The Strong Dollar?

You’ve Heard “The Dollar is Strong”. Ha-ha-ha!

We hear it all the time. Sometimes all day long in the financial news media. About the strong dollar. Here are some examples:

“What the strong dollar means for Americans” — The Hill

“The Dollar Is Extremely Strong, Pushing Down the World” — NYTimes

‘What does a strong dollar mean for the US and world economics?” — Marketplace.org

Although we have written about this before, the topic demands a re-visit.

Now we guess you can call it a strong dollar if you’re going to Europe on your summer vacation. Or if you’re importing Mercedes.

But for the sake of clear communication, the term “strong dollar” should go in the deleted file. Especially since most of us at any given time isn’t doing any of those things.

In fact, the dollar isn’t really strong at all. It is weak. Extraordinarily weak.

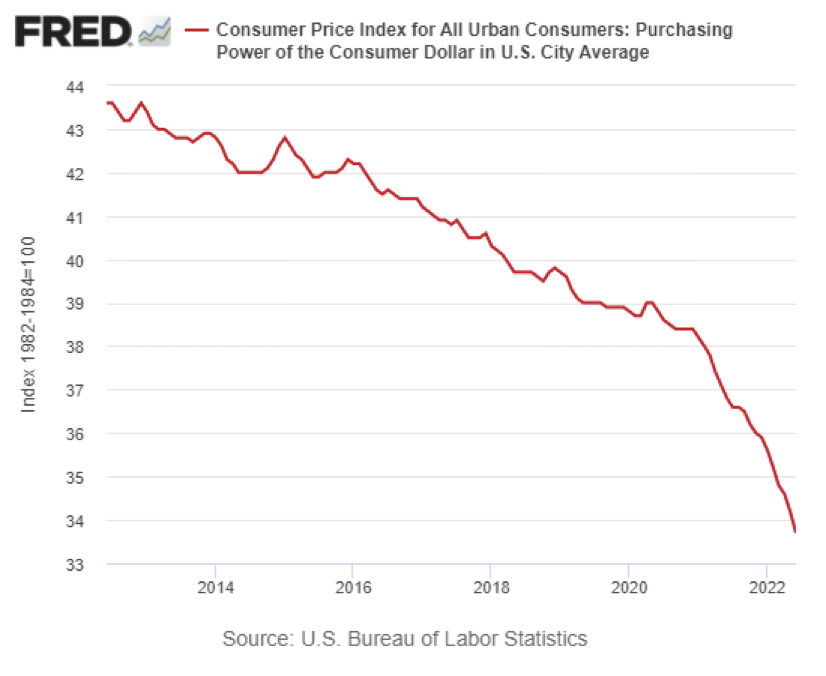

That’s because the function of a currency is to allow people to purchase things. With that in mind, here is a 10-year chart of the US dollar’s purchasing power:

You might notice the trend. The best description is that dollar purchasing power is down, down, down. In fact, the dollar’s loss of purchasing power has accelerated in the last year or two.

Here are the actual Consumer Price Index numbers for 2021 – 22. They show for each month how much the price of consumer goods has increased over the prior 12 months. It’s the inverse of the chart above.

2021 (percentage increase)

- Jan: 1.400

- Feb: 1.676

- Mar: 2.620

- Apr: 4.160

- May: 4.993

- Jun: 5.391

- Jul: 5.365

- Aug: 5.251

- Sep: 5.390

- Oct: 6.222

- Nov: 6.809

- Dec: 7.036

2021 (percentage increase)

- Jan: 7.480

- Feb: 7.871

- Mar: 8.542

- Apr: 8.259

- May: 8.582

- Jun: 9.060

You might notice a trend there, with prices going up, up, up.

No matter how you look at it, its not a good deal for Americans who earn paychecks, buy things, and try to save all in terms of US dollars.

So, if the people’s currency buys them less and less with each passing month, shouldn’t we drop the propagandistic term “strong”?

Because, after all, the dollar has never been weaker. Period. It buys less than it ever has. Period.

And that should be nobody’s definition of strong.

Sophisticated financial writers and commentators may want to try communicating clearly, noting that for now, other currencies like the euro and the yen are actually losing value even faster than the dollar.

Isn’t that more accurate? Can’t they do better?

If you would like to get a clear description of current monetary conditions and how people protect themselves from inflation with gold and silver, speak with a Republic Monetary Exchange professional today.