Student Loan Debt and Other Gold News and Nuggets

STUDENT LOAN DEBT

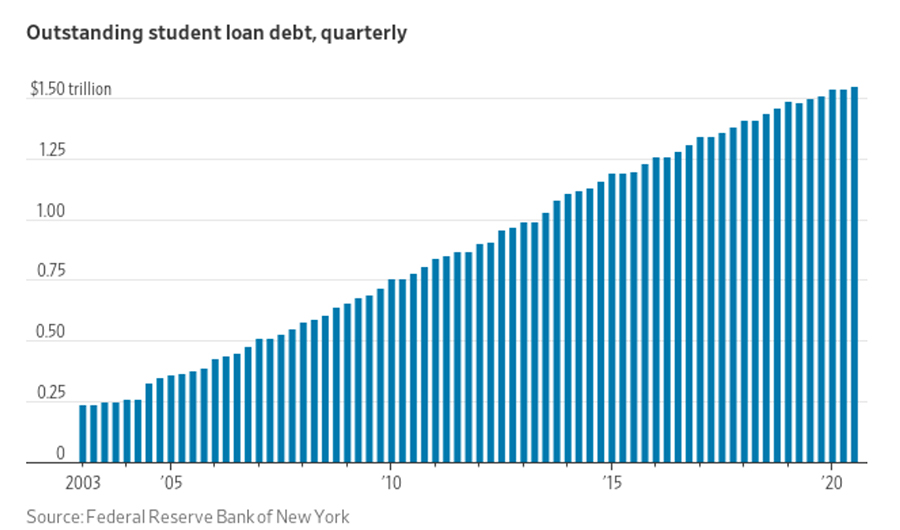

Commenting about student loan debt almost two years ago, we wrote, “Everything about student loan debt is bad economics. All the easy money flowing the way of colleges and universities has led to a doubling of the cost of higher education over the past 20 years. It has made the schools rich. They’ve become palatial in some places, top-heavy with administrators and bureaucrats everywhere, although nobody insists that their graduates are better educated.”

Now the Wall Street Journal reports that the government is starting to figure out it created another mess like the subprime mortgage mess.

from the Wall Street Journal:

“The Education Department, with the help of two private consultants, looked at $1.37 trillion in student loans held by the government at the start of the year. Their conclusion: Borrowers will pay back $935 billion in principal and interest. That would leave taxpayers on the hook for $435 billion. The losses are far steeper than prior government projections and show that after decades of no-questions-asked lending, the government is realizing that it has a pile of toxic debt on its books.”

A CENTRAL BANKER SPEAKS ON GOLD

Central banks have been net gold buyers since 2010. We have called this one of the most important financial megatrends of our time. Here are comments about gold that must be seen as very bullish from Róbert Rékási, head of foreign exchange reserves management at the Central Bank of Hungary.

CentralBanking.com:

“Gold remains an attractive asset class for reserve managers. Amid the uncertainties created by COVID-19, gold is acting as a ‘safe-haven asset’, which is reflected in higher gold prices. The other important consideration is the opportunity cost. Because of the crisis, central banks eased policies further and fiscal policies followed suit. In this context, the opportunity cost of holding gold has decreased further….

“Recent surveys have revealed central banks are still willing to increase their gold exposures. Second, the drivers boosting the gold price are very powerful. The low and negative sovereign yield environment is very supportive. Geopolitical and global trade tensions also boost the gold price. For example, growing competition between China and the US is a long-term factor that will not go away after the pandemic or with a new US administration. Third, central banks in different regions look at gold in a different way than before the financial crisis.”

MORE ON DE-DOLLARIZATION

The SWIFT payments system is the leading international account settlement facility for world banks and commerce. The US has used the SWIFT system as a tool of its foreign policy, refusing access to it to countries in diplomatic contests. Eventually, this will drive the development of alternatives to SWIFT.

But for now, we note that the US dollar’s share of SWIFT settlements is in decline.

Bloomberg:

“The euro was the most used currency for global payments last month, the first time it has outpaced the dollar since February 2013.

“Data from the Society for Worldwide Interbank Financial Telecommunications, which handles cross-border payment messages for more than 11,000 financial institutions in 200 countries, showed the European Union’s single currency and the greenback were followed by the British pound and the Japanese yen. The Canadian dollar overtook China’s yuan for the fifth spot, Swift said.”

Newsletter writer Chuck Butler observes that “the Fed now owns more Treasuries (their value) than all foreigners combined… Now tell me how this doesn’t end in a trail of tears!”