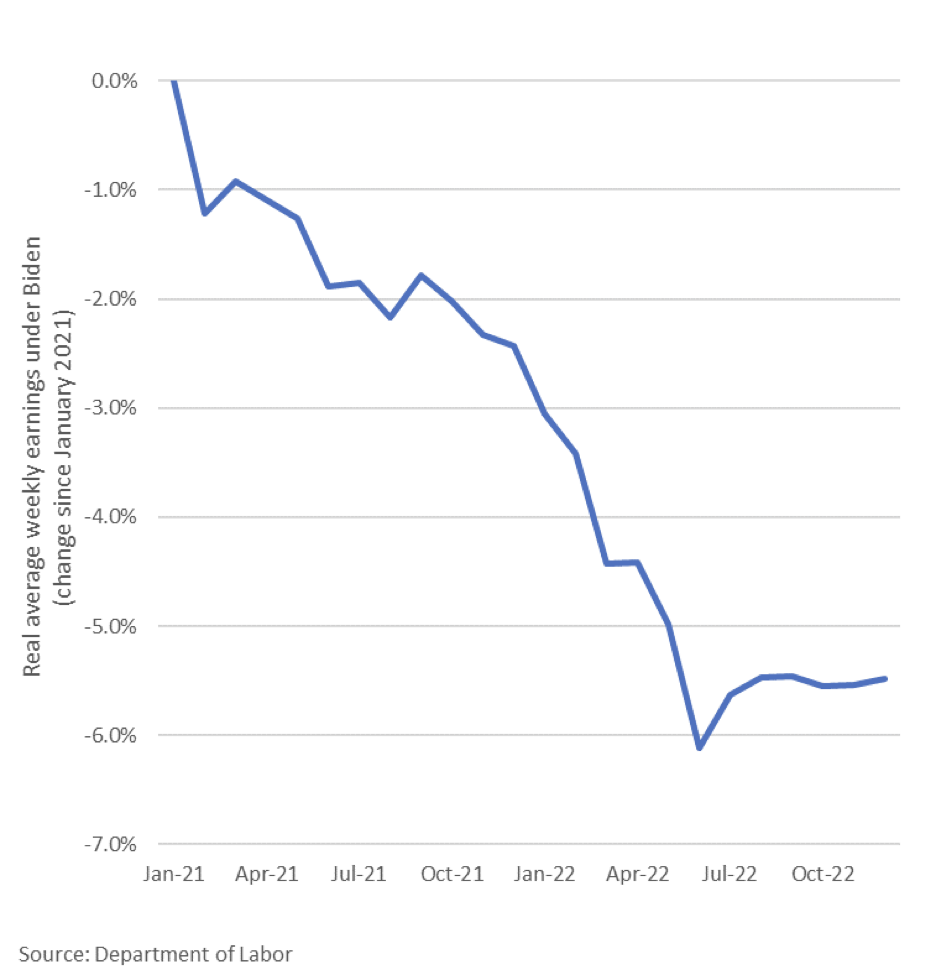

While gold keeps racing ahead, we thought we should share with you what is happening to the average weekly earnings of Americans under Biden-nomics.

Prices continue to rise, while wages fail to keep up. Isn’t it time to invest in gold and silver for wealth preservation, retirement security, and profit? Learn more about gold and silver investing by speaking with a Republic Monetary Exchange precious metals expert today.