The Fed is the Number One Problem

We should also mention fiat currency!

“The Fed is problem No. 1 in American finance.”

So says the wickedly smart Jim Grant, the author/editor of Grant’s Interest Rate Observer.

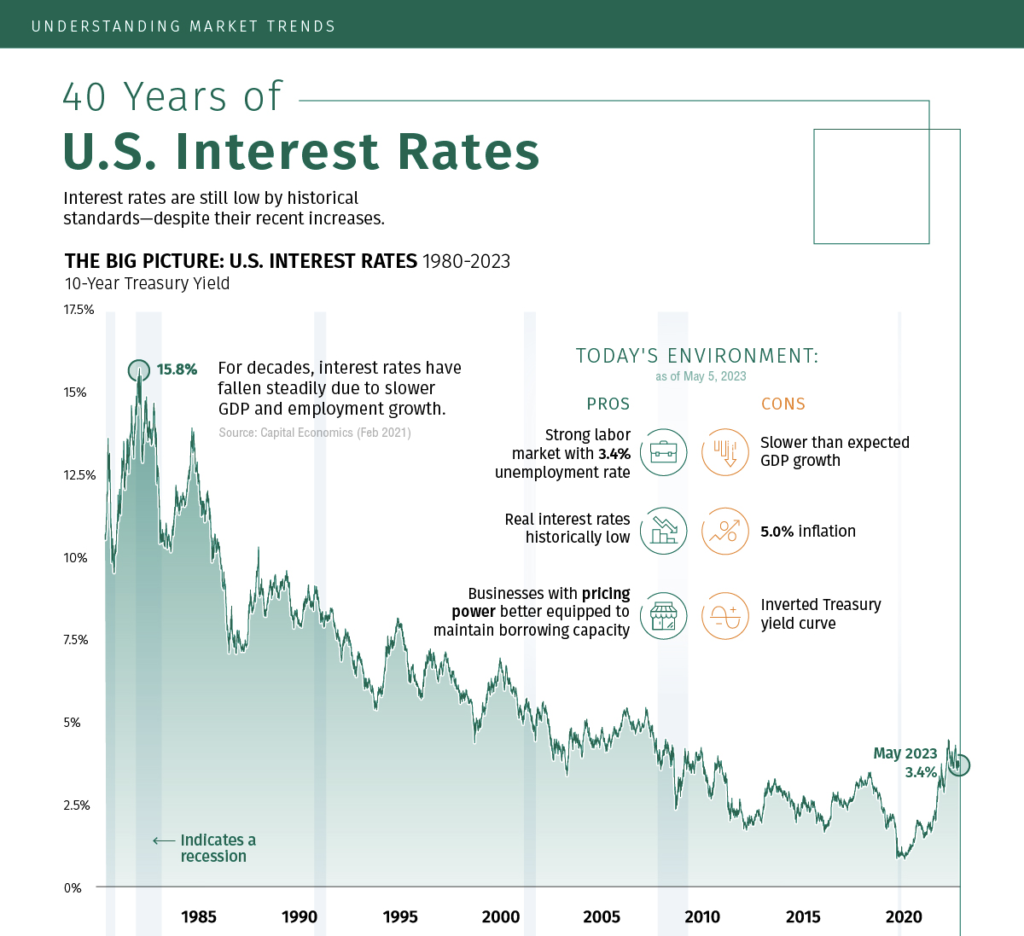

Grant says the long-term suppression of interest rates by the Federal Reserve is the source of our problems. “I think generally that the suppression of rates introduces all manner of distortions in the economy,” Grant said in a recent interview. “It distorts savings. It causes people to go and reach for growth, for yields as if they were on their hands and knees with a flashlight looking under their furniture for some return on their savings.”

During Congressman Ron Paul’s presidential race years ago, he was asked who he would like to appoint to the chairmanship of the Fed. After no doubt explaining first that there should be no Fed, Dr. Paul suggested that if Fed did remain in place, then Jim Grant would be on his list.

That was a good call!

“I think that the basic idea of buying up bonds and thereby suppressing longer-dated interest rates, in the hopes of generating rising asset prices and thereby stimulating the economy by dint of people spending the proceeds of their capital gains, this idea that the Bernanke Fed surfaced in 2010-11 I think it is a very, very dicey proposition longer term. I don’t think it works,”

We agree with Grant that the Fed is a problem that has cost the American people dearly. It has destroyed 93 percent of the value of the dollar during its existence — by design. We think the very existence of the Fed is an outrage and is nothing less than a huge wealth transfer machine that enriches Washington’s banking cronies.

But we might describe the problem somewhat differently, as being the unbacked, fiat, made-up, irredeemable dollar. We suspect Grant would argue with us. He is, he says, “eternally bullish on gold.”

And why not? Gold is the go-to money of the ages around the world and in every kind of financial crisis. And we are sure in a crisis now as people are noticing.