More Dollar Debt

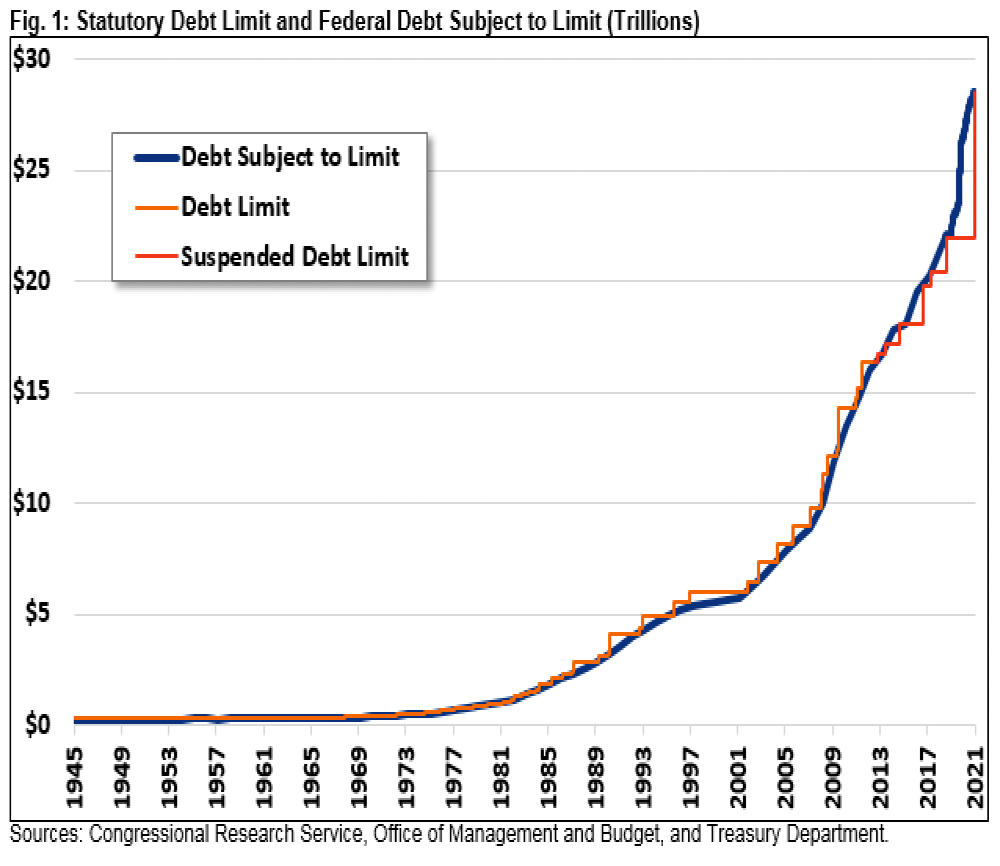

The US national debt ceiling, suspended by Congress two years ago, kicked back in on July 31. That left federal debt capped at the current $28.5 trillion level.

The Treasury will employ a full suite of measures, moving money around and borrowing from account to account, to avoid default for now. It can use accounting manipulations until October or November, but in the meantime, the US Treasury is prohibited from issuing more debt and borrowing until the statutory debt ceiling is raised.

The Committee for a Responsible Federal Budget writes that the debt ceiling has been modified almost a hundred times since the end of World War II:

During the 1980s, the debt ceiling was increased from less than $1 trillion to nearly $3 trillion. Over the course of the 1990s, it was doubled to nearly $6 trillion, and in the 2000s it was again doubled to over $12 trillion. The Budget Control Act of 2011 automatically raised the debt ceiling by $900 billion and gave the President authority to increase the limit by an additional $1.2 trillion (for a total of $2.1 trillion) to $16.39 trillion. Lawmakers have suspended the debt limit seven times since February 2013. The most recent suspension began on August 2, 2019, and will end on July 31, 2021.

One of Washington’s oldest tricks is to use the debate about raising the debt ceiling to bloviate about fiscal responsibility. Measure that we are told will reign in the exploding debt down the road are loudly trumpeted, but it is generally just sound and fury signifying nothing, and the debt continues to grow year after year.

Now the rate of increase in the debt has accelerated.

Debt addiction isn’t limited to Washington. US consumer debt has climbed to $15 trillion.

The biggest borrowers always seen to believe that there will never be a day of reckoning.

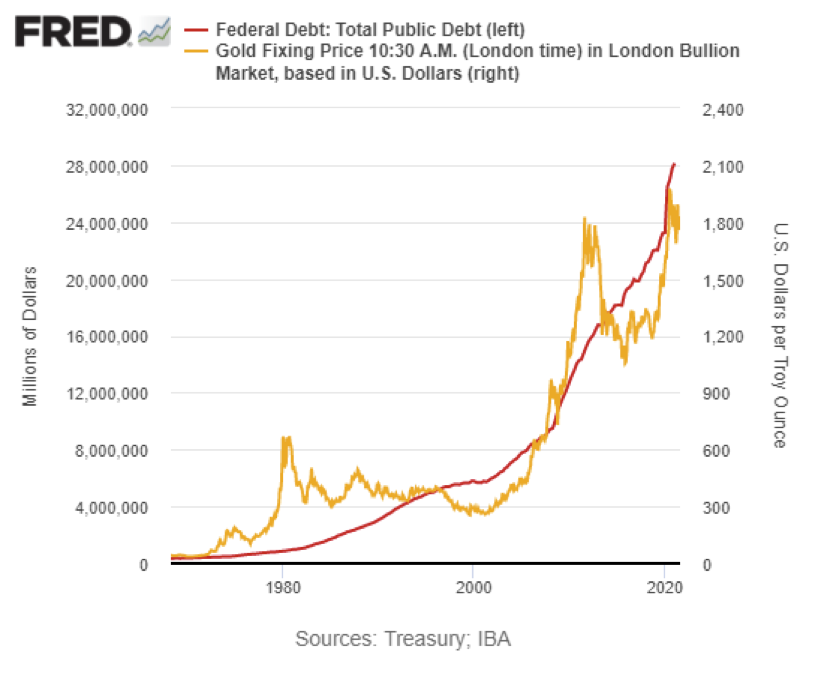

But the gold market is not so easily fooled. We believe this chart showing the rise in US debt and gold makes clear where gold is headed as the growth of US debt accelerates.

To learn more about the dollar, debt, and sensible ways to protect yourself, your family, and your wealth, speak with a Republic Monetary Exchange precious metals professional today.