SVB (Silicon Valley Bust!)

Gold Surges as Banks Tumble!

The best place to start a discussion about bank troubles is to point out that the financial establishment has been wrong about virtually everything.

Federal Reserve chairman Powell testified before congress last week. You would have walked away from his testimony thinking everything looked just fine and without any concern about bank solvency.

Days later, Powell and others gathered to figure out how to save the teetering banking system.

That should not surprise you. A year ago, the Fed thought inflation was transient. Now, a year later the Consumer Price Index in Phoenix where we live is rolling along at an 8.5 percent annual rate.

Silicon Valley Bank went under just 14 days after the Big Four accounting firm KMPG gave the bank a clean bill of health.

KMPG signed off on its audit of Signature Bank just a couple of weeks ago, too. Eleven days later Signature Bank collapsed.

The accounting firm should be embarrassed into next year, but it seems brazen instead. Here is its statement: “It’s important to recognize that audit opinions, which only address the financial statements and internal controls of the business, are based on audit evidence available up to and at the date of the opinion.”

We guess that it is too much to ask them to notice bond portfolios that are billions of dollars upside down.

In any event, conditions are grim enough in the banking industry that Moody’s Investor Services has now downgraded the entire banking system to “negative.”

As for Treasury secretary Janet Yellen this week:

“I can reassure the members of the committee that our banking system remains sound and that Americans can feel confident that their deposits will be there when they need them.”

Right. That is the same Janet Yellen who announced a few years ago that we wouldn’t have another financial crisis in our lifetimes.

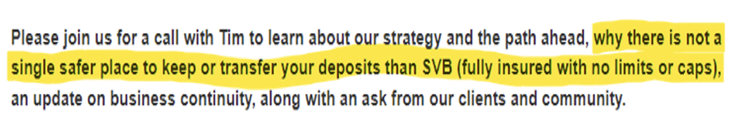

Meanwhile, somebody named “Tim” has now been put in charge of the quivering hulk that once was Silicon Valley Bank. Tim has alerted the bank’s client that there is no place safer than SVB. Here’s his tweet to clients:

So, the Fed meets in a couple of days to figure out what to do next. They will announce their interest rate plans on March 22. As usual, instead of solving anything they will try to kick the problem down the road for a while longer.

We have a lot more financial crises ahead of us.

As usual during times like this, gold and silver are the place to be. Gold and silver never declare bankruptcy!

We urge you to speak with your Republic Monetary Exchange gold and silver professional as soon as possible. Our phone traffic is high, and we are very busy as you can imagine, but we value our friends and clients greatly and will get back to you right away.