Silver Heading to $30 in the Coming Months

Solar Demand Figures Large in Goldman Sachs Outlook

Goldman Sachs has renewed its call for silver to reach $30 an ounce in the next few months.

That target represents a 25 percent near-term gain in the silver price.

Earlier this year Goldman set a price target of $30 for silver. Silver touched $29.91 on August 7. With the price having corrected to the $24 range, the investment bank has renewed the call, writing, “Now, with silver at $24 per ounce, and a few potential upward solar surprises in the coming months, we reopen the trade.”

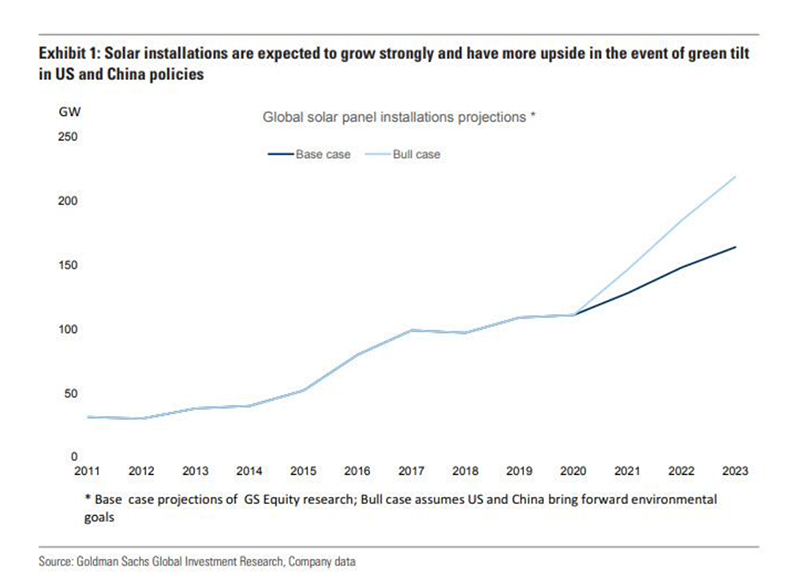

Analyst Mikhail Sprogis, a Goldman Sachs vice president explains, “with global infrastructure stimulus tilting towards renewables, and solar in particular, silver stands out in the metals space as the obvious beneficiary. Solar investment accounts for around 18% of silver industrial demand or 10% of silver total demand.”

In a piece about green energy equities outperforming legacy energy equities, ZeroHedge responded Goldman Sachs with a headline that read, “Is Joe Biden About To Send Silver Soaring?”

Over the next three years, Goldman expects industrial demand for silver to climb by somewhere between two percent in its base case, to an impressive nine percent in its best case.

Details:

“Our Equity analysts’ base case is that global solar installations will increase by 50% between 2019 and 2023 as the greenification trend accelerates. Importantly, there are potential upsides even to this ambitious target. Former US Vice President Biden has proposed a plan which involves installing 500 million solar panels in the US alone over the next 5 years. Our Equity analysts estimate that this could boost installation of US capacity from 15 GW per year to 30 GW. This represents a boost of almost 15% to global solar installations. Importantly, our Chinese clean energy team see potential upside to Chinese solar panel installations in the new 5-year plan. In their view, Chinese installation could reach 93 GW per year vs the current figure of 50 GW. This would represent a 40% boost to global installations.”

Goldman acknowledges the investment demand remains in the driver’s seat for silver prices, which in our view will intensify in the Biden administration, along with government indebtedness and reckless monetary policies. Nevertheless, we some merit in the observation we cited last month, that “silver is the new oil.”