Money Pump!

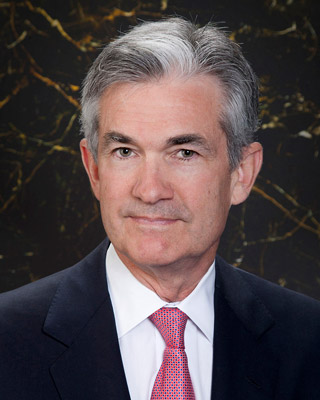

The Wall Street Journal headline said it all: “Powell Confirms Fed to Maintain Easy-Money Policies.”

The Drudge Report headline said the same thing, “Fed Vows More Pump as Inflation Fears Take Hold,” but it added a picture of Monopoly money.

Nice touch.

“We expect that as the economy reopens and hopefully picks up, we will see inflation move up through base effects,” Powell said. “That could create some upward pressure on prices.”

So, with the lockdown winding down and the economy starting to pick up from its deeply distressed COVID recession, interest rates are moving up. They will do that coming out of a recession. But even though there is evidence all around that price inflation is about to make an appearance, the Fed intends to keep printing money.

A scramble for general liquidity hits the gold market for a while (creating a buying opportunity in our view). That is because gold is the most liquid of all commodities. Wall Streeters and hedge funders sell it to raise cash when they get margin calls on their bond portfolios. Then they buy it back later.

These guys are in and out and turn on a dime, buying in the morning and selling in the afternoon. Parking money in one place on Monday and then somewhere else on Tuesday. These are the same guys that had to sell gold in the mortgage meltdown for the same reasons – margin calls – just before gold skyrocketed to all-time highs! These are the same guys who sold gold last year in the early stage of the pandemic pandemonium just before gold once again rocketed to even higher highs!

But for the rest of us, since we are not getting margin calls, it is just a lot of market noise. Especially because the money pump is going to start running at levels never before seen.

Consider:

The Biden $1.9 trillion stimulus bill pork bill is working its way through the Senate. There is no way to fund it except by running the presses. The Fed should be a cautionary voice about being cornered into printing even more than it already has, but contrary to all reason Treasury secretary Yellen, the former Fed chairman, and Powell, the Fed head now, are both cheerleading massive new deficit spending. (Don’t they know they will take the blame when the currency breaks down?)

Goldman Sachs believes that the new Biden infrastructure proposal pork proposal will total $2 trillion – “and potentially even double that,” writes one news source. Same story: no money to pay for it, except for freshly printed digital dollars.

“Investors are having a ‘crisis of confidence in the Fed,” reads a Yahoo News headline.

They ain’t seen nothing yet.

Thank goodness for gold and silver.