Time Proves the US Dollar is a Poor Substitute for Gold

The US dollar’s role as a substitute for gold in international affairs, formalized with the Bretton Woods Agreement at the end of World War II, continues to break down.

It was destined to fail because in substituting dollars for gold, participants were asked to trust in the financial integrity of the government. It was only a question of how long the illusion of trustworthiness would last.

The latest government to peel away from greater reliance on the dollar as a currency reserve is Israel. The country’s central bank has announced a sweeping change in its reserve disposition, heretofore limited to positions in the US dollar, the euro, and the British pound.

Now Israel is adding China’s yuan, the Japanese yen, and both the Canadian and Australian dollars.

The US dollar’s share of Israel’s central bank reserves falls from 66.5 percent to 61 percent.

Moves away from the dollar will accelerate around the world, now that President Biden has announced that the US will unilaterally grab dollar reserves around the world when it wishes. See our commentary “Has the Biden Administration Started a Global Currency Crisis?”

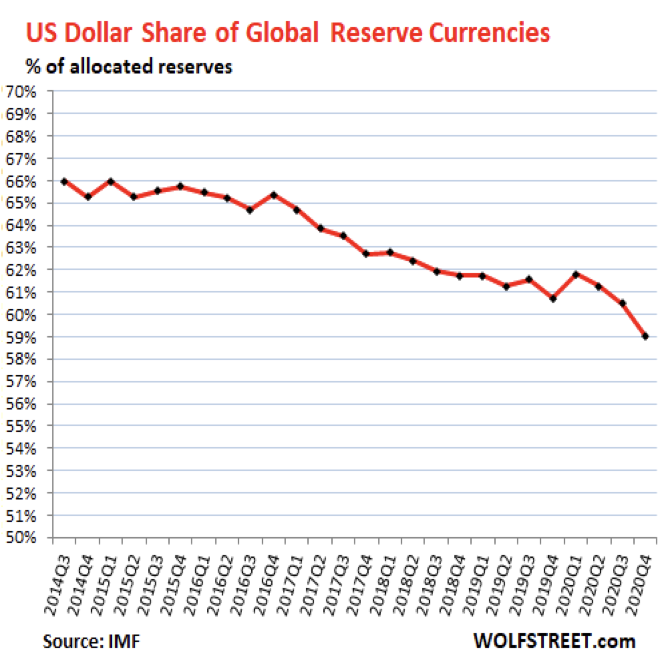

The dollar’s share of global reserve functions has eroded from 85 percent in the 1970s. It is now down to 59 percent, off seven percent since 2014.

As the post-World War II monetary system continues to decay, protect yourself by speaking with a Republic Monetary Exchange precious metals professional and taking sensible steps to reduce your exposure to a developing dollar crisis.