The “Doom Loop” Part II

Since we first told you we’re in a Dollar Doom Loop in March, gold has broken out!

Now things are getting worse with the dollar. Things that will drive gold prices higher still.

Friday’s action, with gold up more than $28, is a sign of things to come.

To describe the Doom Loop we asked you to imagine that you have a business that has to borrow a dollar to make 90 cents. When that happens, you’re in the Doom Loop. Forget borrowing your way to prosperity. When you’re in the Doom Loop, all your additional borrowing just leads to a more painful bankruptcy.

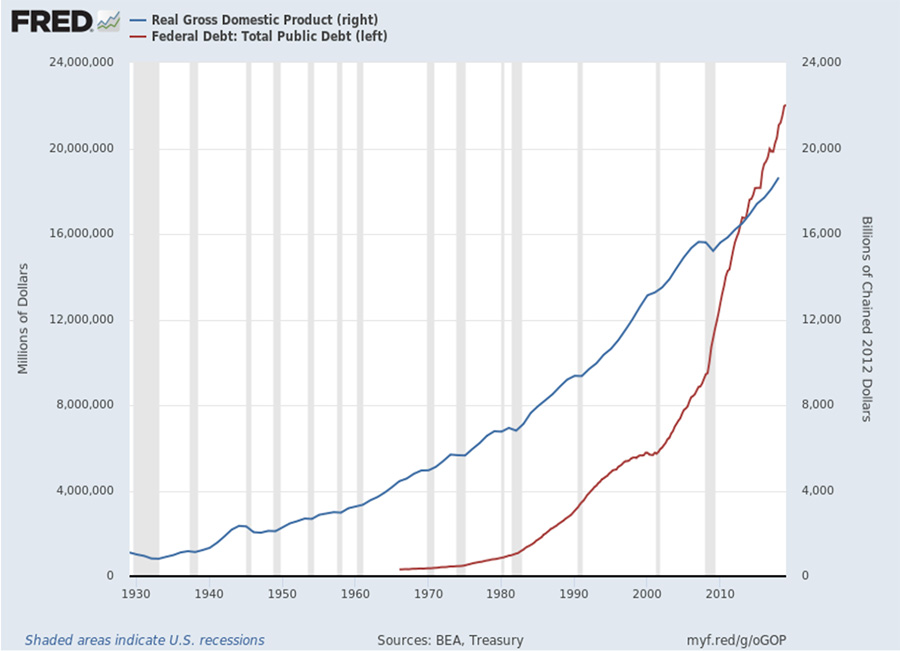

The Dollar Doom loop is when US debt grows faster than the economy. You can see in the following graph that federal debt, the red line, has not only passed the Gross Domestic Product, the blue line but that the debt is climbing at a steeper rate.

Federal debt today is just over $22.4 trillion dollars. It roared right past the GDP in 2013. Today GDP is estimated to be about $2 trillion below the debt level. And that is at the end of what we are told is one of the longest expansions in history, now going on for more than ten years!

But there is more to the Doom Loop story. As we reported recently, for the first ten months of the government’s current fiscal year (FY 2019 through July) federal revenue is up 3 percent. But federal spending is up 8 percent.

If that’s what happens during a booming economy, imagine what happens in the event of a widely expected recession. In that case, federal social spend goes up; federal revenue falls with the slowdown. And the gap widens.

Former Reagan budget director David Stockman says that in constant dollars under President Trump federal spending has increased 4.22 percent a year. That’s more than twice as fast as under Obama. It’s faster spending increases than under either Bush, Clinton, Reagan, Carter, or Ford.

Since President Trump was inaugurated on January 2017, federal debt has grown by almost $2.5 trillion.

We’re not politicians. We’re not running for office. We’ll leave it to others to decide who is to blame: The White House, the Fed, Congress, R’s and D’s, divided government, the media, or the people themselves. Frankly, they are all likely good candidates for some of the blame.

Our job is helping our clients both protect themselves and profit during a period of accelerating dollar destruction. Since the Fed has already destroyed about 97 percent of the dollar’s purchasing power, we’re in the late stages of this debacle.

That’s why we urge you to add to your precious metals holdings now.