Spending More Than You Have Means More Debt!

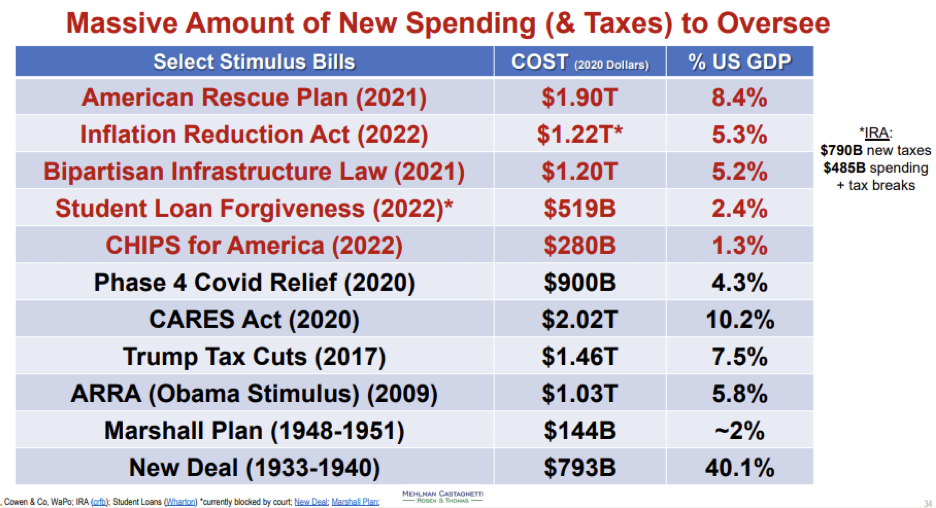

It’s hard to comprehend just how much money has gone into Washington’s “stimulus” measures. But this might help.

It compares Biden’s spending measure to other US benchmark spending bills.

Biden’s American Rescue Plan is 2.4 times larger than all the New Deal spending between 1933 and 1940. The so-called Inflation Reduction Act is 8.5 times the size of the Marshall Plan that rebuilt much of Europe after World War II. The Bipartisan Infrastructure Law is about the same size as the Inflation Reduction Act.

By the way, all of these costs have been converted to 2020 dollars to make comparisons possible.

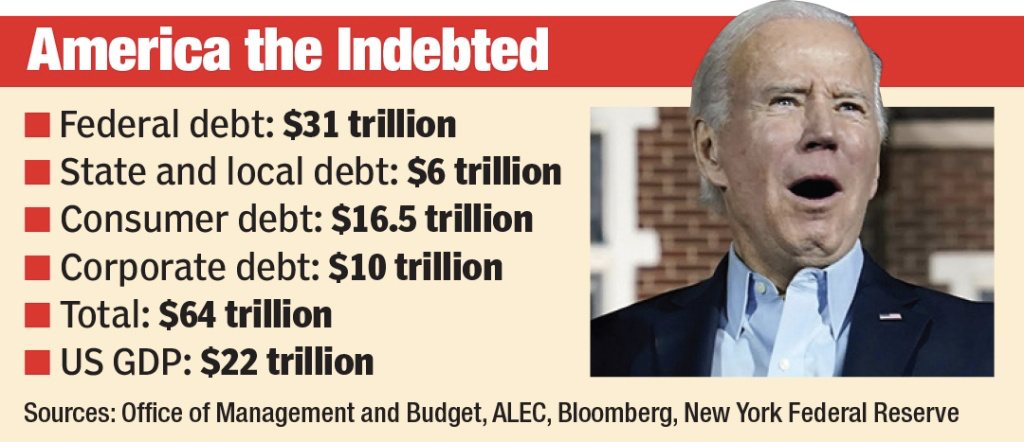

You might think that all this spending would generate some red ink. Well, you would be correct.

Take a look:

As you can see, the debt problem does not consist solely of federal debt. State and local, consumer debt, and corporate debt all add up to $64 trillion. But almost half of that is federal debt.

According to the International Institute of Finance, total global debt has been running about $300 trillion. That’s about three times the total global production.

We’re not saying that the interest on $300 trillion is nothing but a cakewalk, but it’s a lot more manageable when interest rates are 1 or 2 percent than it is when rates are closer to 5 percent, which is where they are headed.

The problem gets even worse when interest rates are higher and growth falters as it does in a recession. That means the level of taxable activity falls. At the same time, government social spending usually rises and deficits get larger.

As always, the Federal Reserve has a printing press (digital, of course) on standby, ready to print however many new US dollars it takes to keep up Washington’s appearance of solvency.

But no matter how hard they try, they haven’t been able to figure out how to print gold!

Have you spoken with an RME gold and silver specialist lately? With the entire world struggling under an unsustainable and unpayable load of debt, it would be wise to do so!