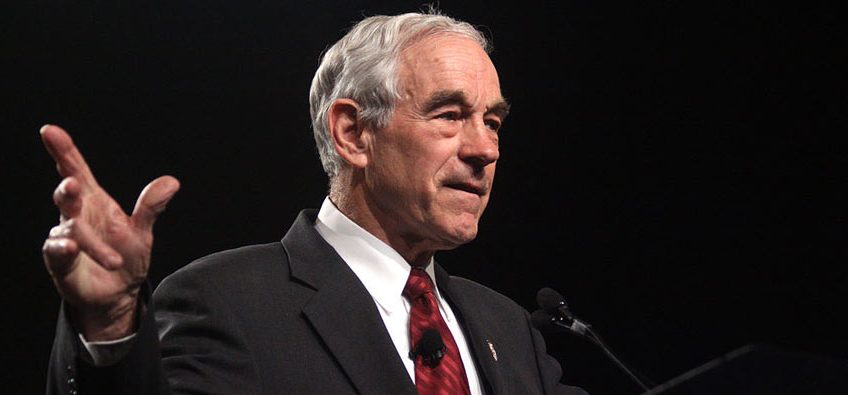

Ron Paul: “Two Things You Need to Do”

There are two things you need to do: Protect yourself from the coming crisis. And help end the Fed and get the government under control.

That is the advice from former congressman and presidential candidate Ron Paul.

It will be a long time before anybody in congress knows as much about money and markets as Dr. Paul. You should know that when he talks about protecting yourself and your family from a financial crisis, he means with gold and silver.

We will get to Dr. Paul’s own words in a moment. But here is what is going on. Federal debt is now over $28 trillion dollars. The deficit just last year was $3.1 trillion. The Fed had to print trillions of dollars to keep the government funded.

As Dr. Paul and the Congressional Budget Office note, this will be two years in a row that the federal debt exceeds the productivity of the entire country, the Gross Domestic Product.

That is not good.

The CBO is now forecasting a $2.3 trillion deficit for this year. But that does not begin to include everything Washington wants to spend money on. The Biden “stimulus” package is almost $2 trillion dollars. Then so-called “infrastructure” package could reach $4 trillion over ten years. And there are all the demands of the big government, big spending constituents that Biden owes his election to. They all want something. Free something.

That is where the Federal Reserve comes in. Chairman Powell recently said, “Well, so what we said about the bond-buying program is that it will continue at least at the current pace… [emphasis added].

The Fed’s current pace is printing $120 billion a month. Made up money. Unbacked. Digital bookkeeping entries. Fiat money. $120 billion a month is the current pace.

Here’s a link to Ron Paul’s most recent weekly column. We think the last two paragraphs deserve to be featured by us:

“Unless the government changes course, America will experience a crisis greater than the Great Depression. The crisis will include a final rejection of the dollar’s world reserve currency status. There will also be much increased price inflation. At that point Congress will have no choice but to limit spending, although it will try to hide cuts in popular entitlement programs by ‘adjusting’ government measures of inflation. Congress could then blame the Fed for the reduction in value of government benefits.

“Those who know the truth have two responsibilities. First, ensure they and their families are protected when the crash comes. Second, redouble efforts to spread the ideas of liberty and grow the liberty movement so politicians are pressured to cut spending and debt and to end the Fed.”