Move to Gold Ahead of Global De-Dollarization

There is more movement afoot in the US dollar’s global status. But first, the backstory:

The US emerged from World War II as a mightier powerhouse than ever. Other leading industrial economies lay in ruins, but not the US. The US dollar was said to be as good as gold. Because foreign governments, many of whom were dependent on US aid for rebuilding, seemed to believe it, they bought into the Bretton Woods international agreement to hold dollars instead of gold as their own reserves.

But that was now a long time ago. In the meantime, as Nixon’s Treasury secretary announced to the world, “The dollar is our currency, but it is your problem.”

It is true. The dollar is their problem. It is a growing problem. Those that are dependent on their dollar reserves see the handwriting on the wall. If the US can print trillions of dollars in just a few years, the dollar is no place to park its reserves.

And so many of them are moving their central bank holdings away from dollars and into the safety of gold. We have described this as the most important monetary megatrend of our time.

Three years ago, in a commentary called De-Dollarization: The Global Monetary Mega-Trend, we wrote:

First, if one central bank decides to upgrade its reserves with the world’s most enduring money, it may only represent a political statement. It is perfectly understandable if a heavily sanctioned state like Iran or Venezuela decides to avoid dollars for political reasons. (Note, though, that US sanctions have proliferated to so many countries that the US is forcing the world’s turn to dollar alternatives.)

But those jumping on the gold-bandwagon include friendly countries like Hungary and Poland. Most recently Poland has been ratcheting up its gold reserves, purchasing 125 metric tons over the past two years. At the same time Poland is repatriating gold. This week Poland announced that it has brought home to Warsaw 1oo tons of gold that had been held on its behalf by the Bank of England. This is not a sign of long-term confidence in the post-war dollar reserve monetary order.

Ten years ago, China held more than $1.3 trillion of US debt. Now its holdings have slipped below $1 trillion to $933 billion.

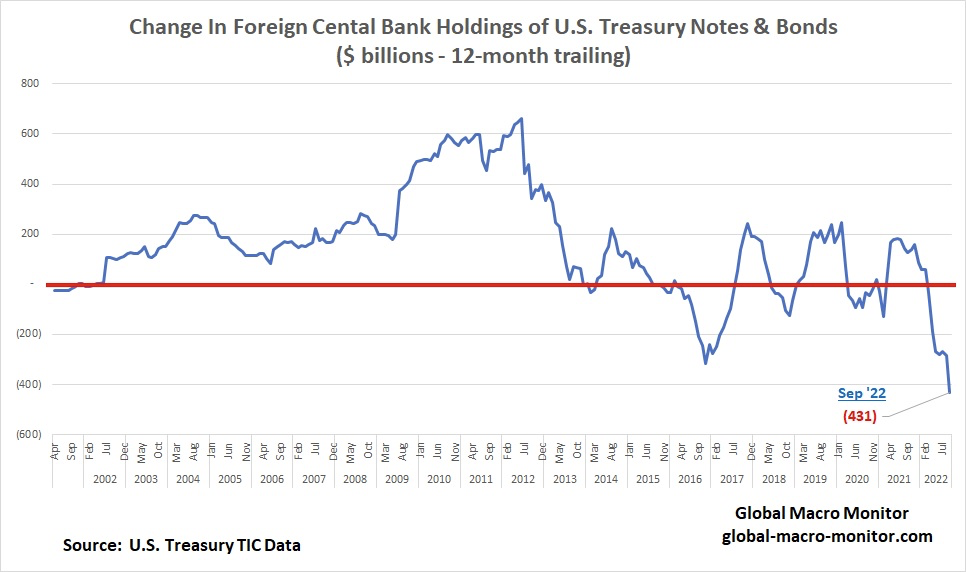

But China is not the only country dumping US treasury debt.

In November 2021, Japan held $1.33 trillion of US treasury debt. Now, just a year later, it has dumped almost 16 percent of that portfolio.

It is an open secret in the capital markets that the Treasury is having liquidity challenges. Foreign holders, friends and foes alike, are backing away. And even the Fed itself, has pivoted from buying US debt to unhoarding its holdings.

This is not good for the US dollar. It is not good for the US economy, because at some point the treasury will have to offer much higher interest rates to attract buyers for its voracious borrowing. Along the way, the Fed will try to ease conditions and rates by printing more money.

That’s what it always does.

It will make gold move much, much higher. Move to gold now as the megatrend gathers momentum.