Spending Our Way to Prosperity

It’s all unfolding like a bad dream.

I mean our financial and monetary future.

Maybe it is more like a “B” movie, one that is totally predictable.

Nations globally have spent $12 trillion they do not have on “stimulus” measures this year. The US is more than $3 trillion of that.

But it is never enough. US Federal Reserve chairman Jerome Powell wants more deficit spending. At the International Monetary Fund annual meeting this week, Christine Lagarde, the head of the European Central Bank, is calling for more deficit spending too.

They all read from the same tired script. We have seen it all before.

The theory that has guided US and global fiscal and monetary policy for almost a century, “Keynesian economics,” calls for deficit spending by governments during slowdowns. Then, according to the theory, governments would run surpluses during recoveries, and pay off the debt.

It was balderdash to begin with, but even those that bought it must acknowledge that in practice the authorities ran deficits in both slowdowns and recoveries.

Stated differently, the US should not have had $23 trillion in debt when the pandemic hit. Especially since we were more than ten years into our post-housing bust recovery, the longest recovery in our history.

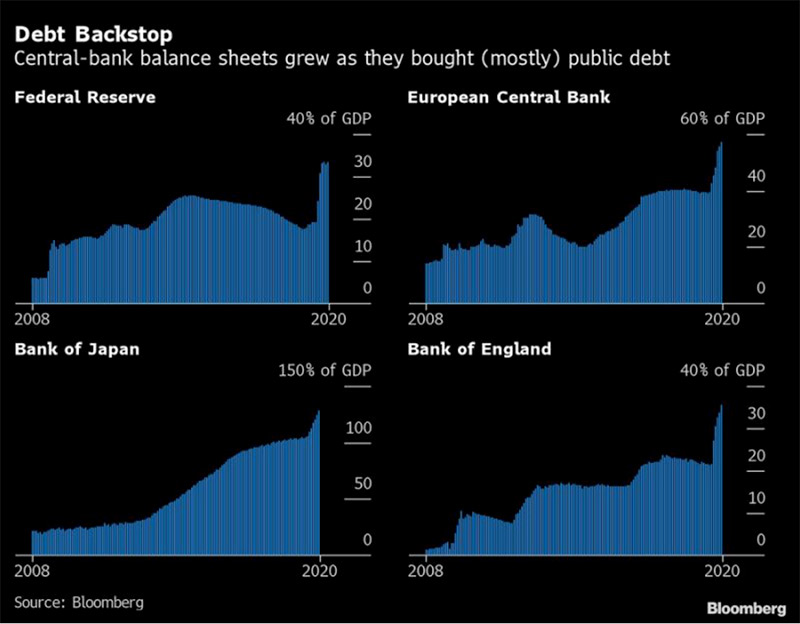

While the fiscal authorities have run the debt to the moon, the central bankers have flooded the world with digital “paper” money. Here’s a chart from Bloomberg that shows what they have done since 2008.

A Bloomberg News story describes Lagarde and other central bankers now pushing for more deficit spending.

“A parade of Federal Reserve officials led by Chair Jerome Powell lined up last week to make the same argument with regard to the U.S., where talks on the next dose of pandemic stimulus have been deadlocked for months in Congress. Fed officials said their own tools, such as another round of bond-buying, won’t be as effective as government spending.

“The message from the most powerful central banks is increasingly clear: there are limits to what monetary policy can do to help in the short run. Fiscal authorities -– who can borrow at rock-bottom interest rates and possess tools better-suited to deliver a rapid and targeted boost — will have to finish the job.”

We find the last phrase, “finish the job,” ironic. The money printers are destroying the dollar, while the deficit spending is destroying US solvency.

Now we will watch the show unfold. Those that have seen it before will watch from the sidelines, having protected their wealth with gold and silver.