The Most Important Global Monetary Megatrend!

The De-Dollarizing World!

Wall Street and bubble-vision endlessly fret and debate over the Federal Reserve’s next move. “Will the Fed raise rates 50 basis points in September? Or will it go for 75?” But while they obsess, something much bigger is going on. Something that is mostly overlooked.

We have called it the world’s most important monetary megatrend because it changes the correlation of global economic forces even as it will suppress Americans’ standard of living.

It is the move away from the dollar as the world’s reserve currency. It appears to be re-enacting Hemingway’s description of how someone goes bankrupt: “Slowly at first, and then all at once!”

With many countries abandoning the gold standard during World War I, the still gold- backed US dollar became the world’s de facto reserve currency. That status was formalized after World War II.

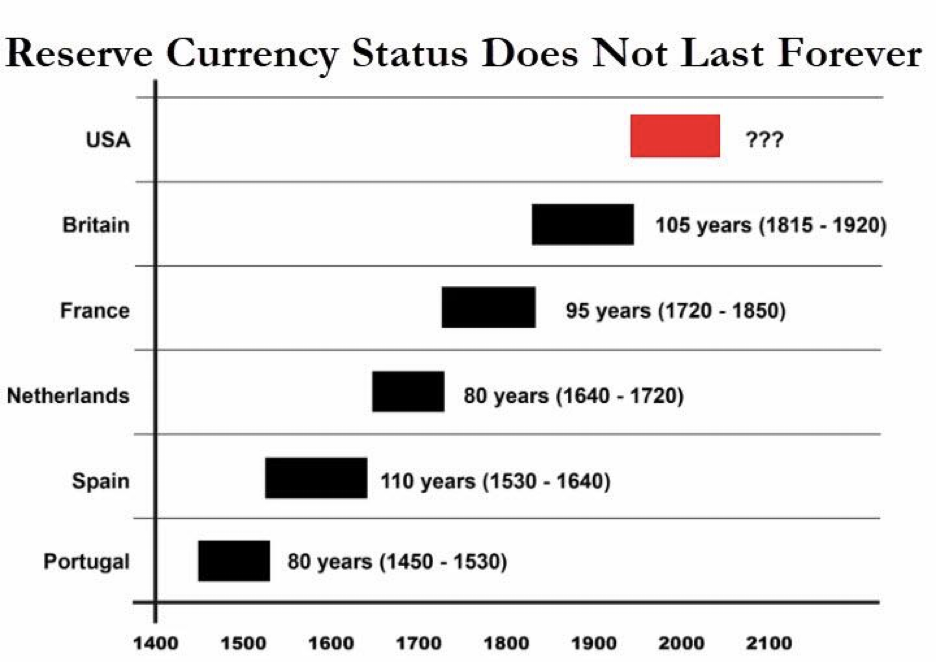

But being the world’s go-to currency doesn’t last forever. There have been six globally dominant reserve currencies since the 15th century. They have lasted an average of 94 years.

The dollar has had a run of about 100 years at the world’s primary reserve currency and standard of international commerce. It is not that a lifespan of 100 years is pre-ordained or the result of some iron financial law. In fact, if the dollar were honestly managed as a gold-based currency it would have had a much longer run in this privileged role.

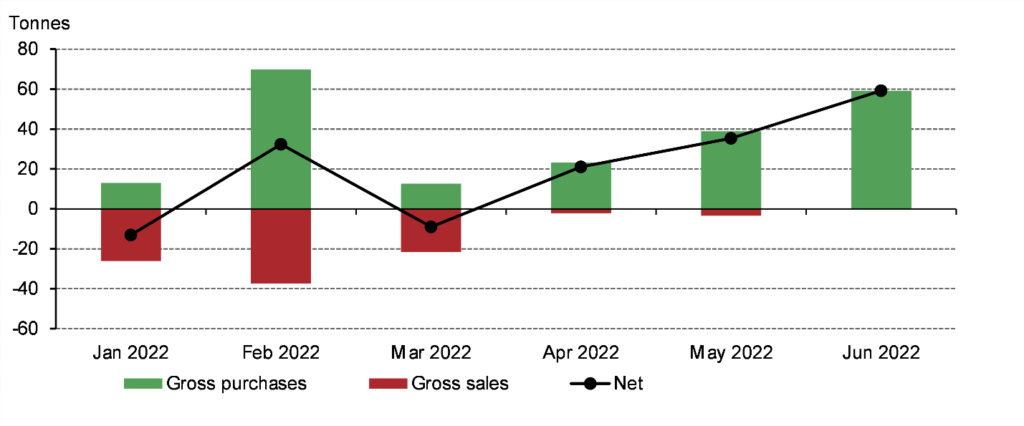

But instead, confidence in the global dollar-based monetary system is beginning to crack. Banks around the world are replacing their dollar reserves with gold. In the first half of 2022, central bank gold reserves grew by 270 metric tons.

This loss of confidence in the dollar is justified by roaring inflation, trillion-dollar deficits, ballooning debts, both corporate and governmental, and politics driven by giveaways, vote-buying, and spending sprees. Dollar users are also being driven away by an endless parade of US sanctions against countries that don’t defer to the American empire. In this way, the US is hurting itself.

We would like to see our friends and clients protect themselves and profit from advance knowledge of this historic trend. Simply call or visit an RME Gold professional to implement a sound strategy for the times ahead.