Social Insecurity

Gold or a Government Program that is Headed Towards Insolvency?

What do you think is more reliable for your retirement? Gold and silver, which are not dependent on politicians’ empty promises?

Or the government’s Social Security program?

If you answered Social Security, here are a couple of things you should consider.

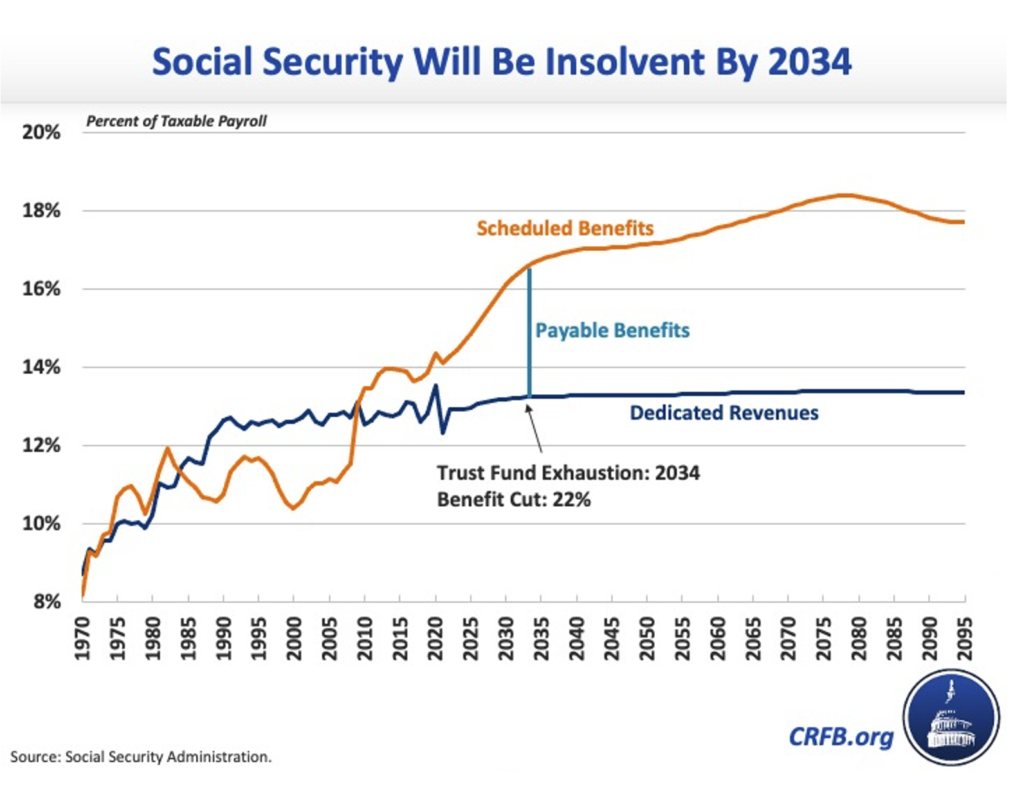

First, Social Security is only 13 years from insolvency. The new report from Social Security’s trustees says that the old age and survivor insurance trust fund – that’s the main component of the program – will be insolvent (that’s another world for bankrupt) by 2034. That is a year earlier than had been expected.

Second, the money you have paid in all your working life has already been spent. It is gone. There is no money in the trust fund. Your congressmen spent it. So even if things are jiggered around the edges with later eligibility ages and some means-testing, the problem of Social Security insolvency doesn’t go away. Congress will have to figure out somewhere to get the money. But there really is nowhere to get it. Already the US has an explicit debt nearing $30 trillion. That debt gets “paid” first.

Third, Social Security was always actuarially sketchy. It was part of the great electoral game of seducing the people with promises that they could live at someone else’s expense. But the numbers don’t work. For example, in 1945 there were 41 workers paying into the system for everyone drawing benefits. Today the load falls heavily on fewer workers per retiree. There are only 2.7 people expected to pay for one retiree. Before long it will be only 2 workers per retiree.

That is only part of the actuarial picture. Americans live longer and therefore draw retirement benefits longer than they did at the program’s inception. The life expectancy of a 65-year-old today is 20 more years. In 1940 it was just 14 years.

Roughly 3 million baby boomers retire each year. And their Social Security is just one of the burdens that they expect Millenials and others to pay. Medicare is another.

There is another name for schemes like this, in which paying returns to some investors today depends on bringing in new victims tomorrow.

It is a Ponzi scheme.

There will be an intergenerational war over this. While the economy is growing by leaps and bounds as it did in the 1950s and 1960s, nobody much notices unfair burden-sharing. But in an era of shrinking expectations, it becomes social dynamite.

Of course, the government’s go-to solution to problems like this is money printing. But what good is the monthly Social Security check they promised when the price of grocery and heating and cooling your house has gone through the roof?

We think it is only prudent to face the problems squarely and make sure you provide for your own retirement with money the government can’t just print into worthlessness.

Let a Republic Monetary Exchange gold and silver professional help you chart a course to retirement security with real money.