Raging Inflation

Pay No Attention to the Mainstream Media!

By now you probably know that price inflation is running hot.

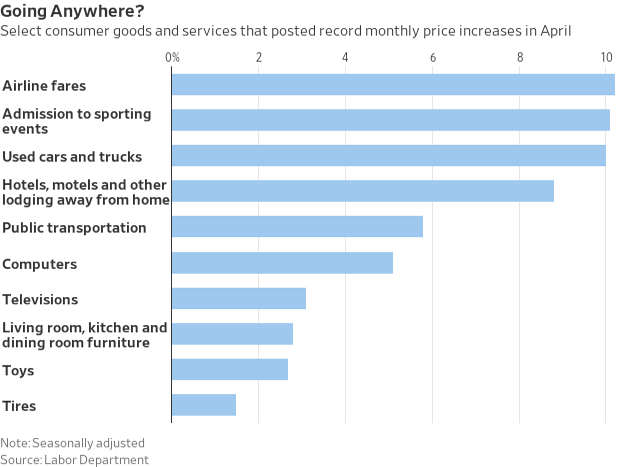

The government’s Consumer Price Index rose 0.8 percent in April. Over the last 12 months it is up 4.2 percent.

For the three-month period February-March-April, consumer prices are up 7.0 percent. And climbing.

Wholesale prices rose 0.6 percent in April. For the last 12 months wholesale prices are up 6.2 percent.

Now, since we do not pussyfoot around about things, let us state clearly what these numbers mean:

The dollar’s purchasing power is falling. It is falling faster than it has in years.

As you have no doubt heard in news reports about these government indices, the media goes to great lengths to state it differently. For example, here is a verbatim report from the Wall Street Journal:

Consumers are seeing many prices jump for a variety of reasons as the U.S. economic recovery gains momentum. Used-car prices have surged as global chip shortage has reduced production of new cars. Many companies are passing on the higher costs they are facing for crops, oil and truckers’ wages. Airfares and hotel-room rates are climbing as consumers start traveling again after a year of restraint during the pandemic. More broadly, rising prices reflect strong consumer demand fueled by widespread Covid-19 vaccinations, easing business restrictions, trillions of dollars in federal pandemic-relief programs and ample consumer savings.

You will note that the fact that the Federal Reserve has printed 4 trillion dollars of no objective value since late 2019 does note figure in the “variety of reasons” the nation’s leading financial journal gives for rising prices.

Reviewing these blog posts, their description of the monetary policies at work, and their impact, it turns out that we have been a better source for financial clarity than the major US media. We are more embarrassed for them than we are proud to keep scooping them. But what matters most is that it is not good for the American people to be confused, and unprepared for what is coming.

In any case, we are grateful that we have been able to provide crucial financial information to our friends and clients. We do not copyright these commentaries because we want you to feel free to share them with your colleagues, friends, and family.

And we always welcome your referrals and are glad to take time with people who need to learn more about the coming monetary calamity and how to protect themselves with gold and silver.