More Gold, Please!

“Russia’s Huge Gold Stash is Now Worth More than $100 Billion”

Source: Bloomberg

Russia decided some years ago that it wanted more gold and fewer US dollars. It was a smart move, as Bloomberg reported this week:

“The country quadrupled gold reserves in the past decade as it diversified away from U.S. assets, a move that has paid off recently as haven demand sent prices to a six-year high. In the past year, the value of the nation’s gold jumped 42 percent to $109.5 billion…”

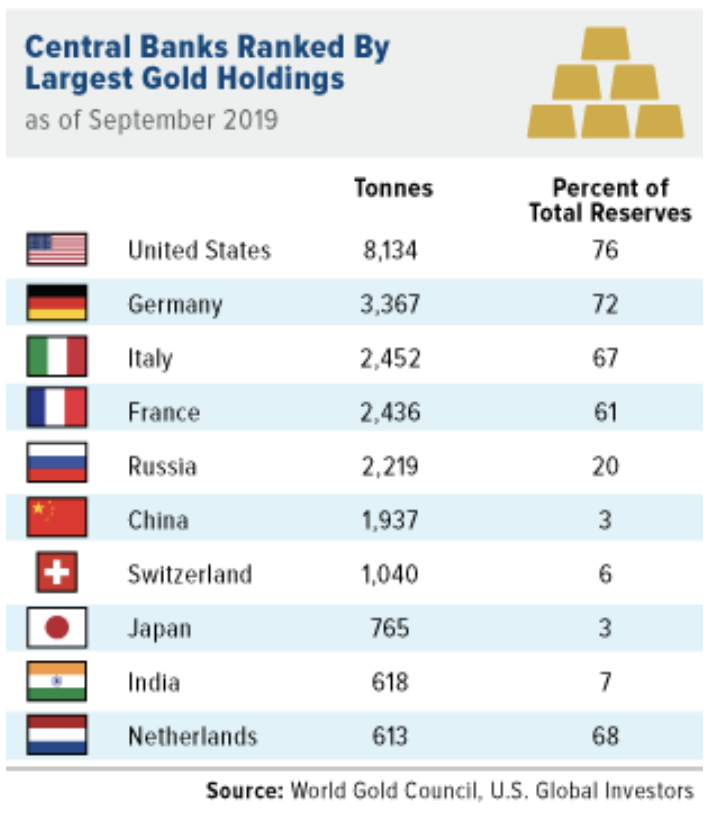

Today Russia owns 2,219 tons of gold. At the same time, Russia began adding gold to its central bank holdings, it began dumping US dollars. In other words, it was selling dollars to buy gold. Russia concluded correctly that the future of gold was brighter than the future of the dollar.

Ten years ago, Russia held $180 billion in US Treasury securities. Now the Treasury Department reports Russia’s dollar holdings as so low they are down in the asterisks, below the holdings of countries like Iraq and Columbia, and less than one percent of what both China and Japan own.

But the de-dollarization move is not limited to Russia. It is a global phenomenon. Countries like Kazakhstan and Poland are moving out of dollars and into gold. Turkey, Mexico, and India are buying gold as well.

China’s central bank has been buying gold aggressively all year long, adding 100 tons since December, while its dollar holding has fallen some $70 billion over the last year.

Gold’s strength has been a windfall for gold owners. Both China and Russia saw the dollar value of their gold reserves jump by $7.5 billion between July and August.

The US still has the largest gold reserves, but, of course, its gold holding has not been audited since the Eisenhower administration. Actually, because that audit was never completed, it is probably more accurate to say that US gold reserves have never been audited.

In May, Congressman Alex Mooney (R-WV) introduced a bill in the House calling for a “full assay, inventory, and audit of all gold reserves, including any gold in ‘deep storage,’ of the United States at the place or places where such reserves are kept.”

A real audit is more than just an inventory. It is not enough to count bars. The title to our gold must be verified. In that respect Mooney’s bill is thorough. Because we know the propensity of governments to try to operate in secrecy – note how vigorously the Federal Reserve has resisted an audit – Mooney’s bill seeks to discover if the title to any US gold has been impaired or encumbered. It mandates “a full accounting of any and all sales, purchases, disbursements, or receipts… a full accounting of any and all encumbrances, including those due to lease, swap, or similar transactions presently in existence or entered into [in the past 15 years, and] an analysis of the sufficiency of the measures taken to ensure the physical security of such reserves.”

Assuming the gold is all present, accounted for, and with clear title, the $400 billion in US gold reserves is a very small base of liquidity upon which to rest a $23 trillion dollar national debt.