Stubborn Inflation and a Confused President

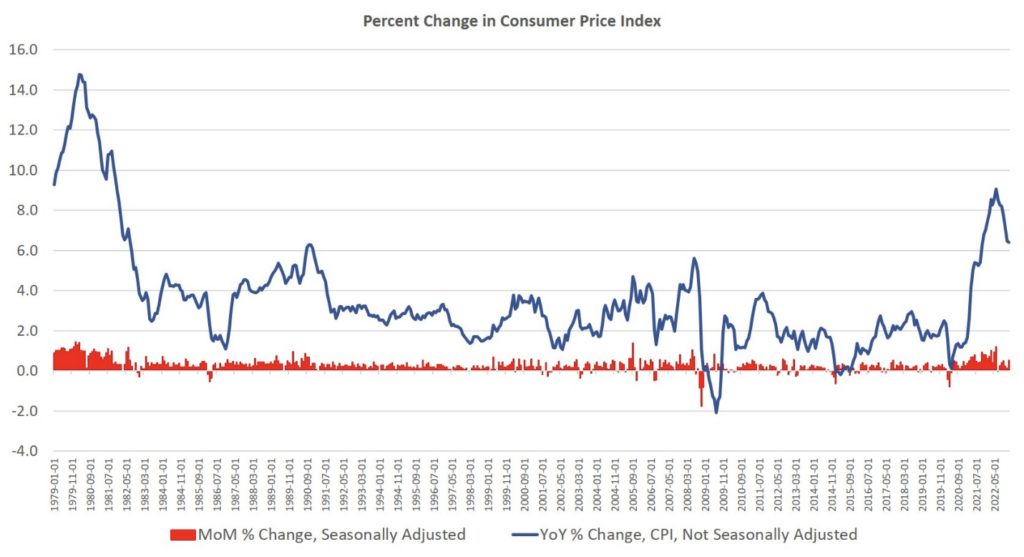

Here is a chart showing the percentage change in the Consumer Price Index going all the way back to the Stagflationary 70s and their aftermath. When people talk about inflation at a forty-year high, they are referring back to the peak inflation of that era.

Just days ago, President Biden commented on the January Consumer Price Index numbers. Inflation is coming down, he said:

Inflation in America is continuing to come down, which is good news for families and businesses across the country. Today’s data confirm that annual inflation has fallen for seven straight months. Inflation for food at the grocery store came down again last month. Gas prices are down about $1.60 from their peak last year. And real wages for working Americans are up over the last seven months, delivering welcome breathing room for American families. We are seeing this progress even as unemployment remains at its lowest level since 1969 and job growth remains resilient.

Did he mention that both the November and December CPI numbers had to be revised higher? Probably not.

No, definitely not.

It is a good idea to take everything politicians say with a grain of salt. This is of course especially true with Joe Biden. So, we decided to turn to Ryan McMaken, the editor of Mises.org for some non-politician straight talk:

This is a rather tortured description of the situation. With the CPI rising both month over month and year over year, it’s a bit of a stretch to say price inflation “came down” in January. It would be more accurate to say that the rate of increase slowed very slightly.

This hasn’t stopped President Biden from declaring that the economy has already achieved a “soft landing” as Politico suggested yesterday.

The markets apparently disagreed… Markets likely fear that—in spite of Biden’s narrative—price inflation looks stubborn, suggesting the Fed will continue to move interest rates up. Wall Street, heavily dependent on easy money, wants to see inflation fall so that the Fed will begin loosening again. If price inflation is seen to be slowing, this could be interpreted as an excuse for the Fed to force interest rates back down and resume asset purchases. If a soft landing were already in the cards, Wall Street would be planning for an acceleration of monetary loosening.

National currencies everywhere are in bad trouble. Years of money printing are catching up with them. Like us, Japan is now dealing with its own inflation crisis. Like ours, it is now the highest it has been in 40 years.

Like our Fed, Japan’s officials are muttering something about this new surging inflation being merely “transitory.”

Right. Transitory.

By the way, just a few days after Biden crowed about inflation coming down, the Fed’s preferred measurement of inflation, the Personal Consumption Index, reported that inflation was up for the 12 months ending in January. For January alone the index rose 0.6 percent. Even core inflation, which excludes food and energy and is a measure they use to minimize the real inflation rate, rose 0.6 percent in January. Try annualizing that!

Said the president last week, “Today’s data reinforces that we have made historic progress and are on the right track, and now we need to finish the job.”

Finish the job? That’s just what we are afraid of for US dollar holders. When these governments stumble about in confusion, boasting about their fiscal and monetary management without even knowing what is really happening under their watch, one would be wise to stay away from their currencies entirely.