US Inflation: It’s a Disgrace

In the Phoenix-Scottsdale-Mesa metropolitan area prices have climbed 12.3 percent!

More news on the inflation front. And it is bad!

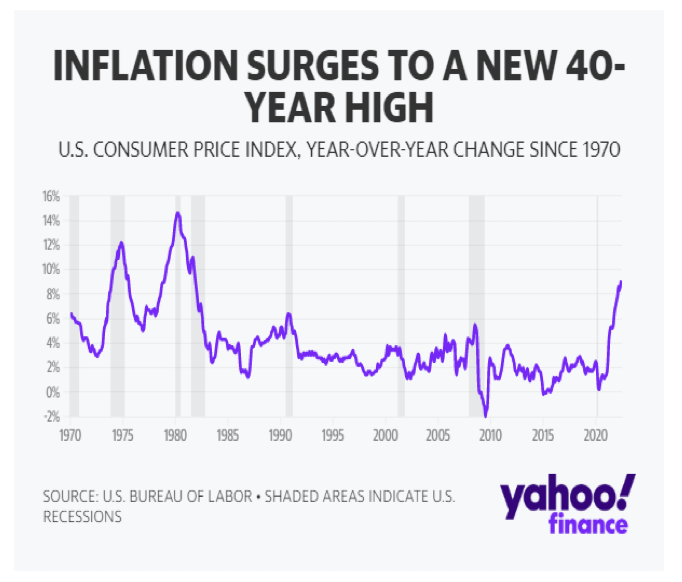

Consumer prices rose 9.1 percent nationally over the last 12 months.

Those are the Bureau of Labor Statistics’ Consumer Price Index (CPI) numbers for the 12 months through June 30. The national rate is up a full one-half a percent since the end of May.

The consensus guesstimate of economists was for the number to come in at 8.8 percent, but the White House already knew it was going to be worse and began trying to soft-pedal the bad news in advance.

The Washington party line is that gas prices were at their highest in June and have since backed off so that the numbers should be lower next month.

That’s funny. Last month they didn’t go out of their way to say that surging gas prices than would mean a higher inflation report for June.

Why didn’t the Fed do something about inflation a year ago when the CPI was climbing at a 5 percent rate? Former Fed chairman Ben Bernanke says it is because the Fed didn’t want to “shock the market.”

Well, how’s this for a shock? 12.3 percent inflation in Phoenix where Republic Monetary Exchange is located and so many of our clients live.

It’s a disgrace!

We think the real reason for the Fed’s foot-dragging on rising inflation is that it was stalling for time. They thought rising prices were all the fault of supply chain problems, so they stalled and they stalled and they stalled. Untreated, the problem grew worse. Apparently, Fed officials didn’t think their creation of $8 trillion since 2008 would matter much. Nobody had ever taught them the quantity theory of money. Or much about supply and demand.

Since consumer prices didn’t explode when Bernanke started Quantitative Easing, they seemed to think money-printing didn’t matter.

But that’s the stupidest thing since Dick Cheney said deficits don’t matter.

Money printing does matter. The money-printing has been so enormous that it will change the US dollar forever. And not in a good way. Inflation this high makes things happen. We can’t foresee all of them, but here are a couple of possibilities:

- With American families having to pay these fast-rising prices for necessities like gas and groceries, something else in the household budgets must give. Things like leisure, restaurants, and travel are already weakening. It’s like a door opening to a recession.

- What about China (or America’s other foreign creditors)? Are they going to watch their trillion-dollar portfolios get eaten up by the dollar’s collapsing purchasing power?

The possible consequences are grave. No one knows what happens next, but it won’t be good. Prepare yourself. Gold is beckoning!