The Beltway’s Financial Crimes!

Decades of Skyrocketing Debt and Slowing Growth!

We read today that well-positioned Washington lobbyists say that Biden’s tax hikes are dead. We hope our friends and clients know us well enough to know that we are no friends of tax hikes.

Even so, we note that when revenue targets will not be hit, spending plans should be curtailed.

But in today’s Beltway, that never happens. Never mind the party in charge.

So, when the financial crimes that are bringing America low are finally reckoned, ever-growing government spending and debt will have to be at the top of the list.

“But,” complain the elected classes, “if we do not give people free stuff to buy their votes, how are we going to get reelected?”

And after all, the normal laws of accounting are widely believed to have been repealed by the Federal Reserve. This board of mostly nameless, faceless bureaucrats is gifted with alchemical magic that allows it to turn debt into money.

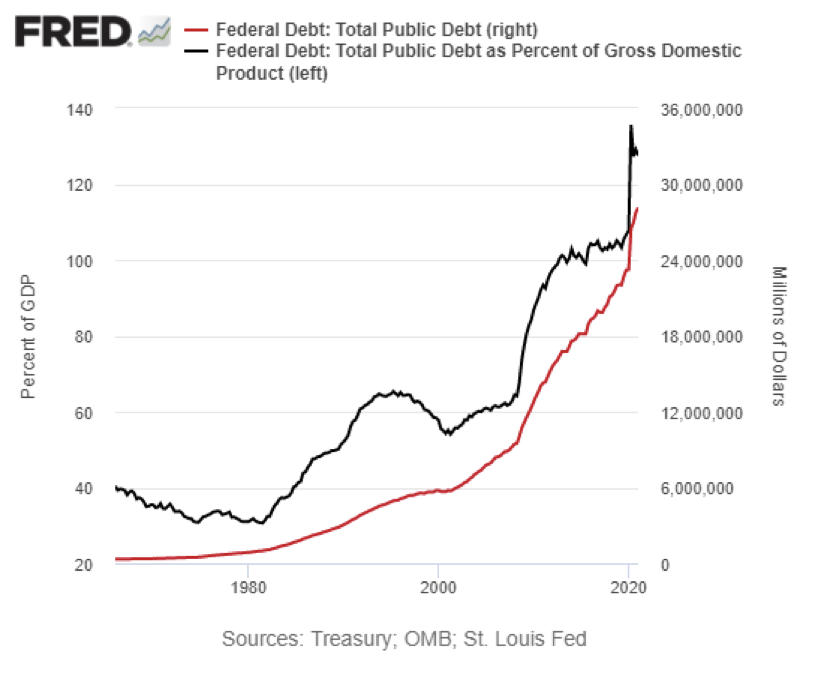

The gullible think it is quite a trick! Their magic will be tested in a big way this year, since the US deficit is tracking to hit $3 trillion this year (13.4 percent of the nation’s productivity), while the national debt is already $28.5 trillion.

You might think that someone would notice that decades of exploding debt have been accompanied by a precipitous drop in America’s growth rate. And indeed, former Reagan budget director David Stock has noted, as follows:

Real GDP Growth Rates, 1951-2020

- Post-war Golden Era, 1951-1970: 3.72% per annum;

- Initial Fiat Money era, 1970-1987: 3.24% per annum;

- Greenspan Money-Pumping Era, 1987-2007: 3.08% per annum;

- Post-crisis fiat credit explosion, 2007-2020: 1.28% per annum.

“That’s right. Real GDP growth has slowed to barely one-third its golden era rate despite the evolution of Fed policy toward increasingly massive money-printing (i.e., real balance sheet growth) on an increasingly continuous basis.”

So, no, do not let any whack job politicians tell you we will grow our way out of this debt problem. Debt has crippled our growth!

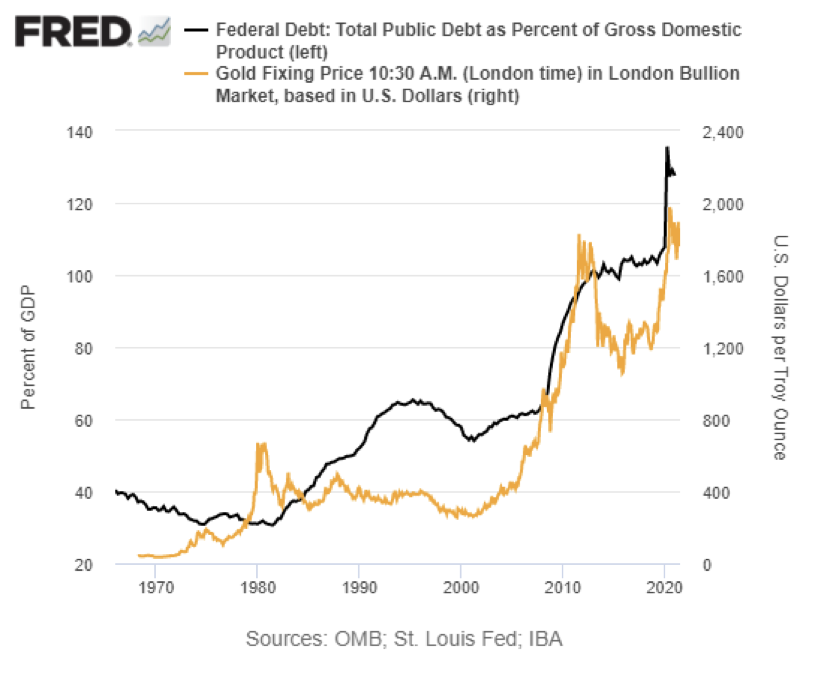

But it does drive gold higher, as this chart suggests:

We think the above chart suggests that gold has some catching up to do. That is likely to happen when the next Black Swan hits- when another “unexpected” event triggers a financial calamity.

What might such an event be? We do not know. Persistent inflation rocketing higher even as the Fed insists inflation is transient and under control? An armed conflict breaking out in the Black Sea or the South China Sea?

We do not know; any more than people knew when their Florida condo tower would collapse. But spiraling US debt and falling productivity is evidence that, like the Surfside tower, vital maintenance of US financial affairs has been deferred.

You do not have to be victimized by the inevitable discovery that the Fed cannot really create money of lasting value out of debt.

Speak with a Republic Monetary Exchange gold and silver professional today. Check your own portfolio’s ability to withstand a systemic breakdown.