Reminds Us of the ’70s!

When stagflation made gold skyrocket!

I recently heard somewhere that “there may not be a lot of advantages to getting older, but it is a plus for investing”.

Live long enough and you will have seen the same old flimflams over and over. Like stagflation. The last stagflation decade was the 1970s. The Fed had printed a lot of money for their cronies and power-hungry politicians. Price inflation skyrocketed. The Fed was clueless and could not decide from one day to the next what to do about it. The politicians were clueless, too, and kept spending money the country could not afford.

The parallels are even eerier than that. Just like Russia today, the Soviets were on the march in the 1970s.

And oil prices exploded, too!

To learn more about the Stagflation Decade see our prior comments HERE, HERE, and HERE.

Since stagflation is a combination of a weak or no growth economy and high inflation, we described conditions this way:

“Weak growth makes it increasingly impossible for debtors – individuals and corporate – to service their massive debts. That is because sales slow down, margins are squeezed, businesses are forced to cut prices, pay raises do not materialize, and jobs disappear.

“At the same time inflation means the purchasing power of the currency falls, interest rates rise in compensation, and saving money becomes pointless. And it blows up the bond market.

“There is a haven of safety and profit in an era of stagflation: Gold.”

Nothing much has changed. Be aware that higher prices for the essentials of life – like food and energy – meaning that the people have less money left over to save for the future or to spend on non-essentials. That is tough on the stock price of a lot of companies.

Today’s inflation rate of 7.5 percent is the highest it has been in more than 40 years. Since the median age of the American people is 37.9 years, most Americans have never experienced inflation this high. Most have no idea how to navigate and prosper in an inflationary episode.

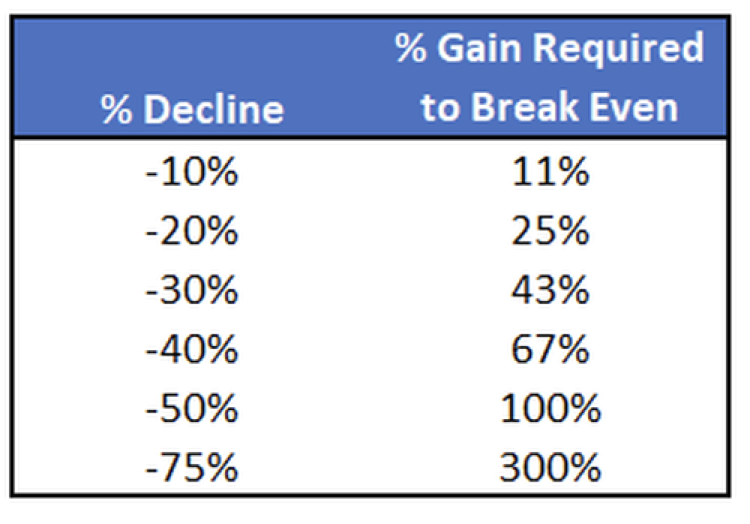

One of the most important lessons is to be sure to protect your principal. Do not be fooled by expressions like “this time is different,” or “it’ll come back” lull you into complacency about the stock market. Remember that if you do not get out when the market is clearly cracking up, you will be sorry. Take a good look at this chart which describes how difficult it is to get back to breakeven after suffering a stock market loss.

And to repeat the essential lesson of stagflation, “There is a haven of safety and profit in an era of stagflation: Gold.”

To learn more about these economic times and how to preserve your wealth and protect your family, speak with a Republic Monetary Exchange gold and silver professional today.