‘Substantial’ Inflation Increase Coming; U.S. Recession Risk as High as 35%

All Signs Point to Stagflation with Higher Gold and Silver Prices

White House expects inflation will ‘substantially’ increase in coming months

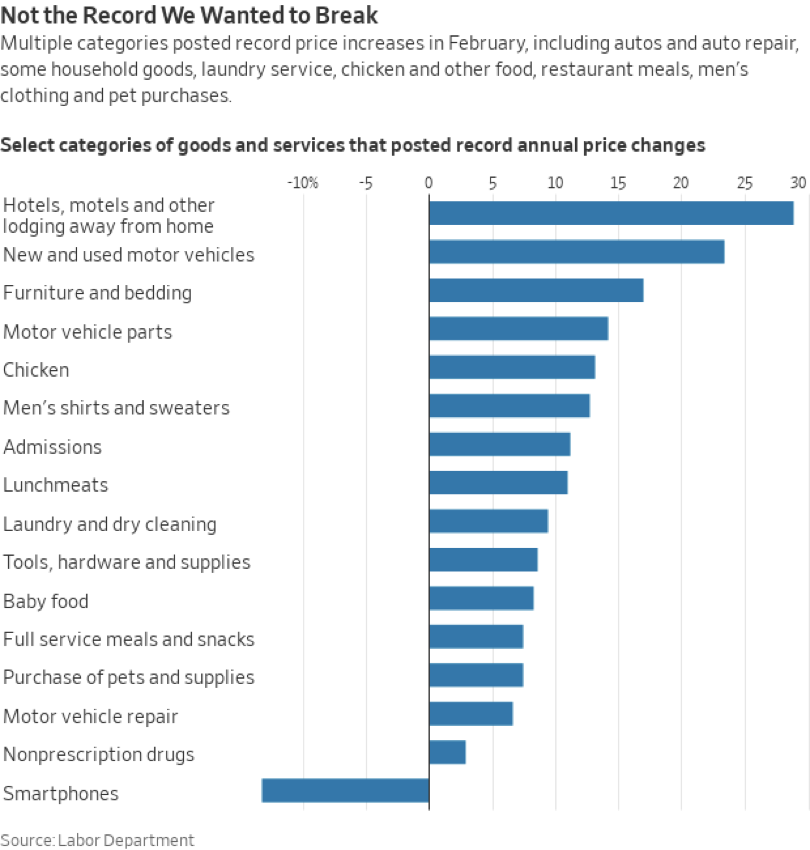

Washington Examiner (3/11/22) – The White House is expecting “substantially” higher inflation figures in the coming months, even after the February Consumer Price Index posted the highest year-over-year rate since 1982.

Yearly inflation rose to 7.9% in February, which the White House attributed largely to a 3.5% increase in energy prices.

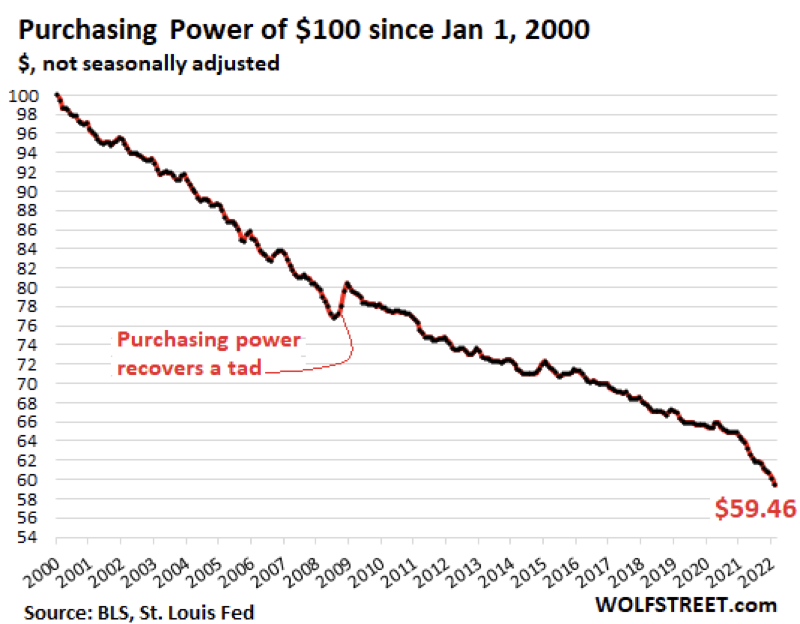

Inflation = loss of Purchasing Power of the Dollar

WolfStreet.com (3/11/22) – Inflation is not a sign of growth, and it’s not a sign of anything positive. It’s just a sign of the loss of the purchasing power of the consumer’s dollar, including the purchasing power of dollar-denominated labor. And this is a long-term cumulative and relentless process that started to accelerate last year. In February, the purchasing power of $100 in January 2000 dropped to a new record low of $59.46.

Risk of a US recession as high as 35%, says Goldman Sachs

CNN Business (3/12/22) – Europe’s reliance on energy from Russia has jacked up the odds that the region could enter a recession this year as soaring inflation pushes people to cut back spending. The United States is more insulated from the spike in oil and gas prices — but it’s not immune.

What’s happening: Goldman Sachs has downgraded its forecast for US economic growth in 2022. It now sees little to no growth during the first three months of the year.

Goldman’s economists, led by Jan Hatzius, said the chance of a recession in the United States over the next year has risen as high as 35%.

As Inflation Rages, US House Approves MASSIVE Aid To Ukraine!

Ron Paul Liberty Report (3/11/22) – First it was $6 billion, then Biden made it $10 billion, then the US House upped the ante again: more than $13 billion US taxpayer dollars will be shipped to Ukraine. As Americans are ravaged by inflation at the supermarket and skyrocketing gasoline prices, will they still cheer for their money being sent overseas? (View HERE).

UMich Sentiment Slumps In March As ‘Hope’ Plunges, Inflation Expectations Surge

ZeroHedge.com (3/11/22) – Following February’s plunge to new post-COVID lows, March’s preliminary University of Michigan sentiment data was expected to fall even further, plumbing new lows not seen since 2011. However, things were much worse than expected with the headline sentiment print dropping from 62.8 to 59.7 (well below 61.0 exp) as expectations plunged (from 59.4 to 54.4) and current conditions slipped from 68.2 to 67.8…

And finally, and perhaps most importantly, inflation expectations soared with the highest 1-year inflation expectations since Dec 1981.

From the Russian Revolution to Vietnam, war has been a reliable precursor to inflation.

Wall Street Journal (3/11/22) – History may be about to repeat as Russia’s invasion of Ukraine tilts the balance of global political and economic forces toward higher inflation. The main channels: First, more military spending, which strains the economy’s productive capacity. Second, embargoes, sanctions and fighting disrupt supply chains. These factors are clearly at work now.