Taking Inflation Seriously!

Watch out for 20% – 25% inflation over the next few years, says Wharton professor!

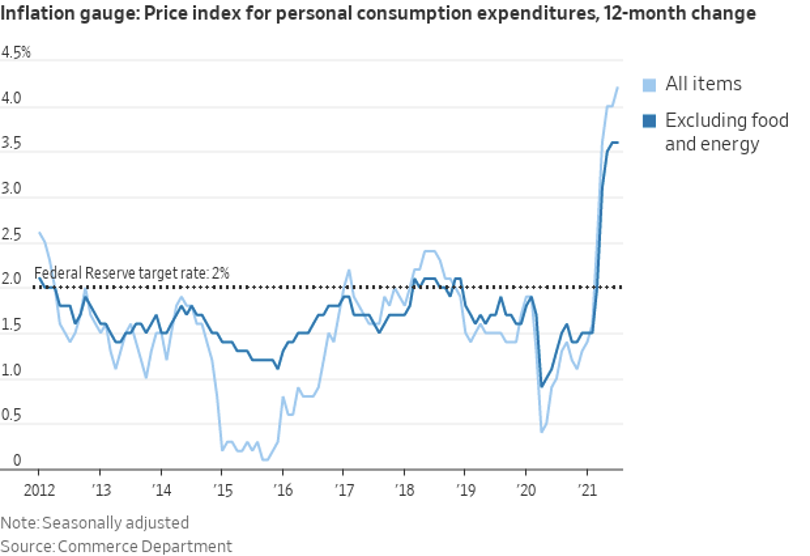

Leading establishment economists are finally starting to take inflation seriously.

About time. Especially since the Federal Reserve has conjured up $4 trillion out of thin air in just the last 18 months.

And it’s pretty hard to deny that inflation has returned, especially for anyone who has visited a grocery store lately.

“Inflation, in general, is going to be a much bigger problem than the Fed believes!” That is according to Wharton finance professor Jeremy Siegel. He told CNBC, “We’re headed for some trouble ahead.”

At a Forbes Top Advisor Summit in Las Vegas just days ago, Siegal projected 20 to 25 percent inflation over the next few years.

The question has always been when does all the Federal Reserve’s Quantitative Easing money printing enters the consumer economy. If the Fed prints money and leaves it shrink-wrapped in a basement somewhere, it will not drive consumer price inflation.

But now Siegal says, the Powell Fed’s QE is getting out!

“Quantitative easing is important but if that quantitative easing gets in the money, watch out,” he warned. “I never predicted inflation from the quantitative easing of [Former Federal Reserve Chair] Ben Bernanke, but I am predicting inflation from the quantitative easing that Jerome Powell and the Federal Reserve is doing now.”

Siegal says that inflation may play out in the form of five to seven percent annually over the next few years.

Siegel also says that gold is relatively inexpensive.

To economist Stephen Roach it also looks like we are headed into a 1970s-style stagflation.

“It’s worrisome for the overall economic outlook and raises serious questions about the wisdom of central bank policies — especially that of the Federal Reserve,” said Roach, also on CNBC.

The inflationary conditions that economists Siegal and Roach are now noticing will drive a stampede of gold buying when it becomes apparent to more average consumers. That day is drawing close now. For shoppers, it is impossible to miss higher prices at the grocery store. The United Nation’s Food and Agricultural Organization’s index of international prices of commonly traded food commodities showed a big jump in September, up 32.8 percent from September 2020.

That is a big jump!

We strongly advise our friends and clients to add to their gold and silver positions now.