Oh, That Inflation!

Inflation? What Inflation? Oh, That Inflation!

Federal Reserve Board Chairman Jerome Powell is “frustrated.” And no wonder. He has no clue what is going on.

Two of his central bank minions have suddenly resigned amid reports of activities that look like insider trading ducks, walk like an insider trading ducks, and quack like insider trading ducks.

It actually makes you wonder if they are insider trading ducks.

Meanwhile, and even though he has done everything in his power to manage the US dollar the way leftists like Hugo Chavez and Nicholas Maduro managed Venezuela’s currency, America’s leftists want Biden to replace Powell with an even more extreme inflationista. Never mind that those are policies that have three out of four Venezuelans living in extreme poverty.

That is not all. There is that talk from the Chairman about inflation’s transitoriness – well, the poor Chairman (actually because “man” is a dirty word these days, they actually call Powell the “Chair,” like he’s a piece of furniture) has had to walk all that talk back.

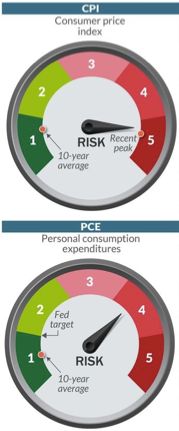

And no wonder. Inflation, according to the Fed’s favorite measure, has reached a 30 year high, “with all signs pointing to price pressure snaking into next year,” writes MarketWatch.

More:

The personal consumption expenditure price index climbed 0.4% in August, the government said Friday. It was the sixth straight big increase.

The rate of inflation in the 12 months ended in August edged up to 4.3% from 4.2% — the highest rate since 1991, when George H.W. Bush was president.

Until very recently, Federal Reserve leaders insisted inflation would start to fall back to toward pre-pandemic levels of 2% or less by the end of this year.

Yet in the past week, senior central bank leaders acknowledged inflation could remain high well into 2022 because of ongoing shortages of crucial business supplies and even labor.

The Chair says all that inflation is related to “supply constraints meeting very strong demand…. It’s very difficult to say how big those effects will be in the meantime or how long they will last.”

Funny, not a word in the Chair’s remarks about the $4 trillion the Fed has digitally printed in the last 18 months. This is an ideal time for you to review the steps you have taken to prepare for de-dollarization and rising inflation. Consult with a Republic Monetary Exchange gold and silver specialist today.