Ron Paul Says…

Fed too late, too little!

It was just weeks ago that Federal Reserve chairman Jerome Powell said that raising interest rates 75 basis points at its June meeting was something that wasn’t under consideration.

BANG! The Fed raised interest rates 75 basis points at its June meeting after all. And it will likely do so again at its July meeting.

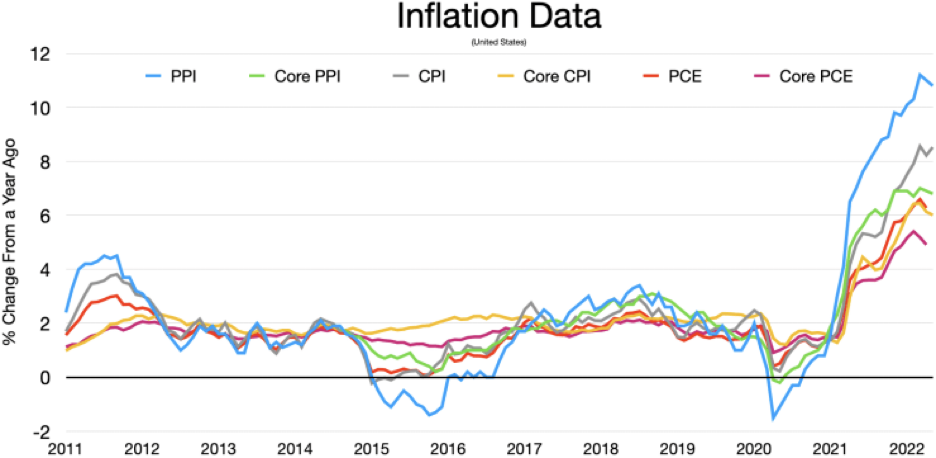

But after 14 years of pumping money into the economy by the trillions, are a couple of interest rate hikes that still leave the Fed funds policy rate (now 1.50 to 1.75 percent) about seven percentage points below the inflation rate (now 8.6 percent), enough to do what Paul Volcker did 40 years ago when he drove interest rates to double-digits? Is it enough to wring inflation out of the economy?

Can the Fed stop inflation with baby steps and halfway measures and thereby avoid crushing employment and throwing the economy into a recession?

Are we headed for a soft landing? Or a crash landing?

Monetary authority Dr. Ron Paul says a soft landing is highly unlikely:

This latest rate increase will only raise rates to where they were before the lockdowns led the Fed to embark on a historic money-creating spree. The Federal Reserve cannot increase rates to anywhere near the level they would be in a free market because doing so would increase interest payments to unsustainable levels for debt-ridden consumers, businesses, and the federal government.

Increases of a couple percent or less in interest rates can cause big increases in federal debt payments. The resulting new spending puts pressure on the supposedly “independent” Fed to maintain low rates, making it more likely the Fed will fail to tame inflation but succeed in resurrecting stagflation, combining price inflation with a recession. This new stagflation will make the 1970s look like a golden era.

A lack of serious intent and pussy-footing approaches to today’s destructive inflation rates can only mean that inflation will persist. And, as the stagflation experience of the 1970s showed, a persistent inflation is enough to power to unforeseeable new heights.

Dr. Paul points to another consequence of a coming bout of stagflation, one that we have called one of the most important monetary megatrends of the day: the ending of the dollar’s post-war reserve currency status.

Says Dr. Paul, “The return of stagflation will increase the growing movement to replace the dollar as the world reserve currency. This will be the final nail in the welfare-warfare-fiat money regime’s coffin.”

The preceding commentary is provided to encourage readers to assure that their gold and silver holdings are sufficient for the monetary turmoil ahead!