Stock Market Warning!

And a Wobbly Social Order!

We have made the point many times that the US stock market is floating on the back of a loose money regime, money the Federal Reserve has been stove-piping to Wall Street.

Here is a 10-year chart of the S&P500 stock index.

Most of the left half of the chart shows the effect of Quantitative Easing money printing and the lift it provided the stock market.

On the right-hand side in the area that reflects this year, 2020, you can see the sharp break in the market with the arrival of the pandemic shutdown. It crashed stocks by 35 percent seemingly overnight.

Since then, in a few short months, the Federal Reserve created some $3 trillion dollars out of thin air to drive stocks back up.

It has succeeded. But at a price.

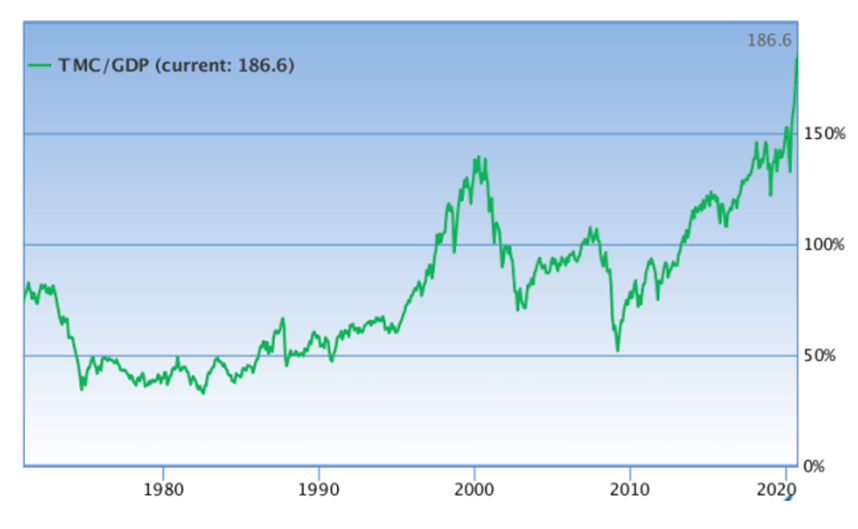

We want to show you another chart, one that puts these lofty stock heights in perspective. This recent chart shows the total market capitalization of US stocks, the market value of stocks today, as a percent of total US productivity, or Gross Domestic Product (GDP).

Warren Buffett calls this ratio of market cap to GDP “probably the best single measure of where valuations stand at any given moment.”

Think about that. The best indicator of stock valuations is at stratospheric heights compared to the actual productivity of the economy. And we know that it is held aloft by Fed money printing.

It’s okay to be cynical about all this. Just the other day, Mary Daly, the head of the San Francisco Fed defended the Fed’s tender, loving care for Wall Street by saying it is all being done for the little people. Speaking at a University of California, Irvine event, Daly said, “I am not willing to trade millions of jobs for people who need a ladder rung up in order to keep the stock market from going up for a few who have those holdings.”

Oh? But if the gusher of Fed liquidity for the past ten years is all being done for the little people, why does the wealth gap keep widening?

The answer is clear. The wealthiest people, as she acknowledges (“the few who have those holdings”), own most of the stocks. Monetary policies designed to lift stocks make the wealthy wealthier. They widen the gap. And they make the stock market vulnerable since it is held aloft by a monetary gimmick and not by real fundamental valuations.

But it’s not just stock markets that are wobbly. The social situation in this country is wobbly as a well, thanks to the Fed’s cronyism. The November election will very likely bring more of our national instability to the fore no matter who wins.

If you are looking for a safe haven from a wobbly stock market and during what could be one of the most divisive periods in US history since the Civil War, we would suggest a well-thought-out portfolio of gold and silver.