Now What?

It could have been one of many other things, but the Coronavirus is the pin that popped the stock market bubble.

Now the Federal Reserve has started another aggressive round of Quantitative Easing. It does so under the general behavioral rule that when you’re holding a hammer, everything looks like a nail.

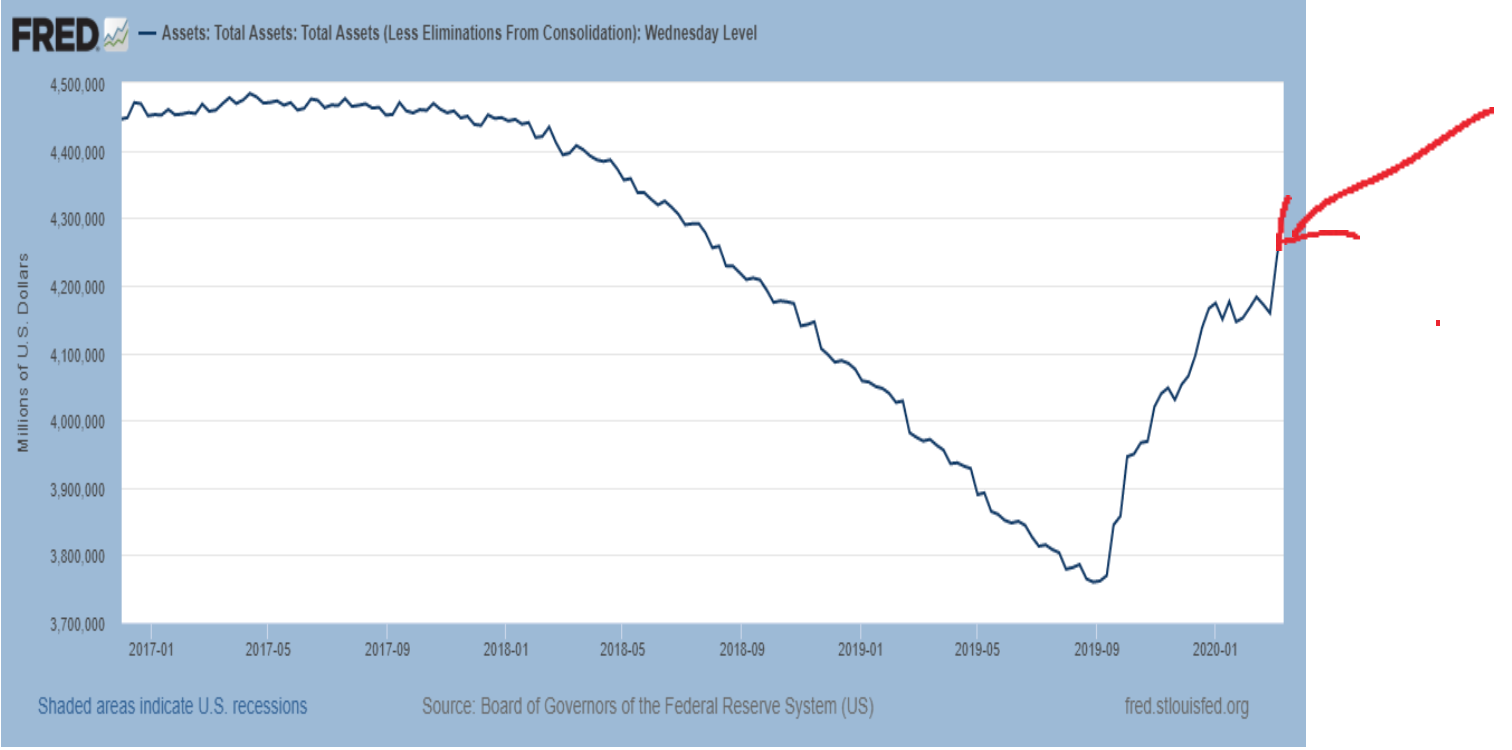

Printing money is the Fed’s hammer. It uses that tool for every crisis. In the original QE program, the Fed created almost $4 trillion dollars. In response, gold marched higher over the next three years, from just above $700 an ounce in 2008 to its all-time high of $1900 in 2011.

Having already launched its new money printing binge last fall, before the Coronavirus, the Fed is now stomping on the accelerator. As the red arrow points out, the Fed’s balance sheet, having leveled off somewhat at the end of last year, turned virtually straight up at the end of February. And it will climb much higher from here. Indeed, it is already on track for a new all-time high, past $4.5 trillion and headed quickly to $5 trillion.

What does that mean? It means a heck of a lot of new money printing. And that’s early in the crisis. New inflation-funded spending initiatives are coming faster than anyone can track.

But the stock market sell-off and the business shutdowns in place and to come are so devastating, that nothing that could be considered “normal,” even on the scale of the prior liquidity easing will be effective.

Doug Noland of Credit Bubble Bulletin puts it this way:

“I do doubt fiscal and monetary stimulus will resuscitate the Bubble in global leveraged speculation. Illiquidity and market dysfunction have been exposed. Huge losses have been suffered and ‘money’ will flee popular (and overcrowded) leveraged strategies (i.e. risk parity). I also suspect confidence in derivatives has also likely been shaken. Liquidity risk will be a persistent feature of global markets.”

Warren Buffett described times like these in a more folksy way: “When the tide goes out you see who’s been swimming naked.”

Make no mistake. The tide has gone out.

Now we must hold our breath while we watch to see the financial trouble that will be exposed, in banks, funds, brokers, companies, pension plans, insurance companies, and investment products like annuities. The criminal recklessness on display will extend to all levels of government.

This is not an age of fiscal prudence or honest stewardship. The politicians and government have established the standards of our age, with its fraudulent representations. It taught generations of Americans that they, like the government itself, could spend their way to prosperity. It taught that it could make up money out of thin air, that deficit doesn’t matter, that debt doesn’t matter either because we somehow owe it to ourselves. They taught the people that they can all live at someone else’s expense. And they even taught that honest accounting doesn’t matter and that something as routine and sensible as an audit was beneath the dignity of the world’s largest money manipulator, the Federal Reserve System.

Now all these lessons have to be unlearned. After so many years of delusion, there is pain involved in confronting reality. But reality always asserts itself in the end.

Now is the time to buy gold. That is because gold is the only financial/monetary asset that is not someone else’s liability. It is not a hopelessly indebted company or government. It is not dependent on someone else’s honesty, prudence, or accounting practices. It is not dependent on the pictures engraved on it, or on the country that minted it. It is not a promise of performance that may or may not be met in the future.

As J.P. Morgan said in congressional testimony over a hundred years ago, “Gold is money. Everything else is credit”