Misery, Confidence, and Inflation!

This is going to be one heck of a gold and silver bull market!

The Misery Index is at Carter’s presidency levels. Consumer confidence is at a decade low. And inflation is at a 30 year high.

Not good.

The Misery Index is the sum of the inflation rate and unemployment. It’s at 10.8 percent. Sure, it was higher during the lockdown. But that’s because everything was, you know, locked down!

Writing for the Mises Institute, economist Daniel Lacalle says, “United States consumers have been able to endure this period thanks to prudent saving and moderating consumption levels, but the cushions that have allowed them to get through these months are vanishing. Time to stop the spending, deficit, and printing lunacy, or the stagflation of the seventies will not be a risk, but a reality.”

And wait until you see what happens with prices in 2022. According to a General Mills memo to retailers reported by CNN, the company is “raising prices in mid-January on hundreds of items across dozens of brands. They include Annie’s, Progresso, Yoplait, Fruit Roll-Ups, Betty Crocker, Pillsbury, Cheerios, Cinnamon Toast Crunch, Lucky Charm’s, Wheaties, Reese’s Puffs, Trix and more…”

“For some items, prices will go up by around 20 percent beginning next year.”

20 percent is a big jump!

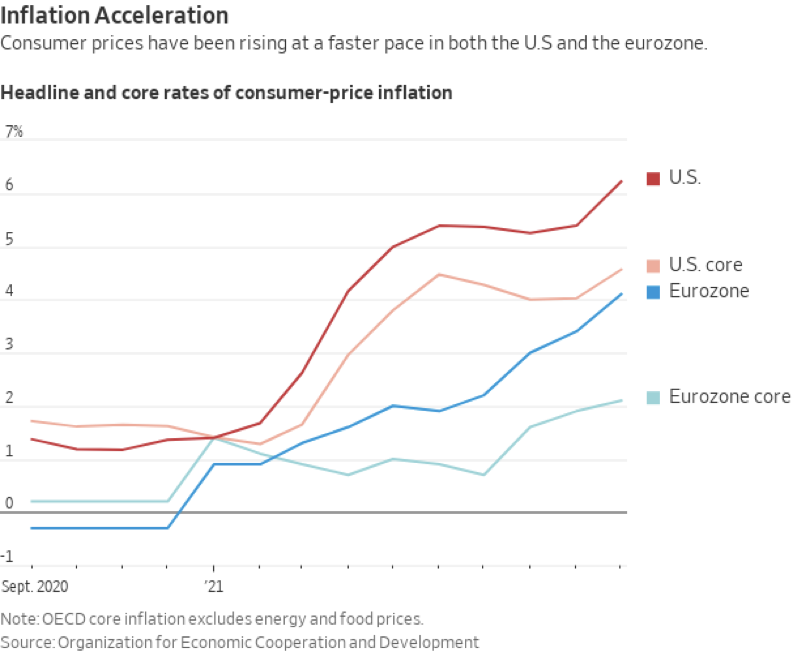

But it’s not just the US that is experiencing inflation. The inflation rate in Hungry is 6.6 percent; in Poland, it is 6.4 percent. Germany’s inflation in November spiked to 6 percent. Both Spain and Belgium report 5.6 percent inflation.

High inflation is the story at every turn. Producer prices in Japan rose by 8.0 percent in the 12 months ending in October. China’s producer price roared ahead 13.5 percent in the same period.

Baby boomers have some memory of the inflation crises of the past, but it is all new to the millennials. It takes a while for consumers of every generation to realize that it is not just prices going up, but that the money itself is losing value. There is always a leading-edge that gets it first. They are buying gold and silver today. At first a few wake up; others figure it out more slowly.

It takes a while sometimes for the masses to catch on, but global inflation will eventually drive people everywhere to the safety of gold and silver.

Joined by investors and common folks around the world, it is going to be one heck of a bull market!