Raising Targets

The biggest banks are raising their target prices for gold. That is because we have already passed their old targets.

We are seeing headlines in the financial press that read, “Stunned by gold’s record rise? There’s more to come, analysts say,” and “Gold Barrels Past $2,000 With Stage Set to Rally Further.”

Goldman Sachs now sees gold headed to $3,000 if the inflation rate were to run at 3.5 percent, or even if it just bounced to an interim 4.5 percent.

That is less a prescient market call than it is simply stating the obvious. A real call from a real gold expert with a real track record is that of former congressman and presidential candidate Ron Paul. Dr. Paul said last year at about this time that we could see $3,000 gold by the end of this year.

Gee, financial conditions would have to be serious for that to happen.

And they are serious.

Paul noted back then that we are in a period of a disintegrating monetary system. “Warning signs are all around us!” he said.

Bank of America now says prices could hit $3,000 within 18 months, while a portfolio manager from Van Eck believes “a price over $3,000 per ounce is reasonable,” and that “$3,400 may be the target.”

There are many calls for much higher gold prices that that, but we have just spotlighted a few from establishment institutions.

As for silver, forecasts for $50 an ounce are all about.

For our part, we think many of these forecasts may prove to be modest. That is because we prefer to keep our eye on the root causes. Prices are an effect, the result of fiscal and monetary mismanagement. No matter how high gold and silver go, if the underlying causes of higher prices remain in place, price will continue to climb.

As for today, and any reasonably likely future, the causes remain not only in place, but we would say locked in place.

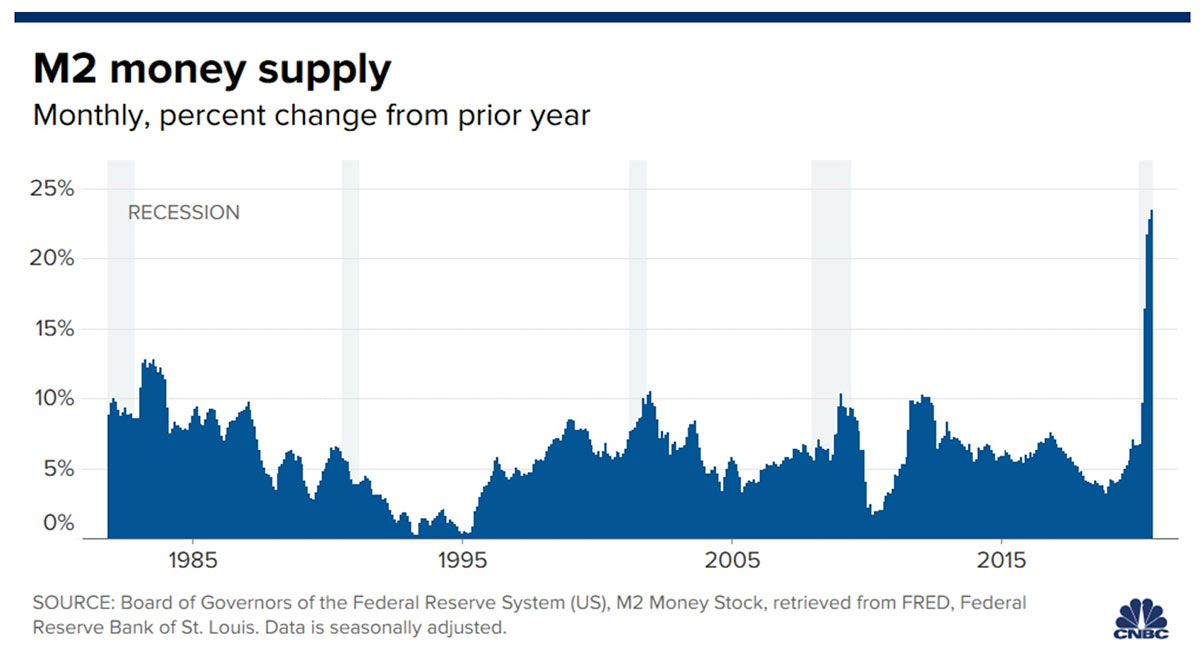

Consider: As you can see from this CNBC chart, US money supply (M2) is up 23 percent over this time last year.

That’s a new world indoor record for US money supply growth!

At the same time, Federal Reserve officials are lobbying for trillions in new spending. The Democrats are now pushing an additional $3.4 trillion stimulus plan. The Republican are pushing one that costs $1 trillion.

America’s Gross National Product has seen a depression-like collapse. The monetary and fiscal authorities are attempting to paper it over with more unpayable debt and legalized counterfeiting. As a result, the dollar’s role in the global economy is under fire.

This is the culmination of years of reckless policies. It is not readily reversible.

It is serious.

At Republic Monetary Exchange, our job is to help our friends and clients protect themselves and their wealth with gold and silver. Real money that can’t be printed and that you can hold in your hands.